How To Cash In On Credit Cards (V MA AXP DFS)

Post on: 1 Июнь, 2015 No Comment

Each day, billions of transactions take place without the use of physical cash or coin. Credit cards have taken hold, and their use is accelerating at breakneck pace. Most people today use a plastic card to pay for their goods, and in most cases, these consumers aren’t even paying for these goods or services with money that they’ve earned yet. As a result, continued dependence on consumer credit — and by extension credit cards — has been one of the contributing factors that have led to the economic rise of the U.S. economy over the past hundred years.

Growth of Card-Not-Present Transactions

The Federal Reserve ‘s recently released 2013 Payments Study. which takes a look at recent and long-term payments trends in the United States between 2000 and 2012, found that the number of general-purpose credit card-not-present transactions (transactions where the individual is unable to show a physical card to the vendor such as those transacted over the internet) have increased at more than three times the annual rate of card-present transactions (situations where the consumer can provide the physical card to the vendor) from 2009 to 2012. Data suggests that card-not-present transactions are increasing more than 25% annually to approximately $1 trillion.

This broad shift in buying behavior is not to be ignored by investors. According to creditcards.com. average debt per credit card that usually carries a balance comes in at $8,220. According to the same site, the average APR on credit cards with a balance is 12.73% as of May 2014. Given the extremely large amounts of money involved you can see why credit card companies make for lucrative investment candidates. (For more, see: Investing In Credit Card Companies .)

Credit Card ETFs. Not Yet

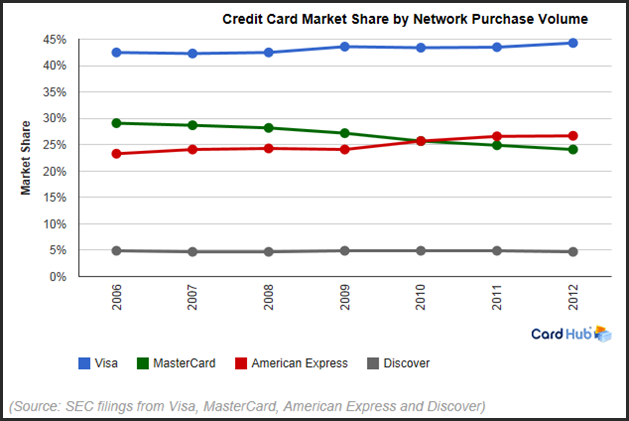

When such a strong investment thesis is formed it’s not surprising for retail investors to turn to exchange-traded funds (ETFs). These investment products offer a one-stop solution for retail investors seeking exposure to whole industries, specific commodities, investment strategies or even broad market indexes or derivatives. Unfortunately, there is no exchange-traded fund in the market that gives investors direct access to the credit services industry. Investors who are interested in buying into credit card companies should focus their attention on the major publicly traded general-purpose credit card networks, which are shown in the table below:

Credit Card Company