How to Calculate Stock Intrinsic Value

Post on: 16 Март, 2015 No Comment

In the previous articles, we have covered on buying a stock that is below its market value. There are 1001 ways on how to define an intrinsic value of a stock. As you know, stock market price is fluctuated every now and then. You will never know at what price that market reflects a stock true value.

I will share on how to come out with intrinsic value. I may not be possible to cover all methods of the stock valuation in one article but will try to cover it as many as I can in the next series of articles.

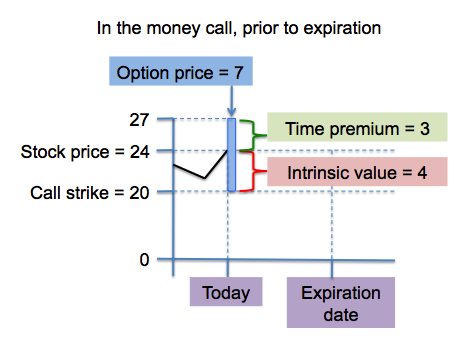

Intrinsic Value Illustration

Just remember, calculating an intrinsic value is not an exact science. It is a projection or estimation on the future value of a stock price based on business historical performance. What determine a future value is subject to a lot of factors, variables and parameters:

- Business performance can a company sustain its current performance in the next 10 years?

- Business trend Will the trend change? (best classic example, Nokia used to be a leader in Cellular phone but it has been knocked down once Apple Inc. introduce Iphone. Now Apple Inc. faced the same cycle where Samsung has slowly become No.1 in Smart Phone Industry)

- Economic condition (country, regional and global)

- Companys financial condition (debt, cash flow, Earning, future expansion and capital expenditure etc)

- Talented CEO or Board of directors

For the above criteria, you need to be really conservative in your stock valuation. One of the stock investor legend (Benjamin Graham and Seth Klarman), they factor in the so-called Margin of Safety (MOS). On the other hand, coming out with Stock Intrinsic Value, it is an estimation. Famous saying by Warren Buffett, It is better to be approximately right than precisely wrong. An intrinsic value of a stock will give a hint or gut feeling whether a stock value can be undervalued or overvalued.

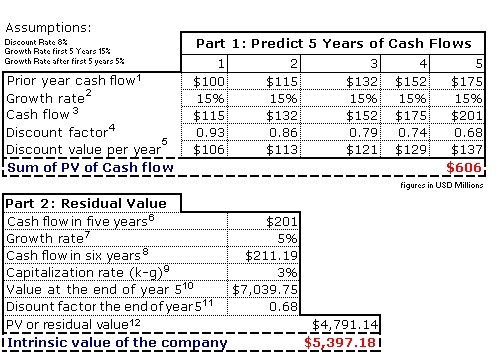

Why do we bother to find an intrinsic value? Heres the reason why. Assuming a companys earning growth 15% on yearly basis. Current Earning is RM100 million. Next 10 years, if a company accumulated RM100 million every year, by year 2023 company has accumulated RM1 billion. Next step is, in the next 10 years [2023], will the value of RM1.00 in 2023 be equivalent to RM1.00 in 2013. You never know what is the inflation rate like, interest rate, BLR rate etc. What do you need to do? You need to factor in Discounted rate.

Lets use a real company information and come out with intrinsic value. I choose Tomypak Holding Berhad.

Tomypak Counter

www.investmentmalaysia.org/2013/04/where-to-find-wtf-investment-tools/ ). This will help you to estimate intrinsic value of a stock.