How to Invest in Gold

Post on: 19 Сентябрь, 2015 No Comment

NEW YORK ( TheStreet ) — It’s never too late to invest in gold, no matter what the gold price.

Whenever you buy gold, the first rule of thumb is dollar cost averaging — putting a fixed amount of money towards gold every month regardless of the price. For the average investor, this strategy spreads risk out over time and lessens the downside.

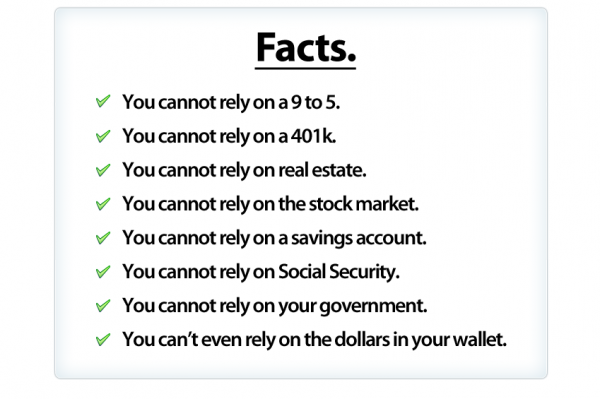

Gold is protection, insurance against inflation, currency debasement, and global uncertainty. Here are four ways you can invest.

1. Gold Bullion

Buy physical gold at various prices: coins, bars and jewelry. Some of the most popular gold coins are American Buffalo, American Eagle and St. Gauden’s. You can store gold in bank safety deposit boxes or in your home. You can also buy and sell gold at your local jewelers. Other companies like Kitco.com allow you to store gold with them as well as trade the metal.

When you buy gold coins or bullion, avoid big premiums. You want to buy gold as close to the spot price as possible, or a 10% premium at most. The higher the premium, the higher the gold price will have to rise in order for you to profit.

Coins typically come from the national mint, where they are made and sold at a 4% mark up — the retailer’s margin is 1% to 3%.

Had you purchased a one ounce gold bar at Kitco.com for $1,225.90 — using a spot price of $1,200 — the bar has a 2.1% mark-up. This means that the gold price only has to rise 2.1% from spot price levels for you to break even on your investment.

Premiums, though, can mount as high as 75% or more based on the gold item.

To avoid getting ripped off you must establish why you want to buy gold bullion. If you want to own gold as a long term investment, then buy gold as close to the spot price as possible.

If you want to own gold to use as money, if you are a survivalist you want to buy a tank of gas with gold as Jon Nadler, senior analyst at Kitco.com says, then you need smaller gold coins like one tenth an ounce and will have to pay the premium.

Nadler’s take is that an individual investor shouldn’t spend more than a 10% mark up when buying gold, but acknowledges that everyone has their own threshold.

Where investors also tend to go astray is by buying semi-numismatic or numismatic coins, otherwise known as rare coins, which come with huge premiums that seldom recoup their value.

A good rule of thumb is to leave rare coin buying to rare coin dealers. Nadler advises that consumers interested in rare coins go professional auctioneers like Bowers & Merena or Christie’s who have experts on staff and can objectively grade the coins the same way an antique dealer would appraise goods.

If a broker tries to sell you a story with the coin like it’s from the old world and there are only a few thousand in existence experts advise to go elsewhere.

Don’t confuse investing in gold with the things being sold as gold investments, cautions Nadler. You want something that tracks the price of gold as close to dollar to dollar as possible.

2. Gold ETFs

Gold exchange-traded funds are a popular way to have gold exposure in your portfolio without the hassle of storing the physical metal. First, you can invest in one of three physically backed ETFs, which track gold’s spot price.

The most heavily traded ETF is SPDR Gold Shares (GLD ). which saw record inflows as fears ballooned over Europe sovereign debt fears and a struggling U.S. economy. Big guns like George Soros and John Paulson own the stock.

iShares Comex Gold Trust (IAU ) is the cheapest ETF with a 0.25% fee.

The newest gold ETF is ETFS Gold Trust (SGOL ). which launched in September 2009. This gold ETF actually stores its gold bullion in Switzerland and gives investors access to different types of gold.

For each share of these ETFs you buy, you generally own the equivalent 1/10 an ounce of gold. If investor demand outpaces available shares then the issuer must buy more physical gold to convert it into stock. Conversely, when investors sell, if there are no buyers, then gold is redeemed and the company must then sell the gold equivalent.

Gold is a tool for investors and for traders looking for gold exposure or as a way to hedge other gold positions. The result can be rough violent price action.

Expense ratios can range from 0.25% to 0.50% and your value erodes the longer you hold the shares. The fund must sell gold, for example, periodically to pay for expenses which decreases the amount of gold allocated to each share.

There are also two types of gold stored in the ETFs, allocated and unallocated. Allocated gold is the bullion held by the custodian, big banks. Custodians provide a bar list of all the individual allocated bars daily and are typically audited twice a year, paid for by the sponsor, by an independent party like Inspectorate International.

