How private are public banks The Hindu

Post on: 22 Июль, 2015 No Comment

financial and business service

banking

14 out of 26 public sector banks had private shareholding in the 40-49 per cent range by end-March 2012.

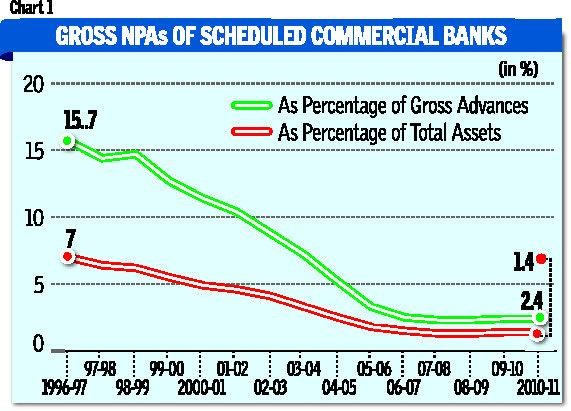

July 1, when the Reserve Bank of India entertains applications for the third round of private entry into banking, marks the beginning of one more phase in banking liberalisation in India. Central to that liberalisation was the reversal of the post-1969 policy in which banking was made a largely public preserve by the nationalisation of the major private banks. Till then, Indias major banks, other than the State Bank of India and its subsidiaries, were directly or indirectly controlled by big business, resulting in the capture of a dominant share of the nations savings by large firms to the exclusion of small borrowers and the agricultural sector. Seizing the ownership of these banks and bringing them into the public sector established social control. Some private banks remained, but they were small domestic ones or foreign players with restricted operations. In the two decades that followed, Indias banking sector, judged by behaviour or social performance indicators, went through a dramatic transformation.

The period since 1993 has, however, seen the slow reversal of that policy, not merely through the grant of greater space for foreign banks in India, but through the grant of licences to 12 private players after two calls for applications. But the current third round call for private entry is significant not merely because it carries the process forward but because it allows for entry by domestic corporates in the form of entities and groups in the private sector that are owned and controlled by residents. This has, as is to be expected, triggered speculation on the future of Indian banking.

However, while change at the margin in terms of new private entrants has made a difference, the essential character of the Indian banking sector seems largely influenced by the legacy that nationalisation left.

Public vs. Private

Though some lament the fact that public ownership stalls innovation and adversely affects customer service, Indias record relative to countries that were badly affected by tendencies that precipitated the 2008 financial crisis showed that public ownership has many other benefits. Public ownership subordinates the profit principle to other development goals, influences the behaviour of bank managers trained as public servants not to succumb to the lure of quick profit, and sets up strong forces within public banking that resist a return to corporate dominance. The result is a more stable and inclusive banking sector. Creeping privatisation through new entry can alter the façade, many argue, but the foundations remain those put in place by nationalisation.

The difficulty with this argument is that it ignores a development that has received far less attention than it deserves, which is the dilution of public ownership in the nationalised and state-owned banking sector. Besides private entry, an important component of the transformation of banking engineered by liberalisation was a restructuring of public sector bank ownership. Reasons given to justify that move were varied. One argument was that private equity ownership would introduce new monitors into the system, and the signals sent by share prices influenced by shareholder preferences would help improve corporate governance in banking. Another was that dilution of a part of equity, subject to public ownership remaining at 51 per cent or more, would help mobilise the resources needed to recapitalise banks and meet the conditions set by prudential rules such as those implicit in the capital adequacy ratios specified under Basel norms.

This meant that it was not just weak public sector banks that were made candidates for equity dilution. Early in the liberalisation era, in December 1993, the State Bank of India, with paid up capital of Rs. 200 crore chose to go in for a public issue of shares worth Rs. 274 crore at par, but sold at a premium of Rs. 90 per share. In the event after the issue the shareholding of the Reserve Bank of India and the Government of India (together) came down to 66.3 per cent, with the remaining 43.7 per cent being held by other entities. That was only the beginning. As the accompanying chart shows, out of 26 public sector banks (including the 19 nationalised banks, the State bank group and IDBI Bank), as many as half that number had no private shareholding even as late as 2002, and only 2 had private shareholding in the maximum possible 40-49 per cent range. But in the decade that followed dilution has been rapid, so much so that as many as 14 banks had private shareholding in the 40-49 per cent range by end-March 2012. Another 10 fell in the 20-40 per cent private shareholding range. Private holdings include foreign ownership of equity in 24 out of the 26, with the extent of such ownership varying from 0.1 per cent (State Bank of Mysore) to 17.4 per cent (Punjab National Bank) as at end-March 2012.

As a result, public banks increasingly accommodate the interests of their private shareholders. Even chiefs of the venerable State Bank of India have uncharacteristically protested against the RBIs call for an end to risky teaser loans for housing, or against the central bank imposing (a much lowered) cash-reserve ratio on banks as a monetary policy instrument. Banks must be allowed to pursue profit at the expense of all else is the view they seem to hold.

This suggests that in terms of equity ownership and business behaviour, Indias public banking system is only a short step away from coming under private control, though that would require the revision of the principle mandating at least 51 per cent government ownership of equity in public sector banks. If such a change comes about it would have a far greater transformative effect on Indian banking than would the entry of new private banks at the margin. So while the response to and after effects of the third call for bank licences from the private sector is a matter for concern, the real danger may be the creeping trend towards denationalisation which would completely erode the many benefits that public banking delivered.