How to Calculate the Dividend Payout Ratio

Post on: 23 Июнь, 2015 No Comment

O ver the past few years, dividend growth investing has become one of my favorite investing strategies which is evident in the number of times Ive written about the topic. I follow the dividend growth investing strategy as it can generate a growing tax efficient income stream over time as well as the comfort of receiving a portion of the companies profits on a quarterly basis.

In most of my previous articles about dividend investing, I mention the importance of giving attention to the dividend payout ratio. As Ive received this question from a reader, here are more details about what payout ratios are, why they are important and how to go about finding or calculating it.

What is the Payout Ratio?

Lets start off by explaining that the dividend payout ratio is the amount of dividends that a corporation pays out to shareholders relative to their net income (income after expenses) or earnings. In the most basic form:

Payout Ratio = Dividends Paid/Earnings

Payout Ratio = Dividends per Share/Earnings per Share

Why the Payout Ratio is Important

The dividend payout ratio will tell you how much of net income that dividends are chewing up which is relevant in evaluating the sustainability of the dividend. Generally speaking, payout ratios will vary by industry. Utilities with very steady and predictable cash flow may have a relatively high payout ratio, while bank and financial companies will be in another range. If earnings are poor, thus a higher payout ratio, there is a probability of the dividend being reduced or eliminated as the management has that option to conserve cash.

How do you Find or Calculate Payout Ratios

The easiest way is to visit a website that does the calculations for you like stockhouse.ca . However, with this strategy, there are times when the ratios are not updated with the most recent earnings. If you want to manually calculate payout ratio, youll need to pull the earnings and dividends data from company financial statements.

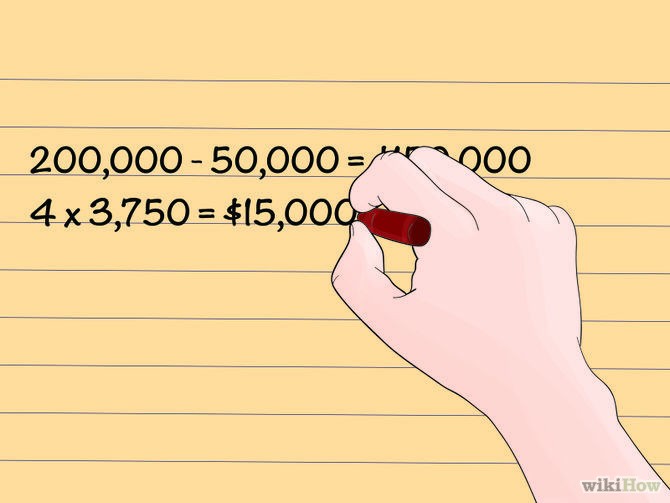

For example, if I take a look at TD, a popular Canadian bank, Google Finance tells me that in the most recent quarter, TD had a net income of $1.30 per share (EPS) and dividends of $0.61 per share. In this case, the payout ratio for the quarter was 47% which is fairly low for a bank. In addition to looking at the quarterly numbers, I like to review annual reports in case the quarter was an anomaly. In this case, for the trailing 4 quarters, TD has a payout ratio of approximately 50%. As mentioned, I like to compare payout ratios by industry, so it would be good practice to compare the payout ratios of the big 5 banks.

For those of you who are really savvy, instead of calculating dividends as a percentage of earnings, you can calculate them as a percentage of free cash flow .

What is an Acceptable Ratio?

As I mentioned earlier, its difficult to say what payout ratios are acceptable as every industry has their own range. However, if a company reports consecutive quarterly losses without a good strategy to get back to profit, then its a red flag that there could possibly be a dividend cut. Remember, its up to the management as to how much the dividend is reduced or cut altogether.

For you dividend investors out there, how do you use payout ratios when determining valuation?