How I Make Money with Lending Club (My Investing Strategy)

Post on: 3 Май, 2015 No Comment

February 17, 2013 41 Comments

This is the post Ive been referring to for the past couple months, and Ive finally gotten around to writing it. If youve read my income reports. you know I talk about Lending Club on a monthly basis. The reason is simple: This is really my only true source of passive income online. Ive used Lending Club for over 3 years now and am happy to be an affiliate as well.

What is Lending Club? Its basically a platform that allows individuals to loan money to other individuals (also known as peer-to-peer lending), with Lending Club as the middle man, making sure that your risk is properly identified before you make an investment. They do everything from running a credit check on the borrower to verifying the borrowers annual income, to make sure its relatively safe for you to loan them the money.

Of course, there is some risk involved, but youre compensated for that risk by earning a nice interest rate on the loan (investment). If you read my income reports, youll see I currently earn around a 6% annualized rate of return on my investment, and the average rate of all Lending Club investors is around 9%. Theres a lot more to it, which is why I decided to write this guide and show you my strategy when investing on Lending Club.

Setting up Your Lending Club Account

Before I actually go into the investing strategy I use, I figured I should probably briefly touch upon how you actually set up your Lending Club account in terms of what you should be thinking about.

First of all, its free to create an account. You can sign up here and set up your account with all the required information. Lending Club is a secure/reputable site, so you can trust them with your sensitive information.

Upon setting up your account, you will want to make some kind of deposit so that you have money to invest. For people that are unsure of it, I usually recommend making a $25 deposit thats the minimum amount you can invest in a loan, and itll allow you to get your feet wet.

Walking Through the Investing Process

Im going to go through the basic investing process here so that you get an idea of how it works and so you can do it yourself.

Determine Your Tolerance for Risk

Before you even start looking at the available loans to invest in, you should first think to yourself, how much risk am I willing to accept? If you feel like youre a bit more conservative. you may decide to invest in loans that seem very safe, but also dont pay a high interest rate.

On the flip side, if youre only using a small % of your investing portfolio for Lending Club, you may decide its worth being a bit more aggressive — in which case, you would target loans that offer a higher interest rate.

No matter what your tolerance for risk is, the process will be the same. Even if you want to be more aggressive, you still want to make smart choices. After all, the end goal is to not only make money, but to make enough money to compensate for the risk you are taking on.

Browse Available Loans and Consider ALL Available Information

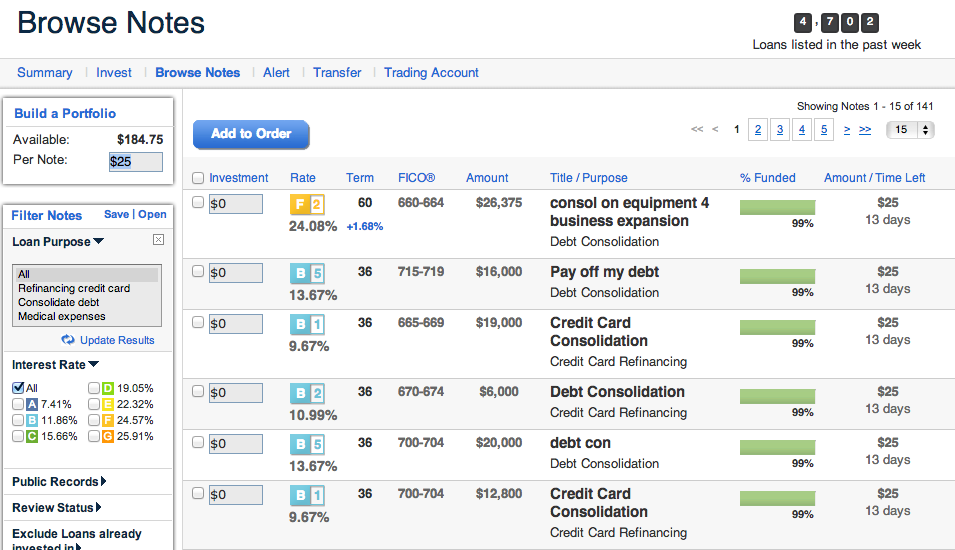

This is the most challenging part of the process, because youll have a lot of information and different loans to sort through. Heres a sample of what it looks like when you are browsing available loans :

