How to Hedge Your Portfolio

Post on: 15 Апрель, 2015 No Comment

Key Points

- Hedging is a strategy to reduce the risk of adverse price movements for a given asset, and should be both effective and cost efficient. Portfolio hedging may be appropriate for investors who actively manage their portfolio or have a strong conviction about a short-term market correction. How to select your hedging vehicle and determine the appropriate number of contracts.

Hedging is a strategy designed to reduce the risk of adverse price movements for a given asset. For example, if you wanted to hedge a long stock position you could purchase a put option or establish a collar on that stock.

Both of these strategies can be effective when dealing with a single stock position, but what if you’re trying to reduce the risk of an entire portfolio? A well-diversified portfolio generally consists of multiple asset classes with many positions. Employing either of the techniques above on every equity position in a portfolio is likely to be cost prohibitive.

Another alternative would be to liquidate part of your equity holdings, which could partially offset the impact of a stock market decline. Most long-term investors, however, aren’t comfortable moving in and out of stock positions, either because of the potential tax consequences or because they want to avoid having to time their re-entry.

What other alternatives are available for investors interested in hedging a portfolio? Here, we’ll look at a cost-effective method for hedging an entire portfolio using S&P 500® Index ($SPX) put options.

Hedging isn’t for everyone

Portfolio hedging is considered an intermediate to advanced topic, so investors considering this strategy should have experience using options and should be familiar with the trade-offs they involve. Many investors have a long-term horizon and try to ignore short-term market fluctuations. However, hedging may make sense for tactical investors with shorter-term horizons, or those who have a strong conviction that a significant market correction might occur in the not-too-distant future. A portfolio hedging strategy is designed to reduce the impact of such a correction, in the event that one occurs.

How do I select a hedge?

Effectiveness and cost are the two most important considerations when setting up a hedge.

A hedge is considered effective if the value of the asset is largely preserved when it is exposed to adverse price movements. Here, we’re trying to hedge the equity portion of our portfolio against a market sell-off. Therefore, the hedge should appreciate in value enough to offset the depreciation in portfolio value during the market decline. Ideally, the hedge would preserve the value of the portfolio regardless of the severity of the sell-off.

How much would you be willing to pay to hedge your entire portfolio for a certain period of time? Perhaps the answer depends on your belief in the likelihood of a significant market correction. For example, if you strongly believe that the stock market will decline anywhere from 5–8% over the next three months, an effective hedging strategy that costs less than 5% may be worth consideration.

If you have a well-diversified equity portfolio, S&P 500 ($SPX) put options might be a good choice. In addition, options on the S&P 500 Index are considered 1256 contracts under tax law and offer the following benefits:

- Favorable tax treatment: Many broad-based index options qualify for a 60% long-term/40% short-term capital gains treatment. Other broad-based index options that qualify include those that overlay the Dow Jones Industrial Average ($DJI), Russell 2000 Index ($RUT), and Nasdaq 100 ($NDX).

- Cash settlement: All index options are cash settled, which makes the position easier to manage around expiration.

- Leverage: $SPX put options have a 100 multiplier which provides the potential to offset a substantial decline in the portfolio for a relatively small upfront cost. 1

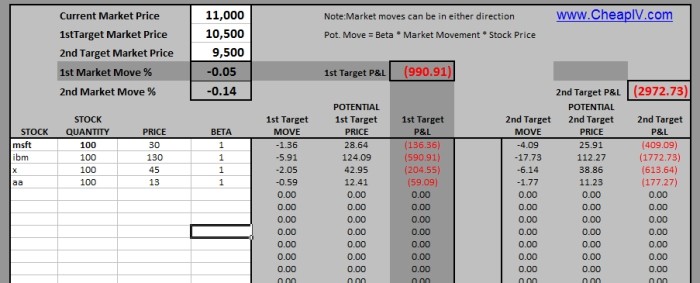

In order to establish a true hedge on an individual portfolio it may be difficult, if not impossible, to find a single financial product that’s perfectly correlated to your portfolio. In the following example, we assume the equity portion of the portfolio has a constant 1.0 beta to the S&P 500 index. Of course, correlation will vary among individual portfolios.

Now let’s see how you might put a hedge to work.

Portfolio hedge in action

- You own a $1,000,000 portfolio with high equity concentration. The equity portion of the portfolio is well-diversified and is closely correlated to the S&P 500 (meaning the beta is

1.0), but the beta of your overall portfolio is 0.80 to take into account the other assets in your portfolio, such as fixed income. This implies that when the value of the S&P 500 index declines 1%, the value of your overall portfolio will decline by 0.80% (assume the non-equity portion of your portfolio remains unchanged and the 0.80 portfolio beta remains constant throughout this example).

For this example, we are using the at-the-money strike price to obtain immediate downside protection in the event of a sell-off. The 3% or $30,000 allocated for this hedging strategy is used to purchase a total of six SPX 1405-strike put options:

$50.00 (ask) x 6 (# of contracts) x 100 (option multiplier) = $30,000 (excluding commissions)

The table below illustrates how the value of the portfolio would be affected based on the performance of the SPX at the expiration of the three month SPX put options.

SPX percentage change