How Rising Interest Rates Affect Your Investments A Wealth of Common SenseA Wealth of Common Sense

Post on: 10 Июнь, 2015 No Comment

“One of the most important things I’ve learnt over the years is to remember that if you don’t know what is going to happen, don’t structure your portfolio as through you do.” – James Montier

According to a recent survey by Edward Jones, 63 % of Americans don’t know how rising interest rates will impact their investment portfolios. And 24% say they feel completely in the dark about the potential effects.

The 10 year treasury yield started the month of May at 1.62% and just recently hit 3.00% in early September. A move of that magnitude in interest rates can have a large effect on your investments in a number of ways.

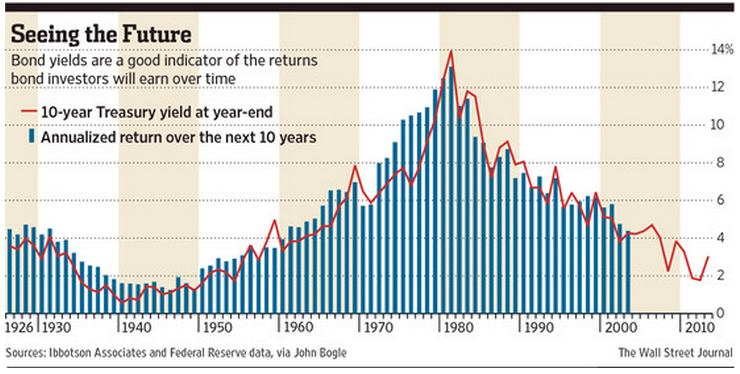

Fixed income 101 teaches us that bond prices and interest rates are inversely related. As one rises the other one falls and vice versa. The Vanguard Total Bond Market ETF (BND) is the perfect vehicle to see how the rise in rates since May has affected bond returns since it covers the aggregate bond market.

From May to August BND lost -4.01%. The year to date loss through September 5 th now stands at -4.11%. These are not stock market crash losses by any means but could be very surprising to bond investors that have seen mostly positive performance in recent decades.

One positive about rising rates is the fact that you can now reinvest your income at higher rates than were seen at the beginning of summer.

Bonds and interest rates have a fairly straightforward relationship, but it’s much more difficult to predict how rising interest rates will affect stock returns. Interest rates do play a role in determining stock returns since higher rate investments can compete with stocks for investor dollars. In a rising rate environment, inflation also plays a large role in determining stock returns.

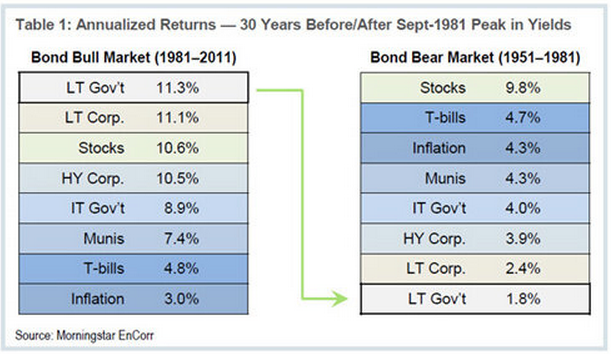

To find the most recent period of a sustained increase in interest rates, you have to go all the way back to the period from the 1950s to the 1980s. Here’s how interest rates, inflation and stocks performed over those decades:

Rising rates alone did not hurt stocks in the 50s and 60s and it was the combination of higher rates and elevated inflation that did stocks in over the 70s. There are many more moving pieces that determine stock market performance so don’t base your decisions purely on interest rates and inflation.

Mortgage Rates

Mortgage rates are priced off of the 10 year treasury yield. At the beginning of May the average 30 year fixed mortgage rate was 3.35%. By the beginning of September it had risen to 4.57%.

The monthly payment on a $250,000 mortgage at 3.35% is about $1,100 while you would be paying closer to $1,280 with a 4.57% rate. That’s real money out of your pocket every month. Although 4.57% is still relatively low considering the average 30 year rate going back to 1976 is 8.62%.

Savings Accounts

Since the rate of interest on your savings accounts are tied to short-term interest rates that are set by the Fed, there hasn’t been any relief for savers just yet. Average rates remain low. The Fed doesn’t control longer term rates like the 10 year, but they do set the short-term rates that banks use to set their savings account rates. I wouldn’t expect those rates to rise anytime soon, but you never know.

Until the Fed increases short-term rates, online savings accounts are your best bet for higher yield on savings accounts. They have much lower overhead costs than banks so they are able to offer you higher rates on your savings dollars. I also think intermediate term CDs with low early withdrawal penalties could be a good option for your medium term cash needs. This is a topic I plan on covering in a future post.

The future is always unknown, especially when it comes to predicting the state of interest rates. There are a number of factors that affect interest rates including inflation (both actual and expected), economic growth, the Fed, retirees and their search for income and the demand for bonds.

Plus, it’s not a foregone conclusion that rates must continue to rise further from here. We’ve had cycles before where rates don’t rise for a long time.

As with all investment decisions you have to weigh both your risk profile and time horizon. If you can’t stomach the thought of losing money the bond portion of your portfolio, stay closer to the short end of the maturity spectrum (1-3 years). If you can handle more volatility for the higher yields that intermediate term bonds offer, invest in the 3-10 year maturity range.

However, most investors look to their bonds for stability, so I don’t think it makes sense for everyday investors to invest in longer duration bonds (10+ years). If you do be aware that the losses can far exceed the higher interest rate that you can earn. The 20+ Year Treasury ETF (TLT) is down almost 14% this year as longer term bonds are more sensitive to interest rates.

It’s helpful to know what effect rising interest rates can have on stocks, your mortgage rate and your savings account, but it’s much harder to take specific actions on these accounts based on your future views on rates.

Your best bet is to refinance your mortgage if you have a rate that currently exceeds 5.25% and you plan on staying in your house long enough to take advantage of the monthly savings to offset your closing costs.