How Profitability Index Measures Your Investment Property Return

Post on: 21 Июль, 2015 No Comment

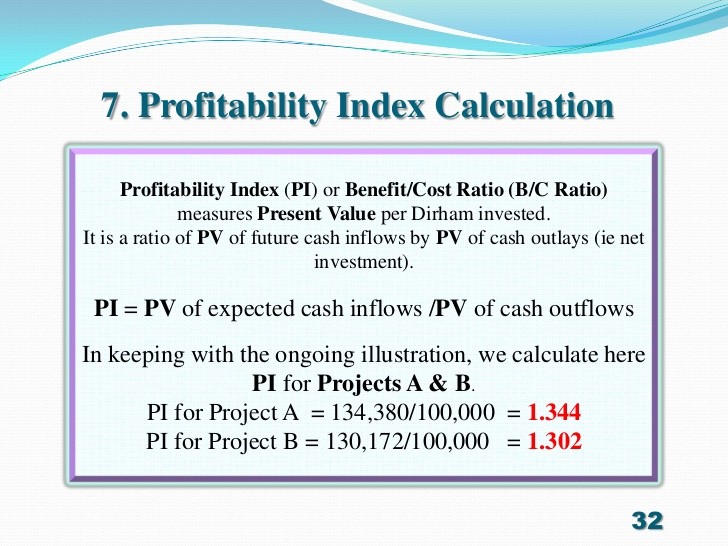

Profitability index (PI) is one of the lesser-known investment property measures of return primarily because it commonly gives way to it’s more popular ‘kissing-cousin’, net present value.

Here’s how they’re related. Both methods apply the element of time value and discount a rental property’s future cash flows to arrive at their present value, than each weighs that value against the investor’s initial cash investment.

Here’s how they differ. Net present value finds the dollar amount difference between the discounted cash flows and initial cash investment, whereas profitability index finds the ratio between those two values.

On the surface, of course, profitability index appears to simply provide another way to express the same result as net present value (which is somewhat true). But there’s also a significant advantage with PI that can help you make more prudent investment decisions.

Because the index is a ratio, it’s not sensitive to the dollar amount of the investment. In other words, because it tells you the proportion between the two values, you can easily compare the profitability for any number of real estate investment opportunities regardless of how much cash each requires you to initially invest.

Formulation

PI = Present Value of all Future Cash Flows / Initial Cash Investment

To make the calculation you must do the following.

- Calculate the total dollar amount of your initial cash investment (i.e. down payment, closing costs, appraisal and inspections fees, etc.)

- Designate a discount rate. That is, the rate of return you require on the cash invested that will cover your opportunity cost of capital, all expected inflation over your estimated holding period of the property, and a premium for the risk associated with the investment.

- Calculate the present value of all future cash flows generated during your estimated holding period by discounting them back at your designated rate of return (i.e. discount rate).

- Divide the total present value of those discounted future cash flows by the total amount of your initial investment.

Example

Let’s say that you’re going to initially invest $100,000 cash to acquire a rental property anticipated to produce a revenue stream of 3,500, 4,000 and 4,500 over three years (plus resale proceeds in the third year of $150,000) and require a 10% rate of return.

The result is a present worth of future cash flows totalling $122,566 and a profitability index of 1.2257.

100,000 122,566 = 1.2257

How to Interpret the Results

- An index of 1.0 means you achieved your desired rate of return exactly

- An index greater than 1.0 means that you’ve exceeded your goal

- An index less than 1.0 means that you failed to achieve your goal

Conclusion

The profitability index is just one of many approaches investors take when they’re trying to make a prudent real estate investing decision. By itself it offers little. But when taken in conjunction with other investment methods, the index can be a helpful tool indeed.

Here’s to your real estate investing success!