How Interest Rate Changes Affect the Price of Bonds

Post on: 17 Май, 2015 No Comment

Whether the interest rate movements are caused by Federal Reserve actions, economic conditions or inflation fears, the impact on the bond investor is the same: Rising interest rates reduce existing bond values and falling interest rates increase existing bond values.

Seems simple enough.

But how will your bond investments be affected by changes in interest rates?

Since bonds differ by maturity, coupon rate, type of issuer and other factors, figuring out how your bond or bond portfolio will be affected by interest rate changes can be complex. Fortunately, you dont need a math degree to understand the basic concepts. Here are some simple guidelines for judging the price volatility of your bonds.

What Affects Bond Price Volatility

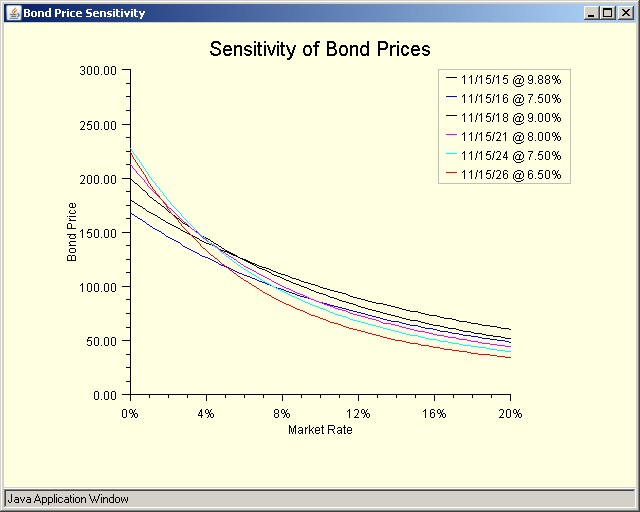

The price that a bond sells for in the market today is the sum of all future cash flows, discounted in value because they are not available today. A dollar tomorrow is worth less to you than a dollar today. The discount rate used is the rate of interest prevailing in the market for bonds of the same risk and maturity. When that interest rate changes, it affects the price of all bonds, but to varying degrees.

The longer the maturity of your bond investments, the greater the price volatility.

Why?

The reason is that the maturity value of the long-term bond, as well as many of the interest payments that are being paid, are future cash flows that are very distant points in the future. If interest rates rise, those very distant cash flows of the long-term bond are discounted in value significantly, and the price of the long-term bond falls in the market abruptly.

Coupon ratesthe periodic interest payment that is paid by the issuer of the bondalso affect bond price volatility. A higher coupon means that more cash in the form of interest payments flows to the investor before maturity than is the case with a lower coupon bond. What this means is that when interest rates rise and future cash flows are discounted at a higher rate, the lower coupon bond has relatively more cash flow in the distant future, the maturity value of the bond represents a greater portion of the total cash flow, and the bonds value today will fall relatively more.

Combining these characteristics produces the riskiest bonds in terms of price volatility: The most price volatile bonds are those with longer maturities and lower coupons. A long-term zero-coupon bond defines the outer boundary for riskiness.

Investors who are risk averse should look for bonds and bond mutual funds that have shorter average maturitiesless than five yearsand should avoid zero-coupon bonds, particularly long-term zero-coupon bonds.

How Much Prices Will Change

Table 1 indicates just how much bond prices can change when interest rates change. The table shows the percentage change in bond price for a given interest rate change for bonds of different maturities and two different coupon rates. The table is based on the assumption of semiannual interest payments and bonds selling at their maturity (face) value. Because of the mathematics of the relative change, the gains are always larger than the losses for the same interest rate change.

As an example of how to read the table, assume that you have a bond with a 30-year maturity and a 6% coupon rate. If you anticipate that interest rates will drop two percentage points, say from 6% to 4%, your bond will rise in value by 34.7%. A bond selling at a face value of $1,000 before the interest rate drop would rise to $1,347, for a gain of $347. On the down side, however, if interest rates instead rose to 8%, your bond would decrease in value by 22.6%, to $774, for a capital loss of $226. Both of these interest rate changes are a bit on the high side but not impossible, and the gains and losses are large because the bond maturity is so long.

You can see from the table that the lower-coupon bond at the same maturity has greater price volatility. A higher coupon rate for the same maturity would result in smaller but still very significant price changes.

The only way to effectively reduce bond price volatility is to shorten maturities.

If you are concerned about the price volatility of a portfolio of bonds, such as a bond mutual fund, you can use the portfolios average maturity and the average coupon rate for a rough idea of the price volatility of the overall portfolio. For mutual funds, this information can be found using simple arithmetic and the information on the funds portfolio composition contained in the funds annual, semiannual and quarterly reports. The volatility indicated will be only a rough idea of what to expect, because the mutual fund portfolio manager may lengthen or shorten the average maturities over time in anticipation of interest rate changes. However, the mutual funds investment objective statement found in the prospectus generally restricts major changes in maturity.

Table 1. Percentage Change in Bond Prices When Interest Rates Change