How to Build a Portfolio of Mutual Funds

Post on: 18 Июнь, 2015 No Comment

The Best Portfolio Structure & Design

You can opt-out at any time.

Please refer to our privacy policy for contact information.

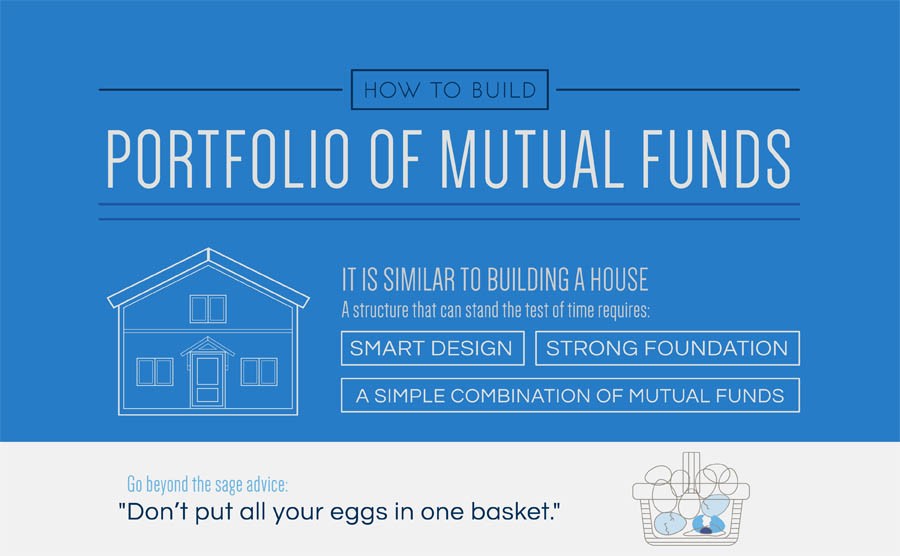

Building a portfolio of mutual funds is similar to building a house: There are many different kinds of strategies, designs, tools and building materials; but each structure shares some basic features.

To build the best portfolio of mutual funds you must go beyond the sage advice, Don’t put all your eggs in one basket: A structure that can stand the test of time requires a smart design, a strong foundation and a simple combination of mutual funds that work well for your needs.

Before building begins, you will need a basic design—a blueprint—to follow. A common and time-tested portfolio design is called Core and Satellite. This structure is just as it sounds: You begin with the core—a large-cap stock fund—which represents the largest portion of your portfolio, and build around the core with the satellite funds, which will each represent smaller portions of your portfolio.

With a large-cap stock fund as your core, different types of funds—the satellites—will complete the structure of your mutual fund portfolio. These other funds can include mid-cap stock. small-cap stock. foreign stock. fixed income (bond), sector funds and money market funds.

Before choosing your funds, you need to have a good idea of how much risk you can tolerate. Your risk tolerance is a measure of how much fluctuation (a.k.a. volatility—ups and downs) or market risk you can handle. For example, if you get highly anxious when your $10,000 account value falls by 10% (to $9,000) in a one-year period, your risk tolerance is relatively low—you can’t tolerate high risk investments .

Once you determine your level of risk tolerance. you can determine your asset allocation. which is the mix of investment assets —stocks, bonds and cash—that comprises your portfolio. The proper asset allocation will reflect your level of risk tolerance, which can be described as either aggressive (high tolerance for risk), moderate (medium risk tolerance) or conservative (low risk tolerance). The higher your risk tolerance the more stocks you will have in relation to bonds and cash in your portfolio; and the lower your risk tolerance, the lower your percentage of stocks in relation to bonds and cash. See these sample portfolio designs for more guidance: Aggressive Mutual Fund Portfolio Sample. Moderate Mutual Fund Portfolio Sample and Conservative Mutual Fund Portfolio Sample .

Now that you know your asset allocation. all that remains is the selection of your mutual funds. If you have a broad choice of mutual funds you begin by using a fund screener or you may simply compare performance to a benchmark. You’ll also want to consider important qualities of mutual funds. such as fund fees and expenses and manager tenure .

Tips and Cautions:

If you are a beginner, you may not have the money to meet the minimum initial investment amount. which is often more than $1,000 per mutual fund. If you are only able to meet the minimum for one fund, begin with the core, such as a low-cost large-cap Index fund. or a balanced fund. Once you’ve purchased the first fund for your portfolio, you can save money on the side to purchase your next fund and continue building your portfolio one fund at a time.

The old way of asset allocation was invest for your age, where your age is the amount of bonds in your portfolio. For example, if you are 40 years old, your asset allocation would be 40% bonds and 60% stocks. Today, people are living longer so this asset allocation strategy is not as valid as it once was.

Disclaimer:

The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.