How To Get Capital Gains Tax Exemption On The Sale Of Your Principal Residence

Post on: 15 Апрель, 2015 No Comment

Updated on July 9, 2014 by Cherry Castillo

ADVERTISEMENT

Everyone wants to have a break from paying taxes, so it pays to know the legal ways we can avoid paying taxes. One of them is to take advantage of the exemption from capital gains tax (CGT) on the sale of a principal residence. Learn how you can avail of a capital gains tax exemption when you sell your home below.

Note: You may also refer to our previous discussion on CGT

Table of Contents

What is Capital Gains Tax (CGT) on the sale of real estate?

Basically, the seller of a real property considered as a capital asset will be subject to CGT. However, if the capital asset sold is the sellers own principal residence, the sale may be exempt from CGT. CGT is computed at 6% of the highest among the BIR zonal value, tax declaration value, or selling price, so the tax savings may be significant.

Just to give you an idea, for the sale of a P1 million property (assuming this is the fair value), the CGT is P60,000. For a P10 million property, the CGT is P600,000. I think the savings may really be significant so it pays to learn about this tax saving opportunity.

What is a Principal Residence?

Section 2(2) of Revenue Regulations (RR) No. 13-99. as amended by RR No. 14-00. defines principal residence as:

the dwelling house, including the land on which it is situated, where the husband and wife or an unmarried individual, whether or not qualified as head of family, and members of his family reside. Actual occupancy of such principal residence shall not be considered interrupted or abandoned by reason of the individuals temporary absence therefrom due to travel or studies or work abroad or such other similar circumstances. Such principal residence must be characterized by permanency in that it must be the dwelling house in which, whenever absent, the said individual intends to return.

In other words, the principal residence is the sellers family home. There may be times when the owner wants to sell his old home and buy a new one in a new place, or maybe a bigger one to accommodate a growing family. There may also be times when owners of a big house experience an empty nest feeling as their children have their own lives, so they want to live in a smaller house or maybe even a condominium unit near a hospital or places of interest.

Please note that as per RR 14-00. the residential address shown in the latest income tax return filed by the vendor/transferor immediately preceding the date of sale of the said real property shall be treated as a conclusive presumption about his true residential address.

Thus, if you plan to avail of the CGT exemption on the sale of real property, make sure that your address in your latest tax return is the address of the property to be sold.

Basic Requirements to Avail of CGT exemption

The following are the criteria as summarized by the BIR website (emphasis mine):

The proceeds of the sale of the principal residence have been fully utilized in acquiring or constructing new principal residence within eighteen (18) calendar months from the date of sale or disposition ;

The historical cost or adjusted basis of the real property sold or disposed will be carried over to the new principal residence built or acquired;

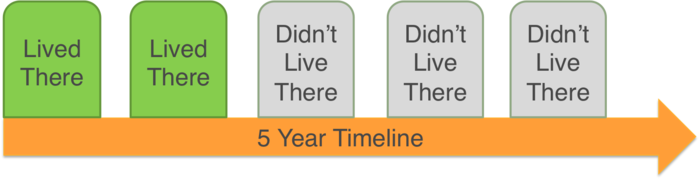

Exemption was availed only once every ten (10) years ;

If there is no full utilization of the proceeds of sale or disposition, the portion of the gain presumed to have been realized from the sale or disposition will be subject to Capital Gains Tax.

In case of sale/transfer of principal residence, the Buyer/Transferee shall withhold from the seller and shall deduct from the agreed selling price/consideration the 6% capital gains tax which shall be deposited in cash or manager’s check in interest-bearing account with an Authorized Agent Bank (AAB) under an Escrow Agreement between the concerned Revenue District Officer, the Seller and the Transferee, and the AAB to the effect that the amount so deposited, including its interest yield, shall only be released to such Transferor upon certification by the said RDO that the proceeds of the sale/disposition thereof has, in fact, been utilized in the acquisition or construction of the Seller/Transferor’s new principal residence within eighteen (18) calendar months from date of the said sale or disposition. The date of sale or disposition of a property refers to the date of notarization of the document evidencing the transfer of said property. In general, the term “Escrow” means a scroll, writing or deed, delivered by the grantor, promisor or obligor into the hands of a third person, to be held by the latter until the happening of a contingency or performance of a condition, and then by him delivered to the grantee, promise or obligee.

The requirements are quite straightforward except for that part about the 6% CGT being set aside and put in escrow with an Authorized Agent Bank (AAB). Escrow is not a very common scheme done in the Philippines but admittedly, it is a good way to ensure that the tax exemption will only be availed by those who complied with all conditions set.

Perhaps in the past, when escrow was not yet required, there may have been some people who availed of the tax exemption but did not really fufill the conditions set. It may have been hard for the BIR to run after the unpaid CGT since no amount was set aside to answer for it.

With the current set-up, should the conditions not be met, it would be easy for the BIR to assess the deficiency CGT and collect the original CGT due because they need only to give instructions to the bank to forfeit the amount (or a portion of the amount) in escrow.

Requirements to get a CAR for the sale of a Principal Residence

One of the major requirements before a person can transfer a title to a property to his or her name is the Certificate Authorizing Registration (CAR) and Tax Clearance from the BIR. Check out the documentary requirements below to see if the sale of your principal residence qualifies for CGT exemption. (click to enlarge)

Click here to download a PDF version of the checklist

Sample computations and other details

For sample computations, we shall refer to Sections 4 and 5 of RR 13-99. which I have quoted below:

SECTION 4. Determination of Capital Gains Tax Due if the Proceeds of Sale. Exchange or Disposition of his Principal Residence has not Been Fully Utilized. — In a case where the entire proceeds of sale is not utilized for the purchase or construction of a new principal residence, the capital gains tax shall attach. In computing the capital gains tax due on the sale of the principal residence, we follow the following steps:

(1) Determine the percentage (%) of non-utilization applying the formula: