How to Calculate Cash Flow on Your Next Rental Property

Post on: 16 Март, 2015 No Comment

When I was a kid, Duck Tales was one of my favorite TV shows.

Each day after school Id watch the adventures of Huey, Dewey, and Louie as they fought off the Beagle Boys who wanted good ol Scrooge McDucks hard earned money. They always managed the thwart the efforts of the villains and save Scrooges money and, as a reward to himself, Scrooge McDuck and the three nephews would take a swim in his vault of money. Yes, you remember. They would jump of the diving board head first into mountains of gold coins. As a kid, nothing seemed more exciting than that.

So how did Scrooge get so much money? To use Scrooges own words, by being smarter than the smarties, and tougher than the toughies.

In other words, scrooge was good at business. He was smarter than the rest.

Yes, this is only a cartoon, but I think there is a valuable lesson to be learned here. If you want to succeed and swim in your own river of cash, you need to be smarter than the rest. I believe the best way to do this is through a solid grasp on the numbers.

Math is not most peoples favorite subject in school, but it might be the most important for a real estate investor. Understanding how your business makes money is imperative in helping it make more. Therefore, today I want to focus on one of the most important aspects of real estate math: Cash Flow.

In laymans terms, cash flow is the amount of income left in your business after all the bills have been paid; this amount is often expressed as a monthly dollar amount. In the real estate rental business, cash flow is the income lefts after paying out expenses such as the mortgage, taxes, insurance, vacancies, repairs, capital expenditures, utilities, and any other expenses that affect the property.

How to Calculate Cash Flow

Cash flow might seem really easy to calculate but trust me, a lot of people get it wrong. At its core, it IS very simple. To calculate cash flow you simply subtract the expenses from in the income:

Cash Flow = Total Income Total Expenses

Easy enough, right? So why do so many people screw this up?

The fact is: while the equation is simple enough, the items that make up the equation are loaded with complexity. Lets take a look at both to see what I mean:

While the total income might be the same as the total rent, many times it wont be. There may be other sources of income you need to account for, such as application fees, late fees, and laundry income. When analyzing a property for cash flow, its wise to list out all possible sources of income, but be conservative. Its best to err on the side of caution and assume youll be getting less than you actually hope to.

Total Expenses

Ah this is when things get complicated. You see, most people can figure out the income, but when it comes to expenses, one mistake can be the difference between incredible success and catastrophic failure. When dealing with rental properties, there are a LOT of expenses youll encounter. For example, just off the top of my head, you might have:

- The Mortgage

- Mortgage insurance (PMI or MIP)

- Property Taxes

- Property Hazard Insurance

- Flood Insurance

- Earthquake Insurance

- Water

- Sewer

- Garbage

- Electricity

- Natural Gas

- Propane

- General Maintenance Upkeep

- Landscaping

- Repairs

- New Appliances

- Capital Expenditures

- Office Supplies (stamps, envelopes)

- Software

- Gas/Mileage

- HOA (Home Owners Association) Dues and Fees and Assessments

- City Taxes

- Advertising

- Payroll

- Property Management

- Vacancy Rate

- Probably a lot more Im not thinking of

To further complicate things, not all expenses are going to occur each month, so it is often best to calculate a certain percentage for those expenses when planning for the future. For example, you may not have any vacancies right now, but you might assume your property will be empty one month out of the year. Therefore, you will want to include 1/12th, or 8.33%, for your monthly vacancy expense.

Some expenses, like office supplies and gas, you may choose to ignore on individual houses, but if you are buying a larger multifamily Id recommend including it because it does add up quickly.

Example: Lets Calculate Carls Cash Flow

Carl is trying to calculate his monthly cash flow for a duplex he might buy.

According to the real estate agent, the property will rent for $600 per unit. Carl would be responsible for paying $125 per month for water/sewer and $50 for garbage. He also learns that properties like this duplex in this area sit vacant for 5% per year. Carl assumes he’ll spend 8% per month on repairs. He also will plan on setting aside 5% each month for capital expenditures, such as a new roof, heating system, or other big ticket items down the road. Finally, Carl calculates that his mortgage payment will be $470 per month (taxes and insurance not included.) The property taxes are $960 per year and the insurance would be $600 per year. Finally, Carl will be using a local property management company that charges 10% per month to manage the property.

