How To Calculate Intrinsic Value of Common Stocks

Post on: 16 Март, 2015 No Comment

Read this post to learn more fun calculator tricks!

Knowing How to Calculate Intrinsic Value of Common Stocks can help you invest intelligently. And luckily, with the tools and calculators available free online, calculating intrinsic value of a companys common stock is easier than you think.

So

Read this short blog post to learn how to calculate intrinsic value of common stocks. Additionally, theres also a list of free online intrinsic value calculators online at the bottom of this post so you can start calculating intrinsic value for yourself.

And just to be clear:

Intrinsic value is basically defined as the true value of the company (or asset) as based on fundamental analysis without regard for the market price. Its the second part of that sentence that should really catch your attention. Calculating intrinsic value means ignoring the erratic quotations of Mr. Market .

How to Calculate Intrinsic Value The Basics:

Learning to calculate intrinsic value is actually pretty easy. And with todays online tools and intrinsic value calculators its easier than ever to figure out what a companys common stock is fundamentally worth. But before we start cracking out calculations of intrinsic value, lets quickly review some of the basics.

The main point to keep in mind when calculating intrinsic value is:

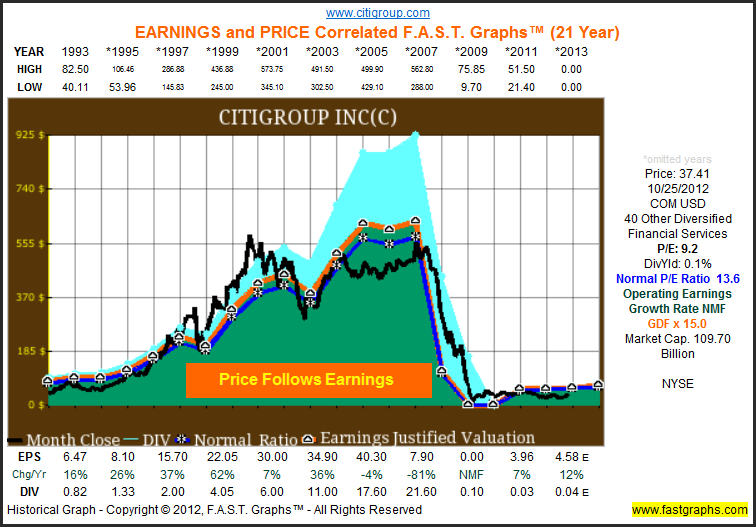

Calculating intrinsic value involves two main parts. The first component to consider are the net current assets of the company. And the second thing to keep in mind are the current (and future) earnings. By focusing on assets and earnings you can start to figure out what a company is worth.

A basic example of this is looking at the Graham Number. This quick and dirty calculation for intrinsic value incorporates both the assets and earnings of the company to arrive at intrinsic value. Of course

Youll want to go beyond just the Graham Number or the Benjamin Graham Formula if youre interested in accurately calculating intrinsic value. Nevertheless, these back-of-the-envelope analytical techniques can help you see and appreciate how earnings and assets factor in to the intrinsic value calculation.

Nowadays:

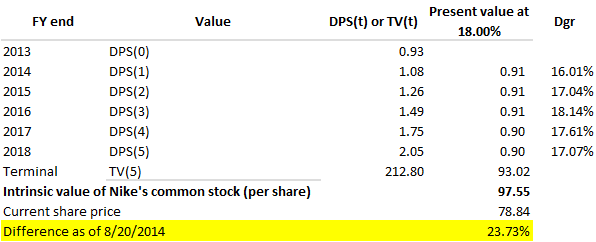

Most intrinsic value calculation takes the form of discounted cash-flow analysis. In this case, you figure out the net working capital of the company and then add the discounted value of future cash flows. This sounds complicated but its actually pretty easy. The link above shares the formulas you can use in detail for calculating intrinsic value.

Finally. if you dont feel like crunching these intrinsic value numbers by hand (even though its easy and worthwhile) there are a number of online calculators you can use for free to help you accurately calculate intrinsic value.

Calculate Intrinsic Value With Free Online Intrinsic Value Calculators:

The great thing about living in this internet era is that not only can you trade stocks online. but you can also research stocks online VERY easily. And instead of combing through the Moodys Manual by hand there are all kinds of free tools to speed up your research. So here are my favourite intrinsic value calculators available free online:

- Warren Buffetts Value Calculator . While Warren Buffett has never explicitly shared his intrinsic value calculations he has talked in broad strokes about how to calculate intrinsic value. This free online calculator gives you intrinsic value results when you plug in the required variables. Check MarketWatch or Morningstar for the required data points.

- Free Ben Graham Intrinsic Value Calculator . This online intrinsic value calculator works much the same as the one above. It relies on Ben Grahams formula for arriving at intrinsic value.

- Weighted Average Cost of Capital (WACC) Calculator . Discounted cash flow analysis requires you reduce the value of future earnings based on the time value of money. While a lot of investors use a standard discount rate, you can use the WACC calculator above to further improve your calculations of intrinsic value. Heres a short video I made on how to use the WACC Calculator .

Finally, Ill share another article if youre looking for a much more in-depth discussion of how to calculate intrinsic value. If youre still a little foggy on the principles behind calculating intrinsic value this article will bring you right up to speed. Now, were almost done.

But in case youre starting to feel confident with your intrinsic value calculations theres one thing you need to know

Common Mistakes When Calculating Intrinsic Value of Common Stocks

I dont want to rain on your parade. And at this point I know youre probably very excited about your ability to calculate the intrinsic value of common stocks. But I want to give you one important warning so here it is

This eBook can help you learn to calculate the intrinsic value of a stock pick for yourself. Check it out! (Click to see)

Your calculations of intrinsic value for your common stocks are only as accurate as the underlying assumptions!

Do you know what this means? It means that if you make crazy assumptions about future growth rates your calculations of intrinsic value will be wrong. The best investors look for a margin of safety in their investments wherein they will stand to make a significant amount of money even in conservative discounted cash flow analysis.

So just remember this

When youre calculating intrinsic value it pays to be modest and conservative in your assumptions. Run models and simulations that rely on sub-par growth to see if your favourite common stock can keep intrinsic value even in a low-growth environment. Without this step you might be inflating the intrinsic value of your common stock more than you think. Would Ben Graham approve?

And By The Way: If youre looking for more free online tools, tips and resources to help you improve your approach to stock markets then sign up for the email form below. Youll get a free 12 page ebook showing how I created an approach to consistently extract capital gains. Youl also get free tips, tools and resources each week to help you improve your trading and investing.