How to Calculate a 401(k)

Post on: 2 Апрель, 2015 No Comment

Instructions

Take your most recent 401k statement and review it carefully. The statement should include your starting balance, the amount of any contributions made by yourself and your employer, and the ending balance.

Divide that gain by the starting balance to get the percentage return on your investment during the time period in question. For instance, if your starting balance was $15,000, the combined contributions between yourself and your employer were $1,500 and the ending balance was $20,000, your gain is $3,500. When you divide that $3,500 by the starting balance of $15,000 (and multiply by 100 to put it in a percent format), the result is just over 23 percent.

References

More Like This

How to Calculate a Cash Out of a 401(k)

How to Use a 401k Calculator

How to Calculate 401(k) Contributions

You May Also Like

No matter what you do for a living or how far you are from retirement, it is important to put money aside.

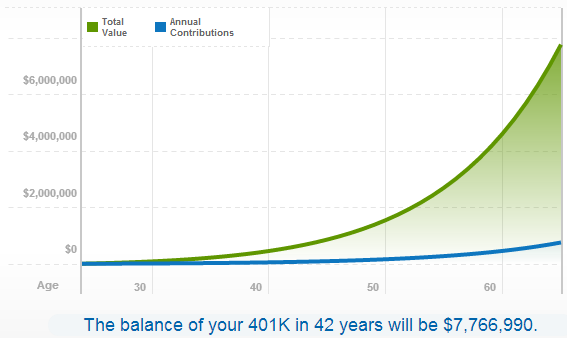

It is never too early to start saving for a comfortable and secure retirement. In fact, the sooner you start saving and.

401k loans are becoming very common. Many people in the USA have a retirement plan at work. 401(k), 403(b), and 457 retirement.

Because the value of assets shifts daily or more often, annual worth is usually determined by the value of a person's assets.

The Best IRA Firms. Investors can set up two types of individual retirement accounts or IRAs: Roth and traditional. IRA accounts can.

If you recently started a 401k at work and want to know how much it will change your taxes, you can calculate.

Db gain, which stands for decibel gain, is the logarithm of the ratio of two numbers multiplied by 10. When a ratio.

Employee stock purchase plans, or ESPPs, provide employees with a way to invest in company stock by investing money withheld directly from.

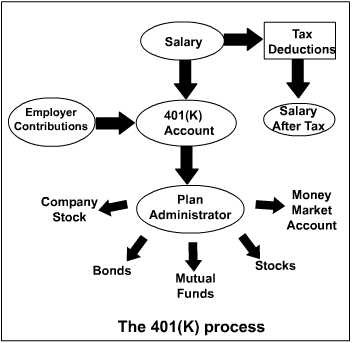

A 401(k) plan is an employer-sponsored retirement program designed to help investors save assets under a tax-advantageous structure. The rules of a.

The IRS treats the tax deduction for 401k losses as a miscellaneous deduction, meaning you must itemize your deductions using Schedule A.

A 401k account allows you to save for retirement through the contribution of pretax income which compounds tax-free. Since the purpose of.

Investing in a 401k plan at work is one of the best ways to save for retirement. The IRS provides workers with.

401k retirement plans are an employer-sponsored benefit that allow you to save money for retirement. Given the time to grow, 401k plans.