How Often Should I Rebalance My 401k

Post on: 2 Июнь, 2015 No Comment

The 401k investment vehicle is woefully inadequate for retirement. With the government capping our pre-tax contributions at $17,500 a year for 2014 and $18,000 for 2015, maxing out our 401K is the very minimum we can do.

In March, 2014 Vanguard then reported that the average 401(k) balance reached a record $101,650. For workers 55 years of age or older, the average balance is $143,300. These are terrible numbers. Oh, how nice it would be to have a pension for life instead!

NOBODY KNOWS THE FUTURE, BUT EVERYBODY CAN REBALANCE

Its important to realize that nothing goes up or down forever. The general trajectory is up thanks to inflation, but theres always a lot of volatility in between. Its currently a bull market in equities, which should be a harbinger for a continued economic recovery. What you need to do is put your 401ks performance in context. Always compare your year to date performance with the current 10-year bond yield. This is your risk free rate of return.

Historically, stocks have outperformed the risk free rate by around 4%. With the risk free rate currently at about 2.5%, you get an expected return of about 6.5%. With the S&P 500 up 30% in 2013, and over 2,000 in 2014, stocks have been crushing the historical average. Instead of rejoicing, you should think more carefully about mean reversion. The more we outperform historical averages, the higher the chance we run the risk of underperformer and vice versa.

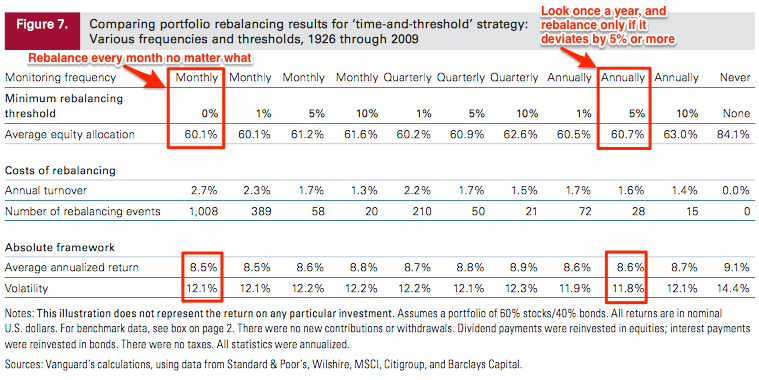

Rebalancing your 401k is important because position sizes can change over time. Im pretty sure that if you havent rebalanced your 401k in 6-12 months, your equities position is much higher than you probably would like. Its important to check in at least twice a year to make sure your investments correspond to your risk tolerance. Once youve accumulated a reasonable size nut, the number one commandment to remember is to NOT LOSE MONEY.

401K REBALANCING THOUGHT PROCESS

1) Ask yourself if you are bullish or bearish about the future. Then explain to someone why you think the way you do. If you can explain to someone your stance in a coherent manner, you might be onto something. Just know that the general trend is up.

2) Check the latest 10 year bond yield and add on a reasonable risk premium of 4-5% to get an expected return. Note the risk premium is the premium return required for you to hold a risky asset. Are there any recent events such as Quantitative Easing in Japan, another Euro debt crisis, a Presidential election, or rising military conflict which would change your risk premium?

3) Compare your year to date return to your expected return (step 2). If your year to date return is above your expected return, you should begin to think about rebalancing into bonds or cash. Remember your overall outlook on the future from step 1 and make a judgement call.

4) Always ask yourself what is your risk tolerance. Will you be comfortable losing 10%, 20%, 30%? Will you be able to buy on the dip? Does losing more than 20% really freak you out? Only you will know what you are comfortable with.

5) You can check out the latest stock market earnings estimates and calculate earnings multiples if you wish. Just know that these earnings estimates are always wrong and are just catching up to whatever trend at the moment. With the S&P 500 at 1,465, its estimated P/E ratio is at 16.6. Sold to you!

REBALANCE YOUR 401K AT LEAST TWICE A YEAR

Its fine and dandy to just dollar cost average like a machine every time you get paid. Really, there is nothing wrong with that. The reason why I encourage everyone to rebalance twice a year is because it forces you to critically think about your portfolio and assess risk. If you can, inspect your portfolio every quarter.

You dont have to make massive shifts like I did with my 401k portfolio from 80% equities down to 21% equities. You can just tweak your portfolio by a couple percentage points here and there. Maybe you might not make a big difference to your overall portfolio performance. However, what you will become is infinitely more aware about your assets, performance, and what is going on in the world if you rebalance. Enrich yourself with knowledge and opinions!

You can never lose if you lock in a gain. But, you can never win if you are never in the game either! Continue maxing out your 401K and investing in your retirement. Stay on track by following my 401K savings guide by age chart. Dont forget that you cant solely rely on your 401K in retirement. Youve got to combine your 401K with your after tax savings, alternative income streams. and hopefully Social Security to have a chance at living a decent life after work. You deserve it!

Recommendation For Building Wealth And Managing Your 401K

The best way to build wealth is to get a handle on your finances by signing up with Personal Capital. They are a free online software which aggregates all your financial accounts in one place so you can see where you can optimize. Before Personal Capital, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to manage my finances.

Now I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and whether or not Im paying too much in 401K fees. Their 401K Fee Analyzer is saving me over $1,000 a year due to its analysis. Personal Capital lets me see whether my 401K asset allocation matches my risk tolerance with their free Investment Checkup tool as well. The free online platform less than one minute to sign up and is the most valuable tool Ive found that allowed me to achieve financial independence.

About the Author: Sam began investing his own money ever since he first opened a Charles Schwab brokerage account online in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college on Wall Street. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate. He also became Series 7 and Series 63 registered. In 2012, Sam was able to retire at the age of 35 largely due to his investments that now generate over six figures a year in passive income. Sam now spends his time playing tennis, spending time with family, and writing online to help others achieve financial freedom.