How Do You Qualify For A Mortgage Loan

Post on: 25 Апрель, 2015 No Comment

by Silicon Valley Blogger on 2012-03-06 27

You finally found the perfect house and youre close to realizing the dream of owning your own homeso close that you can taste it. Its a great time in your life but are you really financially ready to achieve these goals?

Check Out Home Loan Resources

Youll first need to ensure that you can afford the house youre interested in buying. Heres more on how to get some idea on how much house you can afford. As you go house hunting, you may also want to shop for a home loan; so to get the best home loan rates. you can conduct online loan requests. You may want to check out web resources to obtain multiple loan offers from several competing lenders. Bear in mind that before you can obtain a loan approval, there are a few requirements youll need to fulfill.

Criteria For Mortgage Loan Qualification

What does it take to get the loan you want? What do lenders want to know about you? Before mortgage lenders can grant you a loan, they of course would like to make sure you can repay them. Your finances will be pored over like never before, making this experience quite overwhelming especially for first-timers. There are many questions and a mountain of papers to fill out and sign before you even know if the house you have your eye on, can be yours. Mortgage lenders will need to consider your personal finances very carefully before making a decision. The qualification factors for securing a mortgage can be summarized into this easy to remember short list called the 4 Cs of mortgage loan qualification :

- Your Credit history

- Your Capacity to pay back your mortgage

- Closing Costs, Cash to Close or down payment

- Collateral or the property you intend to buy

Lets go through each in more detail. The mortgage lender will need to know:

- Your credit history and credit score. This is why you want to protect and improve your credit status. Youll have a better chance to snag a loan especially when credit is harder to come by if your credit score is good to excellent. A realtor friend told me that victims of the subprime lending debacle who may have had their credit adversely affected may need only wait a few more years to restore their credit or qualify for loans again. Lenders will look at your credit history over the past 5 to 6 years.

The lender will also be taking a look at your debt to income ratio, which is a formula designed to determine how prepared you are to take on additional debt. Different lenders will have different requirements for the debt-to-income ratio. For instance, conventional loans typically a conventional loan from a bank or other mortgage lender will require no more than 26% to 28% of month gross income for housing costs and not more than 33% to 36% of monthly housing plus debt costs. With an FHA loan, the housing costs should not exceed 29% of the monthly gross income and 41% of the monthly gross income. Heres where we discuss the debt to income ratio in further detail.

Additional Factors Considered For A Mortgage Approval

Other factors mortgage lenders will consider in their calculations for a mortgage approval include the cost of your real estate taxes and homeowners insurance. Property taxes can be determined by talking to your real estate agent or by contacting the local tax office for more information. Homeowners insurance is a requirement for obtaining a mortgage; an estimate can be acquired from a local insurance agent. Make sure you have an accurate quote from the agency to get the right estimate.

Some areas will require additional coverage for floods, earthquakes and other hazards. depending on the location of the home. Also, if your down payment is less that 20%, you will be asked to obtain mortgage insurance or to take out a piggyback loan in order to reduce the initial loan to 80% of the purchase price.

Before you begin looking or getting all excited about a great house you have found on the market, take some time to get information about prequalifying for a home loan or getting a preapproval. To prequalify a borrower, the lender will evaluate their financial information and will estimate the loan amount they may be able to secure; theres no guarantee that the borrower will actually get a mortgage. A preapproval involves taking the steps to apply for a mortgage that results in a loan commitment of a particular amount (subject to a home appraisal); getting one can help the borrower cut down the time needed to get a loan. This may save the home buyer a lot of time and trouble when house-hunting.

On the other hand, if youre having trouble qualifying for a conventional loan, you may want to consider other loan types that are geared towards those with weaker credit.

The fact is, youll be better prepared to find the right mortgage and to offer a respectable down payment when you know exactly how much house you can afford. Putting in some research, preparation and time to understand your financial circumstances prior to buying a house will allow you to negotiate a better deal and possibly make the home buying process move along more smoothly.

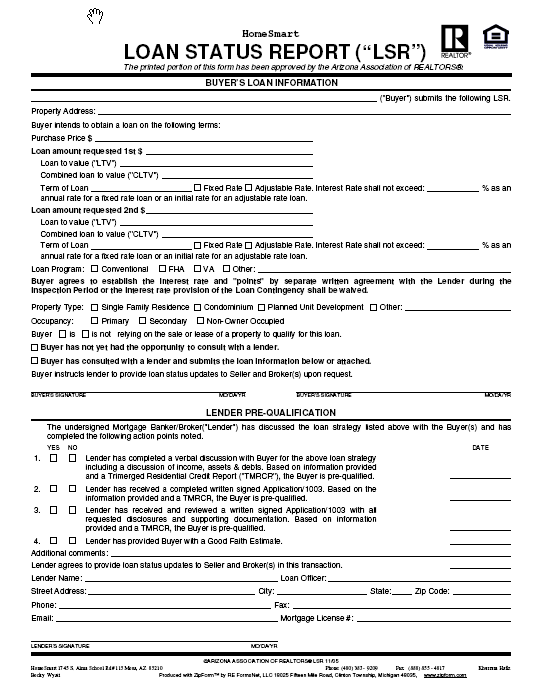

Image Credit: The American Chronicle