How to Perform Financial Forecasting

Post on: 23 Июль, 2015 No Comment

After you’ve completed your goals and actions, assess the financial viability of your strategic plan. While your action items and goals are fresh in your mind, estimate the costs associated with the implementation of each item. All the best-laid strategic plans are subject to time and money.

In this section of our recession toolkit, you look at the estimated expenses and the potential revenue. This review helps you make decisions about when to implement certain action items and whether your cash outlay generates the required revenue to meet your financial goals. As with every business, budgets are never big enough to do everything you want to do.

How to Use the Financial Forecasting Tool

A business can be considered a financial success when it :

- Stays in the black and turns a profit

- Has a healthy balance sheet (See Chapter 4 on ratios)

- Generates good cash flow

- Produces a good return on investment (ROI) for its shareholders

Attaining financial success, starts with a financial assessment that’s based on historical record and future projections. By looking at the past to help plan and predict the future, you can gain much better control over your company’s financial performance. A good financial plan gives you a detailed picture of the financial health of your business and the viability of your strategic plan. It also helps you know if you’re getting off track during implementation so you can take action before anything serious occurs — like running out of cash.

To conduct a financial assessment of your strategic plan, take the following steps:

- Estimate revenue and expenses.

- Conduct a contribution analysis to determine if your strategies positively contribute to the bottom line.

- Combine all your numbers in a one-year and three-year financial projection.

The cold reality is you’re in business to make money. If you’re not making a return on your investment, at some point, you don’t have a business; you have an expensive hobby. Ouch! That hurts, I know, but it’s the truth. If you don’t believe this, skip this section. But if you do, your financial assessment concludes with an analysis on your ROI. After all, there’s no sense in implementing a plan if it won’t yield the desired return.

As an owner, you’re either investing in or drawing out of your business. If you’re investing for growth, you ought to have a clearly defined payback period and strategic plan to get you through it as fast as possible. Your payback period needs to match up with your owner’s vision (see Chapter 6 for more info). Business owners often plan for growth without considering how long it takes to get a payback or developing the action plans to get there.

By looking at how quickly you’ll get paid back for your investment, it forces you to answer the question if you’re comfortable with the time period. If it is too long and too big of an investment, don’t invest. Revise your strategic plan by removing some goals and action items until you develop a plan you can live with. Remember, the plan works for you — you don’t work for the plan.

Estimating revenue and expenses

Expense and revenue estimating is an imperfect science. However, it’s meant to give you an idea of the additional cash outlay required to implement each area of your plan and the revenue you can expect to generate. In the previous exercises, you identified potential expenses for action items as well as potential revenue for each target market group. Here you combine that information with your current operations to get a complete financial picture.

It’s important to identify large expenses that might prohibit implementation.

Revenue

An easy approach for estimating potential revenue is by each target customer group. Ideally, your market research gives you a rough idea of how much you can anticipate generating. Use the following formula to determine estimated revenue. Multiply the number of customers by the average sale per customer by the number of sales per customer per year. That equals your estimated revenue per year.

Expenses

List expenses associated with any goal or action in the plans that aren’t part of your normal operating expenses. Additionally, estimate your current operating expenses by forecasting each item based on how it increases to accommodate for the expected growth.

Contributing to the bottom line

Just because a market looks attractive, doesn’t always mean that you can serve it profitably. Before your creative folks start churning out cool ads, do a quick contribution analysis. A contribution analysis determines whether a particular target customer group contributes to the overall financial well-being of the company. In other words, is this customer group profitable?

This analysis provides you with a projection of whether your strategy generates revenues in excess of expenses. If the contribution analysis determines that the dollar investment in the strategy required to reach this target customer group can’t be justified, rethink and adjust customer goals and financial goals. Eliminate the groups that don’t positively contribute to the bottom line. Those that do are used in your financial projections in the next step, covered in the next section.

Projecting out your financial future

By putting all your revenue and expense numbers together and projecting them out over three years, you can see in black and white how successful your business can be. Projecting also allows you to grow the business without running out of cash. Growth in sales always incurs additional cash requirements to generate and support the additional revenues. When used properly, financial projections help you determine what additional assets are needed to support your increased sales and what impact that has on your balance sheet. In other words, the plan indicates how much additional debt or equity you need to stay afloat.

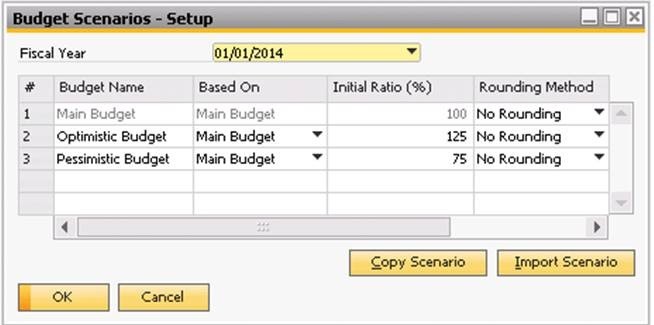

All commonly-used financial and accounting system packages come with functions to create financial projections. Use these tools to create your financial projections by plugging in assumptions based on your strategic plan. If your system doesn’t allow for projections, create an Excel document similar to the one attached.

Your financial projections include forecasting out all three of your financial statements. Produce projections by month for year one and then by year for the next two years. Follow these steps:

1. Project the income statement.

Use the estimated revenue for each target market group that you determined in the section “Estimating Revenue and Expenses.” Plug in the expenses and operating expenses as well, and use all three figures to determine your net profit (hopefully) or loss.

2. Project the balance sheet.

As sales go up, so do other areas of the business — variable assets (accounts receivable, inventory and equipment), variable liabilities (accounts payable and accrued expenses) and (hopefully) net income.

If your net income plus the increase in variable liabilities equals or exceeds the increase in variable assets, the company has the resources to finance itself. If not, you must bring in additional debt or equity. Use your current balance sheet to determine the various asset and liability accounts in your business.

3. Project cash flows.

Using the information in Steps 1 and 2, project how these numbers impact your cash flow, paying special attention to how much new debt or equity you need to inject into the business and when to inject it.

Like much of the work you’ve done up until now, creating financial projections isn’t an easy task. But don’t skip this exercise or you miss an important part of developing a sound strategy. Undoubtedly, one of your financial goals is to increase your sales and profitability.

After you’ve completed your projections, even if they’re rough, double-check to make sure that your goals match up with your numbers. The financials tell you what goals to keep and what to cut. Keep the goals with a positive story. Revise the ones with a negative ending.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D96&r=PG /%