How to diversify assets in your super fund

Post on: 1 Май, 2015 No Comment

Article utilities

This may seem back to front but a good place toinvestigate how you should be invested now is tolook at the future. Although it may sound far away, get a feel for how much youll need to live on in retirement, suggests Assyat David, co-founder of adviser Strategy Steps. Do this via the Westpac ASFA Retirement Calculator which shows, for example, that a couple in Brisbane wanting acomfortable (as opposed to modest) lifestyle would need about $52,000 a year.

Get to grips with different risk levels

If youre with an industry, retail or corporate fund youre likely tobe offered different investment options with different return targets depending on the level of risk. The most defensive option would be cash and the most aggressive 100per cent shares. Most members areinvested in between. For example, industry fund AustralianSupers highgrowth option targets growth of 5per cent each year (on top of inflation) but its viewed as high risk because returns will fluctuate considerably. The funds conservative balanced option targets annual growth of 3.5per cent (above inflation) but risk is lower, with only moderate fluctuations expected.

Check your investment option

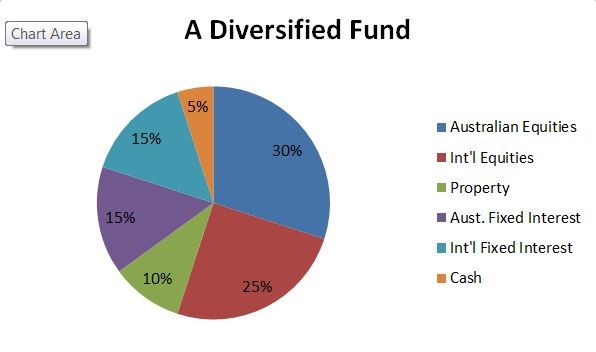

Make sure you have, in fact, chosen an investment option. Where members dont make an active choice, their super is put in the default choice. This is often the balanced option in AustralianSupers case this is invested 34per cent in Australian shares, 20per cent international shares, 12per cent property, 14per cent infrastructure, private equity 4per cent, fixed interest 11per cent and 5per cent in cash.

Test whether its working

Apathy can cost you money, says Brian Parker, senior investment strategist at MLC Investment Management. So whether youve made an active choice or are in the default investment option, make sure its working. Use the retirement planning calculator on www.moneysmart.com.au (run by the Australian Securities and Investments Commission) to see whether your super balance will grow enough for when you retire. Say youre 40 and want to retire at 65, for example assuming you earn $100,000 a year, salary-sacrifice $10,000 a year and have $100,000 in super invested in the moderate option, youre likely to retire on only $39,992 a year. Move to the growth option and youre likely to boost income to $41,839, or the high growth option for a likely annual income in retirement of $43,063.

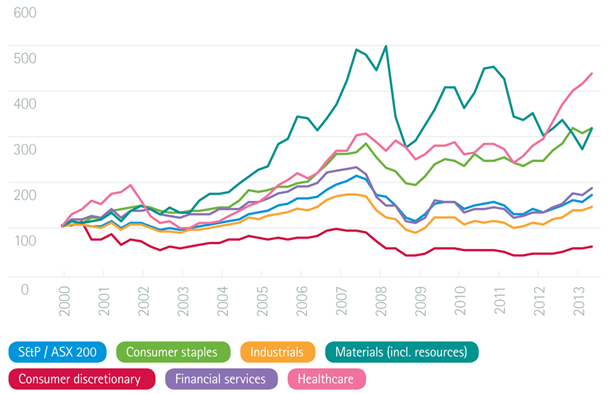

Know what the trade-off is

As shown in the different returns in step 4, there is a trade-off between riskand return. Jonathan Philpot, wealth management partner with HLBMann Judd Sydney, says at 40 youve got enough time to ride out market volatility in a 100 per cent growth portfolio. But for someone aged 50 it would make sense to haveaslightly lower exposure to growth assets via a balanced option (often 60per cent growth and 40 per cent income).

Look at your existing portfolio

Evaluate how you areinvested and what changes if any you needto make so you canreach your retirement goal and sleep comfortably at night.

Implement changes

If you feel you are notexposed to enough growth assets, get your fund toincrease your allocation to international and Australian shares. Ifyoure not willing to accept thehigher risk and youre willing totakethe trade-off of lower returns,staywith a more defensive portfolio.