The Loan Rating

The first column basically shows you the quality/rating of the loan along with the expected interest that you would earn if you invest in the loan. The A type loans are the highest quality this means, the borrower probably had his or her income verified, has a great credit score, little to no history of defaulting on loans, low outstanding debt, etc.

The G type loans (not pictured in the list above) are the worst. Theres a lot more risk here, but the interest rate they offer can be 25% or higher. I typically stay away from these, but that doesnt mean you should if youre willing to take on a little bit of risk with a smaller investment.

B through F obviously fall somewhere in between, and you of course should evaluate each loan individually before making a decision.

The term is the period over which the loan will be repaid to you (loan payments are typically made on a monthly basis). Most loans are 36 months (3 years) but there are some that are 60 months (5 years). Youll notice in the image above that the loans that are 60 months give you an extra bonus. The loan second from the top shows +3.52% .

What this means is, youre getting an extra 3.52% for allowing the person to borrow over 5 years instead of 3. Again, this is all tied to risk the longer the loan will be outstanding, the more uncertainty there is (what if they lose their job in 4 years?), so therefore, there is more risk.

FICO, Amount, and Purpose

These columns are pretty straightforward. The FICO score is the persons credit score (to learn more about how the FICO score works, look at this Wikipedia page ).

The amount is the total loan amount that the borrower is requesting. As an investor, you will (most likely) only be investing in a small portion of that loan, starting as small as $25. Even though your investment will be small, it still important to consider the total amount the person is investing, and the purpose for which they are going to use it.

For example, if I see a loan for $50,000 with a description that says Credit card debt consolidation , there are some red flags that go up in my mind. This person has racked up $50,000 in credit card debt that they have not been able to repay yet, and they are now turning to Lending Club to try and move that debt into something with a lower interest rate. Its smart on their part, but do you want to invest in someone who racked up $50,000 in credit card debt to begin with. Doesnt sound like a financially responsible person to me.

On the other hand, if the person needs the money for a home improvement or something else like that, and their credit score, etc. looks good, I might be more inclined to invest. As Ill explain later on, youll be able to click on the loan and read more about it beyond the one-line purpose shown on the screen above.

% Funded and Amount / Time Left

Social, peer-to-peer lending is an interesting thing. Not only are you trying to make an investment decision based on the characteristics of the borrower, but you can also take a look at what other people are doing.

For example, if there is a loan listing that expires in 10 hours and is only 5% funded, theres probably a good reason for it, and perhaps you should stay away from it.

On the other hand, if theres a loan that people seem to be quick to invest in and is almost fully funded well in advance of the loan listings expiration time, that might be a good loan to look into and see if its something you want to invest in. These arent metrics that should necessarily drive your investment decision, but they are additional signals that can help you determine whether or not it might be a good investment.

Looking Deeper into a Loan That Interests You

Once youve identified a loan that looks interesting (based on the metrics shown on the summary page), you can dig deeper into it to see more information. Heres an example of one that I looked at:

I would rate my interest in this loan as moderate. There are a few things I dont like, but given the fact that the interest rate is a whopping 15.80%. I cant expect it to be perfect.

Lets analyze the loan by first looking at some things that I like:

- 15.80% Interest rate — This is what first got me interested in the loan. Part of the reason its so high is because its a 5-year loan, not a 3-year loan, but that alone isnt going to stop me.

- Verified Income — Lending Club has verified the borrowers income (which they dont always do), so thats a big plus for me.

- Good employment record — This person has been employed for the past 10+ years and I can even see who the current employer is.

