How to construct your own asset allocation

Post on: 4 Апрель, 2015 No Comment

T rying to settle on an asset allocation is a classic cause of analysis paralysis. Financial industry talk of efficient frontiers, mean variance analysis and allocations customised for your unique circumstances can lead you to believe there’s a perfect recipe out there – some financial equivalent of the Ancient Greek’s golden mean .

Sadly, you can only know your ideal asset allocation in retrospect. Thats because nobody can predict with any degree of certainty which combination of asset classes will deliver the best returns after one, ten, or 20 years.

The proper goal of asset allocation is to pick a diversified combo of investments to see you proud in most circumstances. The mix should suit your:

- Investment goals .

- Attitude to risk – can you handle it when the market tanks?

- Time horizon – might you be forced to sell up at the worst possible moment?

In a minute I’ll run you through a simple method to create a robust asset allocation. Well consider what questions you’ll need to ask yourself along the way and some of the rules of thumb you can use to narrow down your answers.

But before that we need to do some spadework.

Asset allocation preparation

You need to know what youre investing for. Specifically, some hard numbers:

Spend some time thinking about those numbers. The result will be a plan that can be adapted to any investment goal.

Don’t worry if your numbers are a little hazy. Investing is like piloting a ship through the fog. We will make a few course corrections along the way. For now we just need to know roughly where the land lies.

You don’t have to consult your local mystic to work out your return number, either. We’ll get that from the historical record and a smorgasbord of sources that have analysed current valuations. This number will be wrong, but it’s the best we can do and is no more likely to be wrong than anyone else’s best guess. (I’ll write more about this in my next post).

Your return number will be heavily influenced by the combination of equities 1 and bonds 2 that suits your risk tolerance. Together, equities and bonds are the rocket fuel and crash bags of a diversified portfolio.

- Equities generally deliver decent growth. but occasionally they destroy value like a shredder that suddenly grabs your fingers.

- Bonds generally offer stability and low growth, and help to cushion your portfolio when your equities fall.

Traditionally, 100% equities is the preserve of beings with an emotional temperature near Absolute Zero. Meanwhile 100% bonds is reserved for timorous burrowing creatures who cannot bear loss of any kind.

Most people lie somewhere in between.

Your place on the spectrum is impossible to know with any confidence until you’ve received your first shoeing in the market. The industry uses risk profiling tests in the absence of other evidence, or you could try the risk tool here on Monevator. We’ll also offer an even cruder approach below.

Ultimately, the amount you invest multiplied by the compound return you receive will equal your big number in X years.

If X years is likely to be less than ten, then you’d be very unwise to commit all to equities. More on this below.

Beware too that if your required return suggests an equity allocation above your risk tolerance – or higher than the expected rate of growth – then you’re heading for the rocks.

Rather than ignoring the red warning light and slamming the risk lever to Max Equities while hoping not to crash, youd do better to save more, reduce your big number, or plan to take longer to reach your destination.

Choosing your equities

Most people must invest in equities because their goals require a rate of growth they’re unlikely to get from bonds, cash, or any of the gentler asset classes.

Equities are inherently risky, so passive investors diversify as much of that risk away as they can by investing in the broadest pools of shares possible.

By doing so, we avoid taking bets on individual companies, industries, countries or regions that could sail down the Swanee.

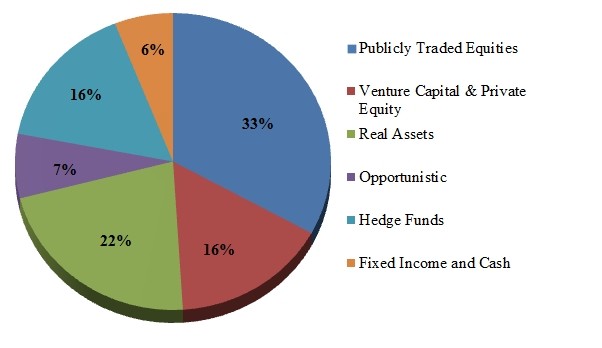

Instead, we invest in the most diversified equity line up available – the World Stock Market, which currently looks something like this: