How to Calculate Enterprise Value of Private Company Invest Money

Post on: 16 Март, 2015 No Comment

How to calculate enterprise value of private company will be discussed in this article. Market capitalization is the easiest number that is available for a common man which we can use to estimate value of any listed company. As an alternative to market capitalization, we can also estimate value of a private company using enterprise value. How this value helps the investors? Enterprise value of private company is taking over cost of that company. Enterprise value is the minimum cost one shall pay to own 100% ownership of company. Suppose today I decide to takeover Tata Steel, what cost I should pay to obtain complete ownership of the company.

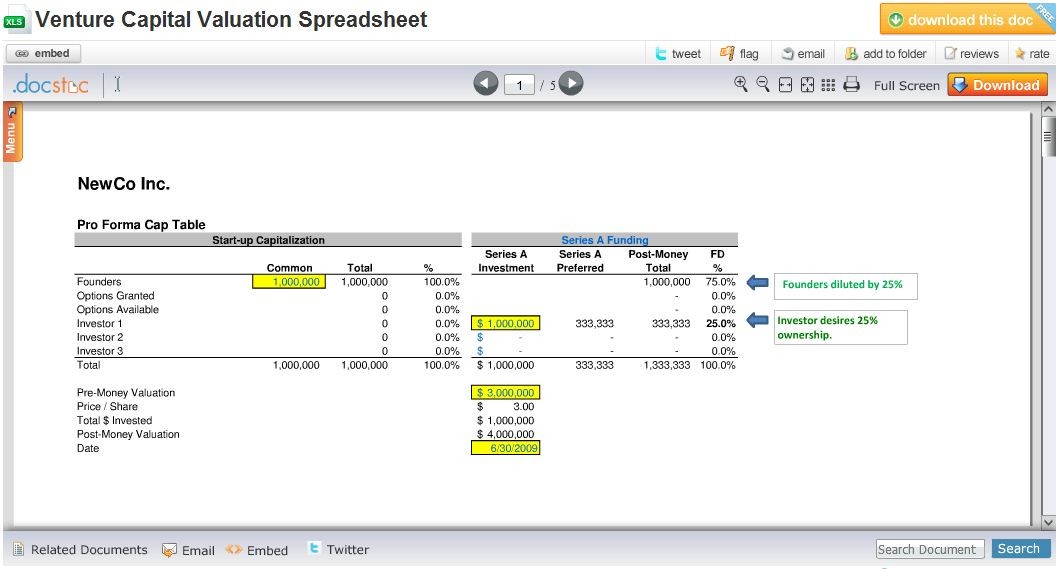

Calculating enterprise value of private company by this formula is very logical. In order to own 100% ownership of any listed company (forget about SEBI rules now), investor will need to buy its shares at market price. This is what is valued as market capitalization (number of shares outstanding x market price). After one owns the company they would also need to pay the company’s debt, and attend to demands of preferred stock holders. But in order to meet these future demands (debts etc) they can use the companies cash reserves to make these payments.

Among investors, enterprise value has found its popularity over market capitalization because in a way it talks about the real or total cost of taking-over a company. As enterprise value of private company takes into account the effect of preferred stock, debt and cash on companies overall value, it has found popularity among analysts.

Theoretically, enterprise value is:

Let’s look into the individual components of calculating enterprise value:

Market Capitalization: If one wants to know the value of company with only a click of a button, then market capitalization is what you are looking for. Though it may not represent the ‘true value ’ of company but it will still give you an approximate idea about companies value. It must be noted that market capitalization generally gives the value of company on higher side compared to its true value. It can be very easily calculated by knowing the following:

No of shares outstanding : 100,00,000 Nos (1 Crore)

Market Price per share : 100 INR

Market Capitalization : 1,000,000,000 INR (Rs 100 Crore)

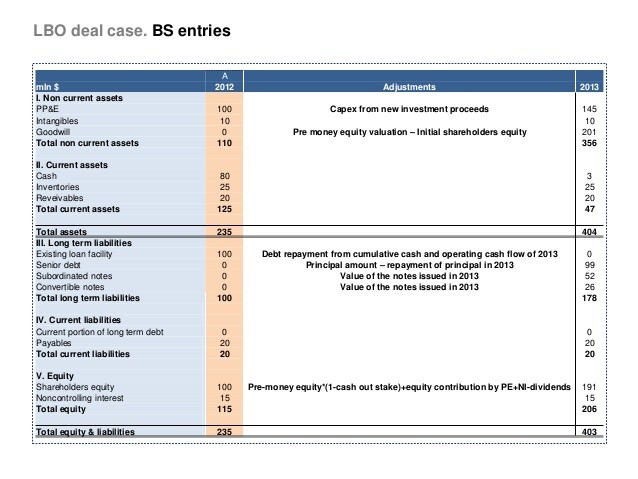

Debt. In addition to market capitalization, an outside investors needs to pay-off the debt of the company. So if a company is acquired at market cap of Rs 100 crore and it also owes a debt of Rs 10 crore (principal + interest) then total cost of acquiring the company will be Rs 100+10 = Rs 110 core. The total debt of the company (long & short term) can be obtained from the companies balance sheet. In calculating the enterprise value of private company it is essential to know the correct numbers of debt owed by the company.

Preferred Stock. In a way preferred stock is like a debt of company. Preferred stock holders can sell their holdings after expiry of a period at a predefined price. While taking over the company, the total value of preferred stock shall be considered as future cost of company. The total value of preferred stock of the company can be obtained from the companies balance sheet. Generally companies do not prefer generating funds from preferred stocks but in case of urgency or problems companies offer preferred stocks. Looking at companies balance sheet one can know the level of preferred stock liability. The higher is this liability the higher will be the enterprise value of private company.

Cash and Cash Equivalents. Cash and Equivalents can also be obtained from the companies balance sheet or else form companies cash flow statements. The cash and cash equivalents are measure of liquid capital that company uses to manages day to day expenses of company. Ideally all companies should maintain a positive value of cash in their current account. This means that even after paying all of its liabilities (vendor payment, interest on loans etc) companies has enough cash left in its current account. This depicts a good financial health of company. This leftover cash can be used by company to pay part of the acquired debt of company.

Conclusion. For value investors, companies that is generating above average cash is of great interest. Value investors will always compare the cash/cash equivalents with enterprise value to judge the true value of company. It is most logical for investors to assume that the companies that has capability of generating extra cash can be very useful to pay-back the acquired companies debts in times to come.