How much cash flow can Carl plan to receive?

Income:

$600 x 2 = $1200 per month in income

Expenses:

- Mortgage: $470

- Taxes: $80

- Insurance: $50

- Vacancy: $60

- Repairs: $96

- CapEx:$60

- Water/Sewer:$125

- Garbage:$50

- Management:$120

- $1111 per month in expenses

Income Expenses = Cash Flow

$1,200 $1,111 = $89 per month

How to Calculate Cash on Cash Return on Investment

Bonus. If Carl spent $20,000 to acquire this property (down payment and closing costs), what kind of Cash on Cash Return on Investment would this be for Carl?

The cash on cash return on investment is the annual cash flow a real estate investor receives based on the cash they invested. It is one method to compare the returns an investor might get through rental real estate compared to other investment methods. To determine your cash on cash return, use the following formula:

Cash on Cash Return = Annual Cash Flow / Total Investment

Therefore, since Carl would be expecting $1,068 per year (with a $20k investment) the formula would be:

$1,068 / $20,000 = 5.34%

Carl’s estimated cash on cash return on investment would be 5.34%. Keep in mind, this return does not take into account potential appreciation, loan pay-down, tax benefits (or payments), or other forms of increase or decrease in his profit. However, I like to use the Cash on Cash Return because, at minimum, this is what I probably will expect. If the property appreciates or the loan pays down over 30 years awesome! However, I dont necessarily base a deal on this.

Lets move on and give YOU a chance to calculate the cash flow and return on investment.

Your Turn: Calculate This!

Shirley is considering purchasing a triplex. Two of the units would rent for $600 per month and the third unit would rent for $1000 per month. She would be responsible for a monthly water bill of $155, garbage bill of $40, and electric bill of $50. The property taxes would cost her $1392 per year while the insurance would cost $936 per year. She will plan on setting aside 10% for repairs, 5% for CapEx, 12% for property management, and 10% for vacancy. Finally, Shirley will be putting down $35,000 to buy the property and obtaining a mortgage that will cost her $586 per month.

How much Cash Flow can Shirley plan to receive, and what Cash on Cash Return on Investment would that be?

Cash Flow Answer:

How did you do? Let me know in the comments at the bottom of this post if you got it right!

How to Calculate Cash Flow Using the 50% Rule

Another, much quicker way, to estimate cash flow is using a technique known as the 50% rule. This rule of thumb states that a rental property’s expenses tend to be about 50% of the income, not including the mortgage principal and interest (P&I) payment. The formula would look like this:

Cash Flow = (Total Income x .5) Mortgage P&I

Let’s use the same information we used earlier with Carl and the duplex he was interested in. In that example, the property was expecting to bring in $1200 per month in income, with a mortgage P&I of $470 per month. Using the 50% rule, we can see:

- Cash Flow = ($1200 x .5) $470

- Cash Flow = ($600) $470

- Cash Flow = $130

Keep in mind the 50% rule is only a rule of thumb and generally not as accurate as using the actual expected numbers. In this example, Carl determined using the 50% rule that he could expect $130 per month in expenses, but the actual numbers we did earlier showed only $89 per month.

Therefore, the 50% rule is a good tool to use to quickly analyze a rental property, but should never take the place of a thorough analysis of a property. Think of the 50% rule as a “quick filter” that allows you to estimate cash flow in under a minute, enabling you to analyzing dozens of properties looking for a deal with potential that you can run a more thorough analysis on.