Unallocated gold relates to authorized participants like JPMorgan or Goldman Sachs who trade gold futures. Futures contracts are often bought if the trustee needs to create new shares fast and doesn’t have the time to buy and deliver the bullion. Typically allocated gold far outweighs the unallocated gold and the amounts are tallied each day by the custodian. The ETF also has a set amount of time when it must deliver the physical gold into the vault.

Because you own shares and not the physical metal, precious metal ETFs may be sold short, so two people can own the same gold — the original owner and the investor who is borrowing the shares. Although baskets of shares are allocated to specific gold bars, which can be found in the ETF’s prospectus, an investor must share ownership.

Profits made on investments in physically backed ETFs are also taxed like collectibles, at around 28% — an investor gets taxed as if he owned bullion, when in reality he just owns paper.

There is the possibility of redeeming shares for physical gold, but that arrangement is conducted with brokers and is typically more difficult. Investors have to redeem in huge lots, like 500,000 shares, not really viable for the retail investor.

ETFs are also very controversial. Many complain that investors can’t know if their gold really exists. Also, if a bank storing the gold fails, the ETF, aka investor, becomes a creditor.

There are other types of ETFs.

If you want the opportunity of redeeming your shares for gold, another option is Sprott Physical Gold Trust ETV (PHYS ). which is a closed-end mutual fund that gives investors the option of trading in their shares for 400-ounce gold bars.

The fund can trade at a huge premium or discount to its net asset value at any time and has higher fees, making it more expensive to invest in. An investor can obtain physical gold on the 15th of every month, although the holder has to make transportation and storage arrangements.

There are also two other ETFs to consider. Market Vectors Gold Miners (GDX ). a basket of large-cap mining stocks. and Market Vectors Junior (GDXJ ). a group of development-stage miners. They both have market caps of $150 million or more and have traded at least 250,000 shares per month for six months.

3. Gold ETNs

If you want more risk, try exchange-traded notes, debt instruments that track an index. You give a bank money for an allotted amount of time and, upon maturity, the bank pays you a return based on the performance of what the ETN is based on, in this case the gold futures market. Some of the more popular ones are UBS Bloomberg CMCI Gold ETN (UBG ). DB Gold Double Short ETN (DZZ ). DB Gold Short ETN (DGZ ) and DB Gold Double Long ETN (DGP ).

ETNs are like playing the futures market without buying contracts on the Comex. ETNs are flexible, and an investor can trade them long or short, but there is no principal protection. You can lose all your money.

4. Gold Miner Stocks

A riskier way to invest in gold is through gold-mining stocks. Mining stocks can have as much as a 3-to-1 leverage to gold’s spot price to the upside and downside.

Gold miners are risky because they trade with the broader equity market. Some tips to consider when picking gold stocks are to find companies with strong production and reserve growth. Make sure they have good management and inventory supported by either buying smaller-cap companies or by maintaining consistent production.

Global gold production has been declining since 2001, only recently experiencing more juice, and big miners keep their gold reserves flush by buying or partnering with small-cap companies, which are in the exploration or development stage.

Many investors make the mistake of buying small gold miners that are in the exploration phase with no cash flow. Picking among these stocks is like buying a lottery ticket, very few companies actually strike gold and become profitable. Even fewer become takeover targets.

With gold prices high, gold companies can make more for every ounce of gold they produce, but their net profits depend on their cash costs; how much it costs them to produce an ounce of gold. Those factors vary from company to company and are subject to currency issues, energy costs and geopolitical factors.

Adam Graf, director of emerging miners for Dahlman Rose & Co.. models 50 companies on a forward basis using forward curves. On a theoretical basis, if gold moved up $100 an ounce, what does the change in the current value do based on what the forward looking cash flow should do.

Another factor to consider when picking gold stocks is how quickly the company will benefit from higher prices. Randgold Resources (GOLD ). a miner in Africa, is almost 100% correlated to gold prices. CEO Mark Bristow says that the company benefits from gold prices in almost two days.

You also have to buy the right amount of gold stocks. J.C. Doody, editor of goldstockanalyst.com, bets on 10 gold stocks because it allows him to take some risk with explorers or junior miners as well as get the safety from a major.

Frankly there aren’t 30-40 stocks in the gold space worth buying, says Doody who would rather be heavily invested in 10 than over invested in 2 and under invested in 40. If you’ve got too many the best you’re going to be is a mediocre mutual fund and if you have too few you’re just taking on too

much

risk.

If you do go the gold stock route, you have to be prepared for the rollercoaster ride.

Leverage swings both ways so if the gold price drops 10%, gold stocks can plummet 20%-30%. Investors often get too spooked too fast and wind up selling out of gold stocks at the wrong time.

It inhales and exhales 20-30% at least once or twice a year, says Pratik Sharma, managing director at Atyant Capital who urges investors to not get spooked by volatility. Ultimately what you have to realize 5-6-7%. these things are meaningless when you have a sector that moves 20-30% several times a year on the downside.

There is always time to buy gold, you just have to know your ABCs before you start.

— Written by Alix Steel in New York.