How do Private Equity Fund Investments Work

Post on: 3 Июнь, 2015 No Comment

How do Private Equity Fund Investments Work?

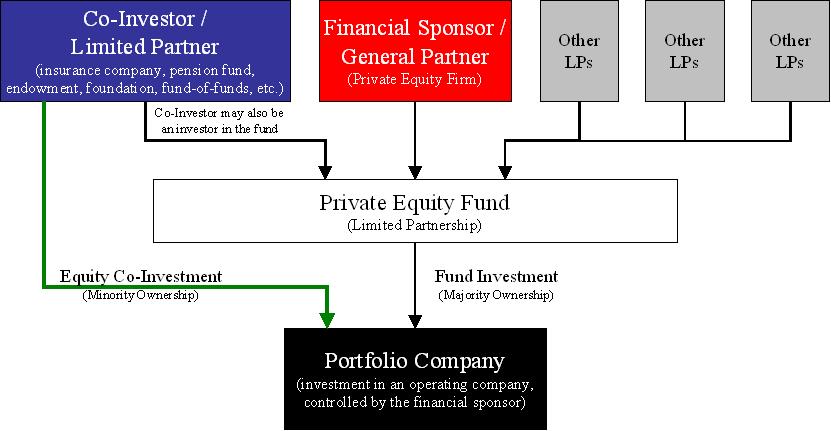

With the complexity of private equity and its recent growth, we felt it was important to teach our readers about the most common corporate structure in the industry, the Limited Partnership. To do so, weve broken down private equity into several key components, and provided a diagram to help you see how they relate to one another. This will allow you to understand the roles of private equity investors, firms, funds, and managers, while teaching you how they operate together as one.

Before we get to the private equity fund diagram, let’s define some key components you need to remember. Scroll down and take a look!

Private Equity Investors : Typically, investors in private equity funds are high net-worth individuals, institutions, or other large companies. In this case, they are considered “Limited Partners” in the fund, and though they do incur financial risk, they do not incur liability. With the potential of higher yields, many have flocked to the private equity markets to take advantage of the growing trend. Generally, yields for private equity funds can exceed almost any traditional investment, hence the recent influx of interest.

Private Equity Fund : In most instances, private equity funds are “Limited Partnerships” owned by a “General Partner” (Equity Firm Manager), and “Limited Partners” (Equity Fund Investors). In short, the General Partner manages the fund based upon the details of the Partnership Agreement. This agreement covers terms, fees, liabilities, and other conditions which must be met by both the General Partner and Limited Partners. In effect, the fund is really a tool to allow the investment process to occur. Without it, there would be far less security for investors, and increased liability for fund managers.

Private Equity Firm : The private equity firm is known as the “General Partner” of the private equity fund . Within the Partnership Agreement, the investors agree to let the firm manage the investment, and in return, it can charge additional fees to the investors. By taking on the role of General Partner, the firm has unlimited liability for the debts and obligations of the Limited Partnership, but also has a strong control in its investment decisions. In short, the General Partner is the intermediary between investors with capital and businesses seeking capital for growth.

Private Equity Investments : In the diagram below, you will see the term “Investments” listed in the three boxes at the bottom. This represents the companies the “General Partner” has chosen to invest in. Typically, these companies are highly profitable, but unable to grow further due to low cash reserves or inadequate funding. In most cases, private equity firms will choose to diversify by investing in several different companies, keeping risk and exposure minimized for their investors.

Now that you understand the components of a private equity investment. let’s take a look at the diagram below to help connect the dots!

To summarize. the Partnership Agreement allows private equity investors and fund managers to define their relationship and liability in the form of a contract. Once the investors allow the “General Partner” to manage their account, they transfer liability but also assume risk by doing so. After the General Partner receives the money from the investors, they invest in companies which they feel have the highest potential for growth, and often diversify to reduce risk. In all reality, this process may sound simple, but it is very complicated as well explain in future articles.

With private equitys impact on the investment world, its always good to understand the moving pieces of the industry and how they work together. Who knows, you may become a private equity investor some day, or even better, you may choose to start your own private equity fund. No matter what your position is, if you just keep on learning, education will protect and direct you on your path to success.

InsideTrade LLC Staff