How Much You Should Spend on a Home Personal Finance

Post on: 19 Июль, 2015 No Comment

Tips

- In most cases, you should consider buying a home only when you plan to stay somewhere for several years.

- The cost of your home — including taxes, maintenance and other costs — should not exceed 28% of your monthly income.

-

Related How-Tos

Feedback

For most people, a house is the biggest purchase they will make in their lives, one they will pay off for years, even decades, to come. But spending too much on a house could leave you with little money for other goals in life, such as retirement, college funds and vacation.

Before beginning a house hunt, you must first decide whether renting or buying makes the most sense.

If youre a renter, keep in mind that your rent will go up over time. Renters usually rent if they know or like the idea that they can move when and if they like. Also, renters usually do not have to pay for the maintenance, lawn care or home repairs. They also dont have to put sweat equity into the rental.

If you buy, know that youre committed to years of fixing anything that breaks in the house, manicuring the lawn, and paying for any major repairs. Renting makes sense if you plan to live somewhere for a relatively short period of time, as the costs associated with buying a home such as escrow fees, taxes and closing costs take some time to amortize. If youre planning to remain in a place for a longer period of time, buying a house is usually the way to go (however, this equation changes with home values in your area, employment trends and several other factors). Even though the market may fluctuate, over a long stretch youre likely to make money. And as the real estate market has shown us in 2007 and 2008, it can be a bumpy ride.

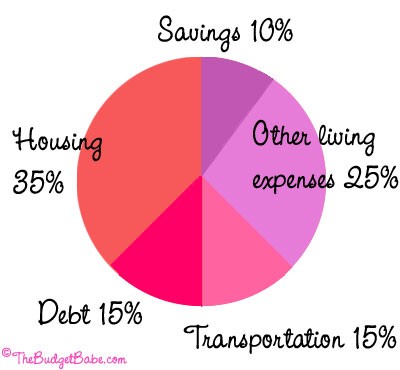

If youve decided that home ownership is right for you, the next step is deciding how much home you can afford. Typically, most lenders suggest that you spend no more than 28% of your monthly income on a mortgage. Try SmartMoneys How Much House Can I Afford calculator to find out how much you can afford. Keep in mind, in addition to the mortgage costs, youll have to pay the closing costs and legal fees, which are usually 2% to 3% of the house price. Also, dont forget moving fees and labor, and any fixes that you might have to make to the house upon moving in, plus monthly maintenance fees if youre moving into a condo or planned community.

When youve figured out your price range, take a look at the market and the issues that matter to you. Research school districts, crime statistics, impending construction or anything that could decrease or increase the value of a home. Look at the surrounding area to see if its a place in which you see yourself and family. You can research at greatschools.net or Zillow.com .

When youve chosen a home to bid on, dont assume that the selling cost is the actual cost of the house. While real estate agents use comparable houses, or comps as way to price a house, consider what it might cost to buy and build a home on piece of land in that area. For a thorough assessment, hire an appraiser. You can even search zip codes online at AppraisalInstitute.org .

If you have the cash to buy and upkeep, go ahead and buy a home. Its an investment that will grow over time.

Online Tools:

- Rent or Buy a house? — Use the calculator to help decide if you should rent or buy at SmartMoney.

- How Much House Can I Afford? — Find out at SmartMoney.

- Fixed Rate or Adjustable Rate? — Use the calculator to help decide if a fixed or adjustable rate mortgage is best for you.

- Mortgage Payment Calculator — Use this calculator to determine your monthly mortgage payments.