How to analyze a fund factsheet (Equity fund)

Post on: 12 Апрель, 2015 No Comment

There is no better way for an investor, other than reading a fund factsheet to analyze a mutual fund scheme and its various aspects in a comprehensive manner. Mutual funds are extremely popular among the investors for a variety of reasons, but the key reason why it scores over other classes of investments, namely a ULIP, is the transparency offered by the fund houses on the mutual fund schemes. Fund factsheet stand testimony to this.

Fund factsheet is a document released by the Mutual Funds on a periodic basis (monthly) packed with loads of information about the various funds they manage, fund performances, other fund details along with the commentary from the fund managers. For every investor, this must be a Gita, Bible and Quran of their mutual fund investments.

What are the key aspects one should look for in a fund factsheet

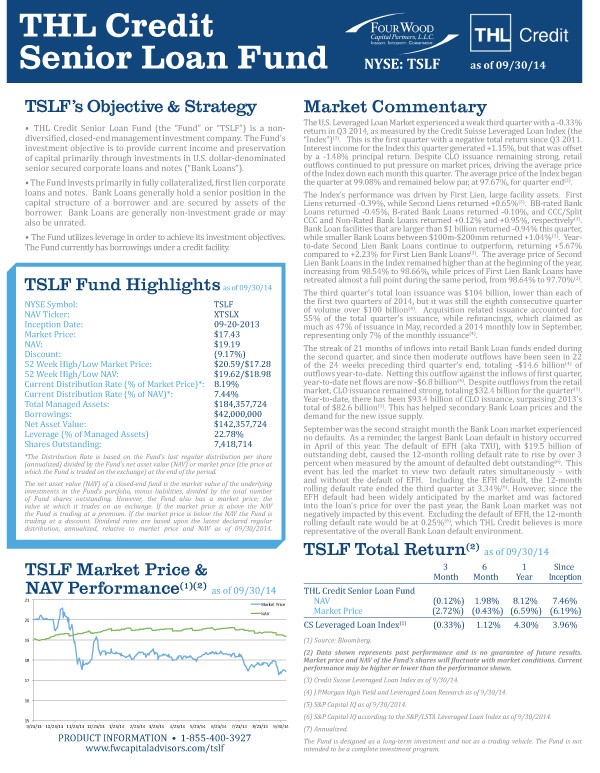

The fund factsheet normally begins with the commentary of the heads of Equity and Fixed Income of the Mutual Funds outlining their views on the markets of the past and the Outlook of the future in a broad sense.

For investors to know the markets, nothing like hearing it from the horses mouth. Fund managers commentary is important for investors to understand the mind of the fund managers. After all they are the ones who manage their funds by investing in the equity markets. And their commentary is a source of great value during the good and tough times, because their views help the investors understand the markets and decide on their investments in the equity markets. Commentary also reflects the consistency levels of the fund managers over a period of time.

- Investment style of the fund -

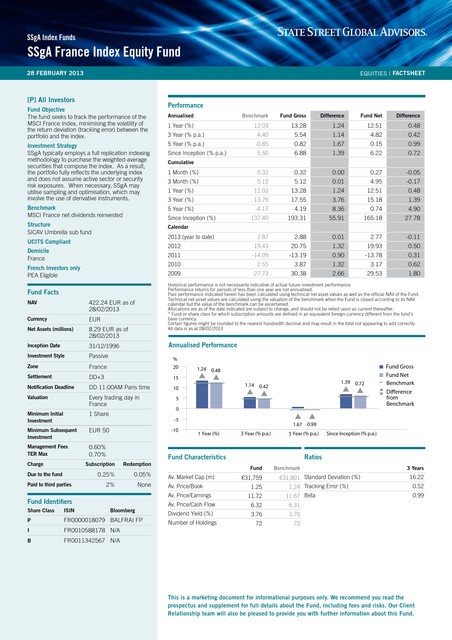

With plethora of schemes and products available in the market, investors need to understand what kind of fund they are getting into. And that should be based on their age, profile, goals and objectives. When the style says, well established and large size companies, the fund invests primarily in large cap companies which are typically blue chip and industry leader stocks.

Portfolio is the important part in the factsheet. It simply says where is the money of the investors invested as on that date. Normally, equity funds depending on the objective and theme, invest in basket of stocks across various sectors. Investors are recommended to go through the portfolio once in a while to understand the funds investment strategy. Break up is given by sectors and the stocks in the sectors, along with the total no of shares owned and the weightage in the portfolio. It also shows the cash available in that fund and its total corpus as on date.

Fund Manager(s) are the dedicated people who manage the funds by investing in the equity markets on behalf of the investors of the particular scheme. And knowing about the fund manager(s) is very important for making investment decisions into a scheme. Investors can always do a detailed study of the fund manager(s) and their track record on managing the funds through various sources. Since they are the ones who decide where to put your money into, its important to know them and their style.

Date of allotment in simple term means, the time since the fund has been in existence offering units to the public. This is very important for the investors as it helps them understand the track record of the scheme. Older the scheme, better it becomes to track it.

The size of the fund will be key factor for choosing a scheme, as size matters in mutual fund schemes. From the investors perspective, bigger the size, lesser the fund cost and vice versa. Fund size always gives a comparative idea of the depth of the fund as the bigger funds invariably has higher number of investors which is good for retail investors, as the size offers stability to the fund and the portfolio.

This the percentage of a mutual funds holdings that have been turned over or replaced with fresh holdings in a given year. The type of mutual fund, its investment objective and/or the portfolio managers investing style will play an important role in determining its turnover ratio. In simple terms, the turnover ratio suggests the churning of a portfolio during the given time period. It is important to know because it will give insights on the fund managers style. Aggressive fund managers churn the portfolio quite often, than the buy and hold fund managers. Higher turnover means higher cost to the fund and vice versa.

Performance is one of the key factors on choosing a mutual fund scheme. Though there are various parameters on choosing a scheme, investors always consider performance as the top factor while choosing a fund. Though the past performance should not be taken for future projection, it still gives a fair picture of the fund history. Fund factsheet talks about the schemes performance in the short to medium to long term, which gives a clear picture of the funds performance over the various time frames. Funds also provide performance details of the investment done through SIP.

For investors, knowing the cost of entry and exit in the fund is very important. As such entry loads are banned in Mutual funds, whereas exit loads are very much prevalent. Investors should watch out for such details as premature exit may attract relevant exit loads.

SEBI has mandated schemes to be classified based on risk with specific colors. Brown color in a scheme indicates high risk of investment, Yellow signifies medium risk and Blue color signifies low risk. Equity funds fall under the 1st category, which is the Brown color code. The whole idea, is to make investors aware of the risk they are taking while investing in equity funds.

Fund factsheets offer excellent insights of the fund and its schemes and investors should make it a point to go through them for a better understanding and to become an informed investor.