How investors can get ready for the inevitable energy recovery

Post on: 12 Июль, 2015 No Comment

Markets have not been kind to Canadian investors this year, especially those with a high concentration of oil and gas stocks — something that happens quite often among those who earn a living from the industry.

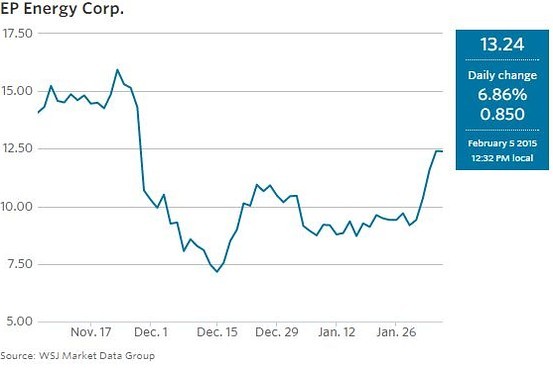

It wasn’t that long ago that the energy market was finally looking quite promising: a healthy financing market, record-setting IPOs and many companies setting new 52-week highs. Then the bottom fell out, with oil breaching the US$80-a-barrel level to the low US$60s.

The sector responded in kind and has since been walloped nearly 40% from its mid-July highs. Some Canadian oil and gas companies have lost more than over three quarters of their value.

It is rather interesting that the broader equity markets such as the S&P 500 continue to set new all-time highs while the TSX Capped Oil & Gas index has been sold off to levels not seen since the 2008 financial crisis when oil was down to US$30 a barrel.

Unfortunately, this means anyone addicted to energy stocks will be in for quite a shock while opening their November statements.

The good news is that it is never too late to take a few simple steps to rehabilitate your portfolio.

First, now is not the time to capitulate and panic by going to cash or chasing top-performing markets such as the S&P 500. Nor is it time to double down on energy either, since you risk compounding losses should markets continue their descent.

Instead, look to harvest sizable capital losses and switch into a well-diversified energy exchange-traded fund or energy fund to position for the recovery.

The benefit of doing this is that it will offer more downside protection should energy markets continue to sell off. Even better, when the market turns — and it will — you will want to be positioned to participate and recover any losses.

For those with expertise in the sector, its a great time to high grade your energy portfolio by owning companies with strong balance sheets and high-quality management teams. These companies will be able to survive a prolonged correction and potentially even benefit from it.

Specifically, look for companies with both oil and natural gas assets or those with management teams prudent enough to have hedged out their capital programs for next year to ensure they can sustain dividend payouts and/or projected growth targets.

Also, stick to larger companies that are more liquid such as the intermediate and senior producers, as smaller companies can quickly go no bid, thereby pushing their share prices much lower.

That said, there are some junior oil and gas companies with massive upside from current levels, so it’s worth having a small allocation. Manage the going concern risk by sticking to those that are able to survive on their existing cash flows, and have a strong capital market following and history of operational excellence.

Finally, and most importantly, when the sector recovers, don’t forget what has recently happened.

Until recently, energy represented more than 25% of the TSX, but it should be a much smaller component of your overall portfolio. A more appropriate weighting might be to mirror the 8% level that energy companies hold on the MSCI World Index.

For those lucky enough to have underweighted the sector, you will never find a better value than now. It is impossible to call a bottom, so we recommend layering positions into the sector in order to avoid catching what has clearly been a falling knife.

Martin Pelletier, CFA, is a portfolio manager at Calgary-based TriVest Wealth Counsel Ltd.