How to get the best asset allocation in your portfolio

Post on: 3 Июль, 2015 No Comment

Article utilities

Many investors, particularly those Australians with an increasing portion of their wealth in superannuation, learnt the importance of asset allocation the hard way.

Before the global financial crisis, the only thing most people cared about was whether their account balance rose in line with the booming sharemarket.

Important investment principles such as diversification and the fact that higher returns mean higher risk were the convenient casualties of a spiking sharemarket and the accompanying boom in wealth.

Of course, history has taught all of us a sober lesson in investing: shares dont always rise and there are times when other, more conservative, assets make good sense.

A useful concept

This is where asset allocation comes in.

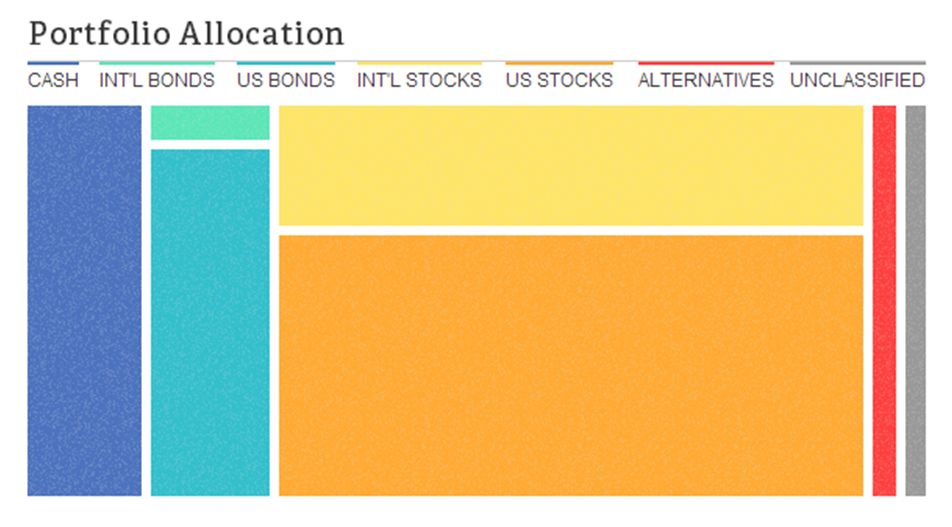

Asset allocation is jargon for how you divide your money between different investment categories such as equities, property, fixed interest and cash.

The theory is that when you spread your money between these categories, you can reduce risk because each asset class has a different correlation to the others.

For example, when share prices rise, the price of bonds often falls.

When the sharemarket begins to fall, real estate might begin generating above-average earnings. The results are smoother returns. But a big problem during the GFC (between November 2007 and March 2009) was that most asset classes fell in tandem, honouring the adage that in a crisis, the only thing that goes up is correlation. That left a lot of investors unsure which way to turn.

Bad move

In retrospect, the worst thing to do was sell out of the sharemarket at its low point in March 2009 and move the money to cash.

This would have ensured that any losses incurred from the falling sharemarket would have been crystallised. right before the market went on to regain most of its 50 per cent drop in the following six months.

Set sail for a port

Unfortunately, if understandably, the shock of seeing their wealth plummet did cause many to flee the market for safer waters.

While cash might be the safest investment option for most people, it also offers the lowest returns over the longer term and, for many people, that is what superannuation is all about.

Unsurprisingly, older Australians tend to take a far greater interest in their level of retirement savings and where they are invested than the younger generations, who are known to be apathetic about their superannuation, perhaps because they think retirement is too far away to worry about.

The general lack of interest means most people (80 per cent) in the so-called accumulation phase of superannuation are in the default balanced option offered by their superannuation fund (see table).

In a balanced fund, between 60 per cent and 80 per cent of the money is invested in growth assets such as domestic and international shares and property, with the rest in defensive assets such as bonds and cash.

Aggressive strategy

Recently, the media has been reporting the views of experts who believe this high level of equity holdings compared with other parts of the world is too aggressive for anyone close to or in retirement. The argument runs that this group might be better off opting for a more conservative stance of, say, 40 per cent in equities and property and the rest in fixed interest and cash.

But that might merely be a knee-jerk reaction to recent market falls.

In fact, the debates among investment professionals about whether asset allocation should respond to cyclical ups and downs can obscure the main game: to make sure enough money is coming in the door to pay bills and fund a lifestyle.

Investments strategies should always be designed around immediate and future cash-flow needs, says a private client adviser at Prescott Securities in Melbourne, Ben Prisk.

A model portfolio

With that in mind, Prisk says a typical retirees fully invested portfolio might be structured as 10 per cent cash, 15 per cent fixed interest, 40 per cent Australian shares, 15 per cent international shares. 10 per cent infrastructure and 10 per cent listed property.

Its those already drawing a pension from their superannuation accounts who are more likely to take advantage of the investment menu on offer by most funds to ensure they get the best asset allocation possible.