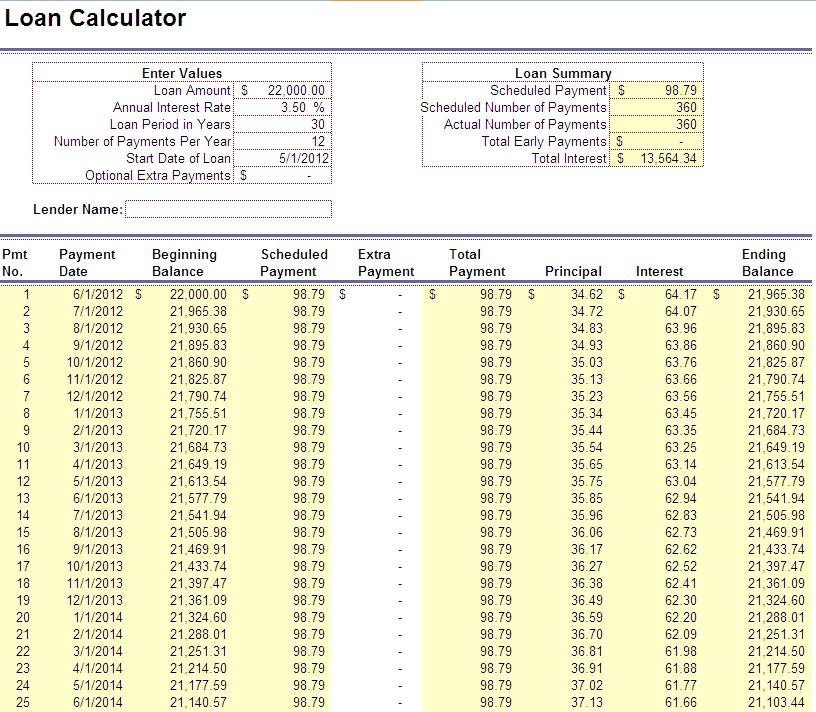

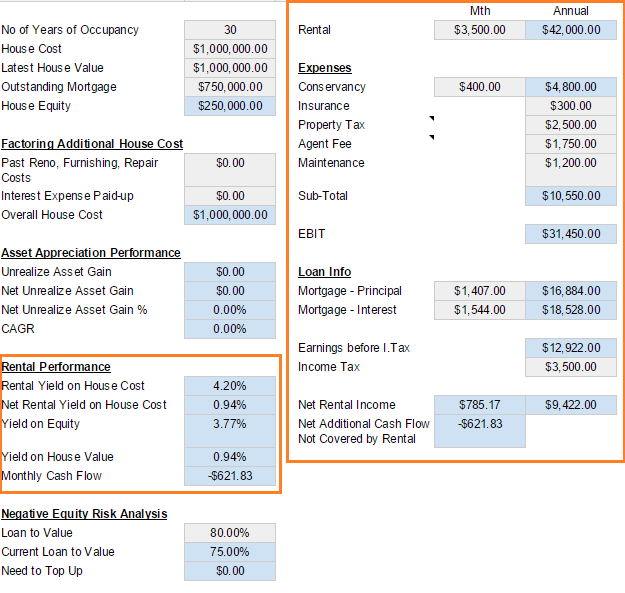

Finally, it would be a shame not to mention that all these numbers you can do online using the BiggerPockets Rental Property Calculator. While you can easily do these numbers on a spreadsheet or on the back of a napkin, I find it helpful to use the online calculators to ensure my math is correct and that I’ve considered all the potential expenses. Furthermore, you can save your analysis reports and even print out your report to give to potential lenders, partners, or others.

Check out the video below to learn more about the rental property calculator:

To check out the BiggerPockets Rental Property Calculator, and all of our other online analysis tools, go to BiggerPockets.com/calc .

What do you think? Did you get the answer right? Let me know if you have any questions or comments by leaving me a note below!

Free eBook from BiggerPockets!

Get The Ultimate Beginnner’s Guide to Real Estate Investing for FREE — read by more than 100,000 people — AND get exclusive real estate investing tips, tricks, and techniques delievered straight to your inbox twice weekly!

- Actionable Advice for Getting Started,

- Discover the 10 Most Lucrative Real Estate Niches,

- Learn how to get started with or without money,

- Explore Real-Life Strategies for Building Wealth,

- And a LOT more

Sign up below to download the eBook for FREE today!