How to Comply With the New Revenue Recognition Rules

Post on: 29 Март, 2015 No Comment

Fusion-io , a fast-growing start-up based in Salt Lake City, needed a more efficient way to provide its investors and bankers with a clear picture of its revenues. The company, which launched in late 2005, makes cutting-edge flash storage memory devices and also provides year-long maintenance contracts. The old accounting rules required Fusion-io to spread out its recognition of the revenue for both product sales and maintenance throughout the life of the service contract, which didn’t accurately reflect their revenue realities. So when the accounting standards were updated earlier this year, Fusion-io was quick to embrace them.

These new accounting standards were developed by the Financial Accounting Standards Board (FASB). the non-profit group recognized by securities regulators in the U.S. to set accounting rules for public companies. The group has recently provided companies with a roadmap for how to recognize revenue from goods at the time they are sold and delivered, even if they are sold bundled with service contracts. In addition, another rule allows makers of goods that contain software — from computers and cell phones to medical devices and cars — to avoid having to follow special software revenue recognition rules in accounting for sales.

The new guidance is part of a larger accounting standards overhaul spelled out in a 170-page draft that is expected to be finalized in 2011. But the new revenue recognition provisions take effect for fiscal years beginning on or after June 15, 2010, and some companies — including Fusion-io — have opted for early adoption for fiscal year 2009.

‘If you think about the old guidance, it was inconsistent with what our economic benefit was. We had deferred revenue on the books that we couldn’t recognize but for which we had already collected the cash,’ says Catherine Voutaz, Fusion-io’s controller. ‘When people went to look at our financial statements, they would ask why we had a huge amount of deferred revenue on our books. It gave investors a view that was not really reflective of reality.’

The new FASB rules amount to ‘an easier way for us to communicate with our internal investors and the bank,’ she says.

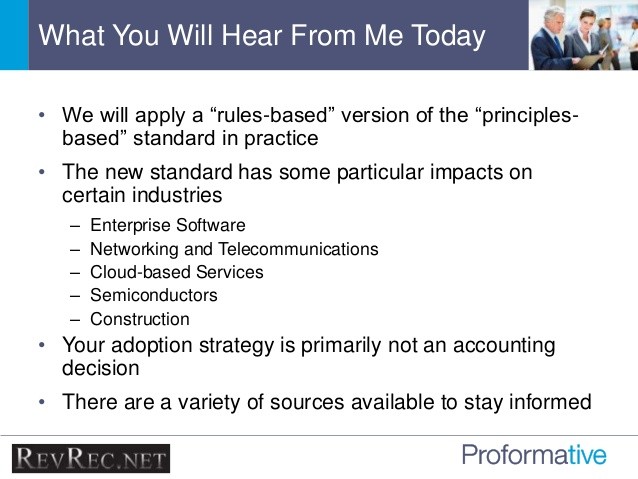

The following guide will review the background of revenue recognition rules, what type of companies are covered under the new rules, and tips on how to switch to the new rules.

Revenue Recognition Basics

Revenue is one of the key figures that investors, bankers, customers, regulators, etc. look for in financial statements to gauge the past performance of a company, as well as its future potential. But the revenue recognition rules in the generally-accepted accounting principles (GAAP) in the U.S. are different from those used in much of the rest of the world under International Financial Reporting Standards (IFRSs).

In addition, a series of companies — including Sunbeam, Xerox, PurchasePro, and Microstrategy — were targeted by the U.S. Securities and Exchange Commission (SEC) in the late 1990s and early 2000s with allegations that those companies improperly recognized revenue, leading some of the companies to pay settlements and restate revenue. Those actions often roiled stock prices and market capitalizations.

In 2002, FASB and the IASB agreed to work jointly to clarify the principles for recognizing revenue and set out to write a set of common revenue standards to remove inconsistencies and weaknesses, improve comparability of revenue recognition practices, and to simplify the preparation of financial statements for companies. That process has culminated in the new rules, which are now being subject to a commentary period before their adoption.

After years of deliberation, FASB issued new guidance for revenue recognition on two highly controversial issues. FASB, under Accounting Standards Update (ASU) 2009-13, now allows companies to establish and even estimate selling prices for multiple-deliverable arrangements. Another new rule, ASU 2009-14, allows makers of computers, cell phones, and even cars to avoid special software revenue recognition accounting rules if the software included in the product was incidental or, conversely, essential to the product. Those companies can now estimate selling prices for software and recognize that over a different time period than hardware.

Companies Impacted by the New Revenue Recognition Rules

The new rules are sometimes informally called the ‘Apple rules’ because Apple Computer was especially interested in the changes to the old guidance; some of the company’s most successful products — such as the iPhone — involve the sale of both hardware and software updates that extend over a year. In the past, Apple had to defer recognizing some of the revenue from iPhone and Apple RV sales; it ‘was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time to time provide future unspecified software upgrades and features for those products free of charge,’ the company says in a press release. ‘Under subscription accounting, revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product’s estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV.’

