How ETFs work

Post on: 21 Июль, 2015 No Comment

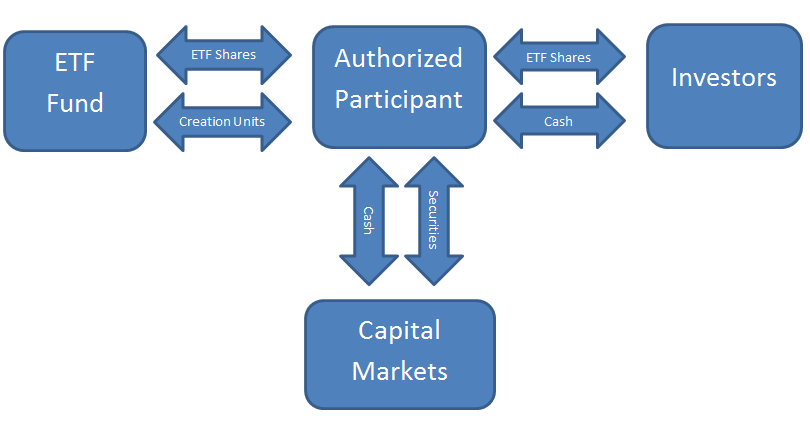

An exchange-traded fund (ETF) is an investment fund that holds a collection of investments, such as stocks or bonds owned by a group of investors and managed by a professional money manager. ETFs trade on a stock exchange and can be sold short or margined. You can also trade in futures and options on ETFs.

ETFs and mutual funds both offer similar options to spread out risk using diversification – but they’re built, bought and sold differently.

4 things to know

- Risk – The level of risk and return depends on what the ETF invests in. You can lose money investing in ETFs.

- Past performance – How an ETF has performed in the past can’t tell you how it will perform in the future. But past performance can help you determine how volatile or risky the ETF’s returns may be.

- Buying and selling ETFs – You buy and sell ETFs on a stock exchange, in a similar way to buying and selling stocks .

- Fees – You typically pay commissions and management fees to invest in ETFs. There may also be costs to set up an investment account.

How to make money on an ETF

Some ETFs pay out the money the ETF makes to investors. These payments are called distributions. For example, you may receive:

- interest distributions if the ETF invests in bonds,

- dividend distributions if the ETF invests in stocks that pay dividends, or

- capital gains distributions if the ETF sells an investment for more than it paid.

Unlike many mutual funds, ETFs do not reinvest your cash distributions in more units or shares. Here’s what happens with your distributions instead:

- The cash stays in your account until you tell your investment firm how you want to invest it. You may have to pay a sales commission on what you buy.

- Your investment firm may offer a program to automatically buy more ETF units or shares for you. You likely won’t pay a sales commission on these automatic purchases.

How ETFs are taxed

You’ll pay tax on:

- any capital gains you make from an ETF when you sell it, and

- any distributions you receive from the ETF.

If you hold an ETF inside a tax-sheltered account such as an RRSP or a RRIF. you won’t pay tax on what you make investing until you take the money out. With a TFSA. you won’t pay any tax on the money you make while it’s in plan or when you take it out. Learn more about how investments are taxed .