How to Invest in HighYield Dividend Stocks

Post on: 13 Август, 2015 No Comment

You can opt-out at any time.

Dividend-paying stocks with high yields can seem like an outstanding investment at first glance. After all, who wouldn’t want to own a stock with a yield of 10 or 12%? However, the highest-yielding stocks can also carry the danger that the dividend is unsafe or may not be what it appears on the surface. But how can you tell the difference between a legitimate high yield and one that’s too good to be true?

Dividend Stocks: Separating the Wheat from the Chaff

The difficulty with investing in high-dividend stocks lies in the search for what the yields actually are. Most data providers show a trailing yield – or in other words, the total dividends of the past 12 months divided by the current share price. The problem is that while many stocks have steady, reliable dividends, others have dividends that are a) changeable on a year-to-year basis or b) in jeopardy due to the financial problems of the underlying company.

A case in point is the Brazilian pipeline company Transportadora de Gas del Sur, which is traded in the U.S. market under the ticker TGS. During early 2012, most investing websites showed this stock as having a yield anywhere from 45-50%. While the stock did indeed have a yield this high on a one-year trailing basis, its yield in the two years before that only averaged out to about 2%. And in the seven years prior to that, it paid no dividend at all. In terms of what investors could receive in the 12 months ahead, there was no indication as the company had not yet announced its payout. The takeaway: although an investor could easily be fooled into thinking TGS would garner them a 50% yield, in reality their yield would be much less than that.

Another example is the type of U.S.-based natural gas partnership known as royalty trusts. Early in 2012, most of these securities were listed as having yields in the 10-12% range. However, their distributions are dependent on the price of natural gas – which plunged in the early part of that year. As a result, investors were on track to receive a yield half than what they may have thought based on the headline number.

The Solution

There are several ways to get around this problem. One is to look at “forward yield,” which calculates the yield based on expected distributions in the next 12 months. Since many providers report inaccurate numbers here as well, the best bet is to do your own research. Has the company in question announced planned distributions for the coming year? If not, use news articles about the company to determine what the expectation is.

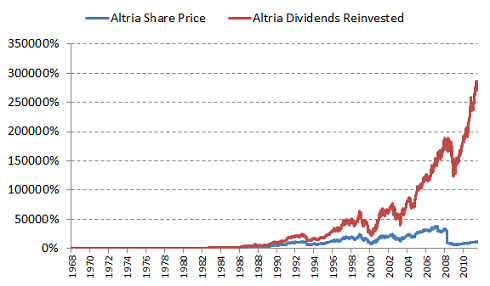

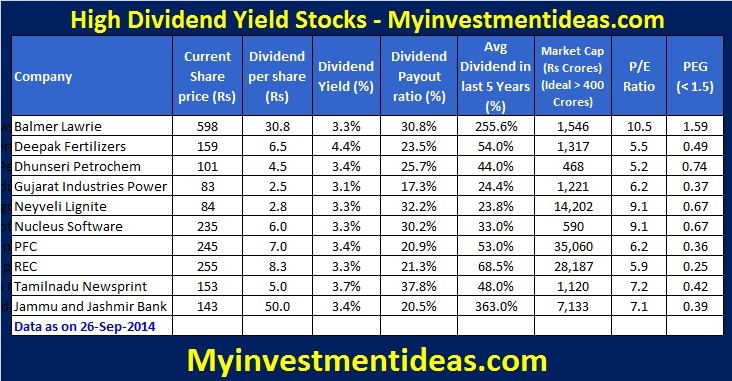

Also, it’s important to keep in mind that – as is the case with bonds – a high yield can in fact be a sign of distress. In many cases, the smart money will know that a dividend cut is on the way, and will drive the price of a stock down to levels that make a yield look attractive when in fact it is unsustainable. As a result, the best course of action is to look for companies that may not necessarily top the list of high-yielding stocks, but that have strong balance sheets. plenty of cash flow to support their dividends, and a history of raising their dividends over time.

The Bottom Line

With so many people devoted to searching for value in the stock market, there are no “free lunches” available to individual investors. So always keep in mind, if a listed yield seems too good to be true – it almost definitely is.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.