How to choose between a traditional 401(k) and a Roth 401(k)

Post on: 6 Июль, 2015 No Comment

Its been several years since the Roth 401(k) was introduced to the American retirement scene. As this retirement planning option has become more well-known, and as more employers offer the Roth version of the venerable 401(k), more workers are faced with making a decision about which is more likely to help them reach their retirement goals.

If your employer offers access to a Roth 401(k), it makes sense to rethink your retirement contribution plan. Heres how to decide which type of 401(k) to use for your retirement investment .

Cash Flow Now vs. Tax Savings Later

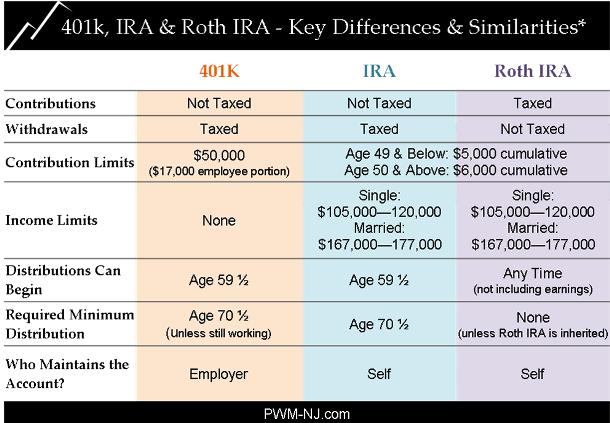

The Roth 401(k) is a great addition to the retirement savings landscape because it combines the higher contribution of a 401(k) with the tax-free growth seen with the Roth IRA. Plus, a Roth 401(k) doesnt come with the pesky income limitations attached to the Roth IRA. Your Roth 401(k) is just like the regular 401(k), except instead of getting a tax deduction now, you contribute with after-tax dollars and you dont have to pay taxes on your withdrawals during retirement.

For many employees, the decision comes down to this: Do you need the cash flow now? Or do you prefer to enjoy tax savings later?

With a traditional 401(k), you make your contributions with pre-tax dollars. This decreases your taxable income, and reduces your current tax bill. If you are going to make a retirement contribution automatically from your paycheck, you are going to see a bigger pay day with the traditional 401(k). This is because the money is taken out of your paycheck before taxes are assessed. Your employer withholds your taxes based on this lower income, so less tax is taken out.

On the other hand, your Roth 401(k) contribution is taken only after taxes have been assessed. After your higher taxes have been withheld, your Roth 401(k) contribution is deducted from your paycheck. The result is a smaller payday with a Roth 401(k).

If you are counting every dollar and struggling with your cash flow needs. a regular 401(k) might make more sense. But for those who are more concerned about the future, a Roth 401(k) provides a nice opportunity to improve tax efficiency. Its true that you pay taxes on your income right now, but if you think that taxes will rise in the future. you save in the long run by paying now.

Thats because, with a traditional 401(k), when you eventually withdraw your money from your account, it is taxed as ordinary income; you dont even get the advantage of long-term capital gains rates. Your Roth 401(k), however, sees no taxes. All of the money in the Roth version grows tax-free, shielding you from higher taxes down the road.

Your decision should be based on your current situation. Its also worth noting that you can change things up later. While you might need the tax deduction from a traditional 401(k) right now, in a few years, after your income increases. you can switch to a Roth 401(k). Pay attention to your individual needs, and consider consulting a professional to help you make the best decision.

(Photo: Tax Credits)