How Is the Fed Monetizing Debt

Post on: 29 Апрель, 2015 No Comment

When the Fed buys U.S. Treasuries, it allows the government to borrow more while keeping interest rates low. Photo: Peter Gridley/Getty Images

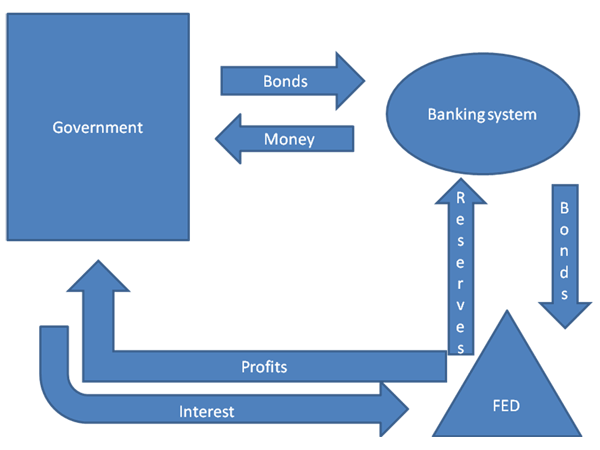

The Federal Reserve monetizes debt anytime it buys U.S. Treasuries. When the Federal Reserve buys these Treasuries, it doesn’t actually have to print money to buy them. It issues a credit, and puts the Treasuries on its balance sheet. Everyone treats the credit just like money, even though no actual cash is printed.

The Fed doesn’t buy Treasuries directly at auction. Instead, it purchases them from its member banks. It actually does this through an office at the Federal Reserve Bank of New York.

How does this monetize the debt? The U.S. government borrows from individuals, corporations and even foreign governments when it auctions Treasury bills, bonds and notes. The Fed turns this debt into money by taking those Treasuries out of circulation. This decreases the supply of Treasuries, making the remaining Treasuries more valuable.

Treasuries that are more valuable don’t have to pay as much in interest to get buyers. This lower yield drives down interest rates on the U.S. debt. Lower interest rates means the government doesn’t have to spend as much to pay off its loans. This is money it can use for other programs.

The net effect is that it is as if the Treasuries bought by the Fed didn’t exist. But they do exist on the Fed’s balance sheet. Technically, the Treasury must pay the Fed back one day. Until then, the Fed has given the Federal government more money to spend, increasing the money supply. This is called monetizing the debt.

Technically, the Fed monetizes the debt whenever it engages in its open market operations. The Fed has always used this tool to raise and lower interest rates. It lowers interest rates when it buys Treasuries from its member banks. The Fed issues credit to the banks, who now have more reserves than they need to meet the Fed’s reserve requirement .

Banks will lend these excess reserves, known as Fed funds. to other banks who need it to meet the requirement. The interest rate they charge each other is the Fed funds rate. To unload these excess reserves, banks will lower this rate.

Most people weren’t concerned about the Fed’s open market operations monetizing the debt because they weren’t really large purchases. That all changed during the recession. The Fed bought $600 billion of longer-term Treasuries between November 2010 and June 2011. This was the the first phase of Quantitative Easing. known as QE1 .

Why Does the Fed Buy Bonds?

The Fed’s primary purpose in all phases of QE was to keep the Fed funds rate. and all interest rates, low. This helps companies expand, creating jobs. Low interest rates also help people afford more expensive homes. Therefore, the Fed was trying to revive the housing market. Low interest rates also reduce returns on bonds. In time, investors look toward stocks and other higher-yielding investments. For all these reasons, low interest rates help boost economic growth .

However, part of the Fed’s intention probably was to monetize the debt. It helped the Treasury increase government spending to stimulate the economy without raising interest rates, which would depress the economy. Now that the economy is improving, the Fed has announced it will cut back on its purchases. Eventually, and if needed, it will reverse the transaction, get the Treasuries off of its balance sheet, and remove the credit from the Federal government’s operating budget.

The St. Louis Fed Disagrees

In February, the Federal Reserve Bank of St. Louis issued a report that denies the Fed is monetizing debt. The central bank can only monetize debt if its intention is to keep the Treasuries on its balance sheet indefinitely. In other words, it would be using its power to create money out of thin air to permanently subsidize Federal government spending.

Instead, Fed Chairman Bernanke specifically said that the Fed will sell Treasuries as soon as the economy improves to the point where Quantitative Easing is no longer needed. When this happens, interest rates will rise. The Federal government will find financing its spending to become more expensive. (Source: Federal Reserve Bank of St. Louis, Is the Fed Monetizing Government Debt?. February 1, 2013) Article updated December 10, 2014