Under the new rules, Apple can assign a value to the software to account for over time and book revenue faster for the hardware, meaning that if the company launches a successful new product it should, theoretically, drive up the company’s earnings more immediately. Apple in January announced that it was retrospectively adopting the new accounting rules and revised its financial statements for each quarter dating back to 2007. ‘The Company believes retrospective adoption provides analysts and investors the most comparable and useful financial information and better reflects the underlying performance of the Company’s business,’ Apple explains.

Other companies are also finding that they are impacted by the new rules. ‘The rules involve multi-element revenue recognition for any company that may sell multiple items on a single sales order. For example, we would sell a subscription to our software service and professional services,’ says Ron Gill, CFO of NetSuite. a company that sells accounting software on a software-as-a-service basis. ‘The two items on the sales order may have different delivery timing.’

NetSuite was not only impacted by the new revenue recognition rules in its own business, but the software maker has developed a module to help companies implement the new revenue recognition rules. In its own business, NetSuite provides a subscription-based module for its software that customers pay on a monthly basis, meaning the company recognizes that revenue on a monthly basis. At the same time, NetSuite often provides customers with professional services to help them implement the new software module and integrate it with their existing financial systems. Those services are often provided within the first three months of a contract, but in the past NetSuite had to recognize that revenue over a 12-month period, as well, because it was often sold as a bundle with the subscription.

While many high-tech companies are impacted directly by the new rules, they can also apply to other types of businesses that sell products and services together. For example, stores such as Best Buy or Sears might sell refrigerators or washing machines along with a maintenance contract. Likewise, a consulting firm that sells multi-element arrangements — advice and outsourcing services along with software — might price their products in a way that causes the new revenue recognition rules to apply to that business, as well. In addition, an industrial equipment manufacturer might sell trash compactors along with a service contract or consulting services. In the latter case, the actual product might be delivered right after the contract is signed, but the service agreement may extend over the course of a year or more. In the past, if the product and service were bundled and sold together, oftentimes companies had to recognize the revenue for both over the term of the service contract.

Tips for Implementing New Revenue Recognition Rules

The new guidance will force many companies to change the way they recognize revenue. That may create problems with existing financial software being used to allocate revenue for bundled products and services. Some of the changes that FASB identified include the following:

- An element of a sale can be recognized after being ‘delivered’ to the customer only if the item has a stand-alone value and if the element is expected to be delivered.

- A new concept of ‘estimated selling price’ gives companies the option of relying on internal estimates of the selling price of one of the bundled elements in a sale when there is no third-party evidence of the selling price nor something called vendor-specific objective evidence (VSOE).

- Companies can no longer use the residual method of accounting to allocate value of the elements of a sale. They have to decide at the inception of the products and services to be bundled whether to use estimated selling price, VSOE, or third party evidence of selling price.

- Companies will have to provide disclosure in their financial statements for how they came about the estimated selling price of the sale elements.

Companies that need to alter the way they recognize revenue for multi-element sales may want to hire outside consultants to help analyze the best way to proceed, how to determine prices, and what impact these changes will have on the company’s financial statements.

Apple was ready to go when the FASB changes were announced. The company formerly had to recognize revenue for each sale of an iPhone over a two-year term to account for the software upgrades that came bundled with the device. Under the new rules, Apple has set a value for the software upgrades and recognizes that amount over two years, but the bulk of the revenue from each iPhone sale is for hardware and is recognized immediately.

Some ERP systems may be unable to handle this differentiation when it comes to implementing the new rules. As a result, some companies, just like NetSuite, are developing products that help businesses recognize revenue for these different elements under the new rules. ‘It’s very complicated,’ Gill says. ‘What our software does is it allows you to take your price list and for every item on the price list append additional prices or objective values. You’re going to put in your prices and then put in these values and as you process a sales order the system will calculate the proper amount of revenue to recognize for each item based on the allocated values.’

Fusion-io opted for the NetSuite software. But the company also set up a pricing committee made up of senior management to go through on a quarterly basis and look at what products the company sells and what price to assign elements of multi-element products. ‘We break out each element individually and say the product sale will be a certain amount and the maintenance will be a certain amount and we sell that over and over at about the same price to our customers,’ says Voutaz. Where the company previously broke out the elements in spreadsheets, its accounting system now automatically applies the new revenue recognition rules. ‘It’s much easier,’ she says.

Recommended Resources:

A PricewaterhouseCoopers report on the impact of the new rules.

A rundown on the new rules and history of the problem by Boston-area CPA firm Moody, Famiglietti & Andronico.