- No delinquencies — In the past two years, this person hasnt had any delinquencies (i.e. no issues repaying debt).

- Credit score is good (not great) This borrowers FICO score is 695-700, which is considered fairly good by most standards. Its not great, but its good enough for me to have some trust in this borrower.

- Social signals — This shouldnt be weighed too heavily, but I like to see that the loan is already 67% funded with 10 days to go. It tells me that many other investors have decided to invest. And while we dont know how smart the other investors are, its still a somewhat positive signal.

- Renter — Depending on your perspective, this could be good or bad. With someone at this income level, I like knowing that this person doesnt have a mortgage to worry about.

Now, some things I dont like as much:

- Purpose of the loan — The total loan ($19,750) is going to be used to pay off existing debt. This always leads me to ask, how did the debt become so great to begin with? This leads us to a further question: If this person continues to build up additional debt, will they be able to continue paying down our loan for the 5 year duration? No one knows for sure, which is a big reason why the interest rate is what it is.

- Relatively low income compared to loan — Assuming the $3,683 gross monthly income is only around $2,700 or so after taxes (this is only a guesstimate), the monthly loan payment represents almost 18% of this persons income. Again, this is okay. but its not ideal.

Overall Analysis

Even though Ive only listed two negative points compared to 7 positive points, the two negative points are very significant. This is the type of loan I would invest in a small percentage of the time (maybe 10-20% of the loans I invest in). Its okay to take some risks. but you have to keep your entire portfolio in mind and how it relates to your overall risk tolerance.

Determining an Amount to Invest

This is going to be based on your personal preference, but I like to strictly stick to $25 per investment. This way, I can be sure that my portfolio is diversified. Inevitably, you will eventually run into a bad loan and the borrower wont pay it back in full. When this happens, your risk will be minimized if your loan amount was only $25.

If you have a lot of money to invest, you might consider increasing the loan size to $50 or $75, but thats not something Ive done due to my portfolio size (under $5,000 right now).

If you start out by depositing $500, dont feel like you need to get out there and invest in 20 loans right away. Take your time, and only invest if you see loans that you like. It doesnt hurt you to have a little bit of cash sitting idle while you wait for a good loan to appear.

Even though most loans are three years, youll generally start to see money coming back after the first month (because the borrower typically pays the loan back on a monthly basis). Each payment you receive will consist of both principal (i.e. the money youve loaned the borrower) and interest (the compensation you receive for lending the money).

Eventually, that repaid principal + interest will accumulate to $25+. At this point, you can take the money and reinvest it in a new loan. I am constantly reinvesting the money I receive, so each month Im able to invest in new loans without actually depositing more money into Lending Club. Id recommend doing this if you want to maximize your rate of return.

Streamlining the Investing Process: Filters

Lending Club allows you to save filters so that you can always see the loans that match your preferences (loan rating, verified income, etc.) and dont have to set them each time you log in to look for a new investment.

You should set your filters to match your risk tolerance and other preferences, but in case youre wondering what mine looks like, you can see it pictured on the right.

You dont want your filters to be too restrictive because you might be filtering out good loans that youd actually like to invest in. Your best bet is to only filter out the types of loans that you definitely would not invest in.

Here are the key aspects of my filters (as pictured to the right):

- Lending Club has approved the loan application.

- Show loans of ALL grades.

- Show both 36 and 60-month loans

- Debt to income ratio must be 25% or less.

- Exclude the loans Ive already invested in.

- Must have NO delinquencies in the past two years.

- Credit score must be at least 695.

Conclusion

There you have it thats my investing strategy and how I make passive income with Lending Club . Theres nothing too exciting about investing in loans its like investing in a CD or stock. You put the money in and sit back while you wait for the investment to pay off. In this case, I believe the return is nice given the risk involved.

Once again, you can sign up for free here . and get started with as little as $25. If you have any questions at all. please leave them in the comments and Ill be happy to answer them.

If you decide to invest, best of luck, and hopefully you find it to be a great source of passive income like I do!