Certainly, this was the case following the GFC, when there was a flood to cash at the expense of balanced options, says the operations chief of superannuation research group SuperRatings, Nathan MacPhee.

SuperRatings research shows the amount of money retirees invested in cash went from 3.7 per cent in 2008 to 14.5 per cent in 2009 before falling slightly to 10.5 per cent and 10.9 per cent in 2010 and 2011, respectively.

Money in balanced funds (the majority of which is in equities) for retirees dropped from 56.2 per cent in 2008 to 47.8 per cent in 2009. It fell to 39.8 per cent in 2010 before rising slightly to 41.6 per cent in 2011.

The stable option

The other notable switch for retirees was the rise in the capital stable option, in which the typical allocation to growth assets such as shares and property would be about 20 per cent to 40 per cent.

Although the latest weakness and volatility in the sharemarket has once again prompted superannuation fund members to get in contact with their funds, there is evidence that, this time, fewer members are actually switching between investment options.

During the GFC, members who called their fund wanting to move from the riskier and more volatile growth options were automatically switched, MacPhee says. However, three years later, the same funds are better equipped to deal with member inquiries and concerns. New rules that allow some kinds of financial advice to be given over the phone mean funds can provide advice directly to members and perhaps deter them from switching and crystallising losses, and provide guidance about their most suitable long-term options.

Find the right balance

So, how should you divvy up your money? Unfortunately, when it comes to asset allocation, no one size fits all.

But while a simple answer is elusive, you should spend some time thinking about it: the decision about what assets to hold and how is often regarded as the biggest driver of investment success. The managing director of Professional Wealth, Doug Turek, likens asset allocation to the design of a house. It is more important to get the overall architecture right, such as the number and sizes of rooms you will allocate to different assets, than interior design, which is analogous to choosing the individual stocks or bonds you buy.

Turek says the main asset-allocation decision is getting the balance right between growth assets (the ones that let you eat well) and the defensive assets (the ones that let you sleep well).

That decision depends on an array of factors, including how much risk you can tolerate and how long you have before retirement.

Keep it simple

The simple formula is that the more growth assets you have in your portfolio, the greater the risk its value will fluctuate from year to year.

People who find it difficult to sleep when their wealth is bouncing up and down would probably have fewer growth assets and more defensive assets such as bonds and cash, which tend to provide more stable, if lower, returns.

Turek also says someone who has their asset allocation wrong is probably suffering more financial distress than they need to.

If you prudently set aside enough funds in bonds and cash in advance of a GFC, and we dont know when there will be another one, you can sleep well, avoid having to sell assets and ensure a more financially secure retirement, he says. If you got that wrong and you are forced to sell assets or the value of shares dont come back, then the quality of your retirement going forward might be impaired.

Time out

All investors should regularly take the time to review the asset weighting of their portfolio and make adjustments to take into account major moves in the market.

Before the GFC, it was not unusual for portfolios to have a greater exposure to growth assets such as equities than they perhaps should have, resulting in the move out by many people.

Having your age in bonds is not a bad default position for many to keep in mind, Turek says. In other words, if youre aged 60, allocate 60 per cent of your funds to fixed interest.

Prisk reiterates that you shouldnt make wholesale changes to well-constructed portfolios because of recent market volatility.

As we have seen over the past couple of months, markets move quickly, he says. Recoveries tend to be swift, so market timing and aggressive trading in and out could leave you worse off if you get it wrong.

Still, Prisk says, you need to be comfortable with what you are investing in and understand your assets and strategy.

Different assets invariably perform well at different times, so by sticking to the basics and buying good quality at reasonable prices, investors will not have to take a big bet on complete unknowns.

Common fund labels explained

A guide to where the money is invested and to what end:

GROWTH

Invests.

70 per cent to 90 per cent in shares or property and 10 per cent to 30 per cent in defensive assets such as fixed interest and cash.

Aim. for higher average returns in the long term; for example, to beat inflation by 4.5 per cent a year, over rolling 10-year periods.

Risk. volatility in annual returns is likely and a chance of a negative return, on average two years in eight years.

BALANCED

Invests. 50 per cent to 70 per cent in shares or property and the rest in fixed interest and cash.

Aim. for reasonable returns: less than growth funds but to reduce the risk of losses in bad years. For example, beat inflation by 3 per cent a year over rolling seven-year periods.

Risk. there might be volatility in annual returns and there is a chance a negative return might be recorded, on average two years in every 12 years.

CONSERVATIVE

Invests. 30 per cent to 50 per cent in shares and property, with most in fixed interest and cash.

Aim. to reduce the risk of loss and to therefore accept a lower return in the long term. For example, the consumer price index plus 2 per cent a year over rolling four-year periods.

Cash

Invests. 100 per cent in deposits with Australian deposit-taking institutions.

Aim. for stable returns in a short term. For example, exceed CPI by 1.5 per cent over rolling three-year periods.

NB. Different funds might have different names for their portfolios and asset allocations might differ. Full details are in a funds product disclosure statement