How can we truly value companies when their balance sheets show net of longterm assets

Post on: 2 Июнь, 2015 No Comment

Related Topics

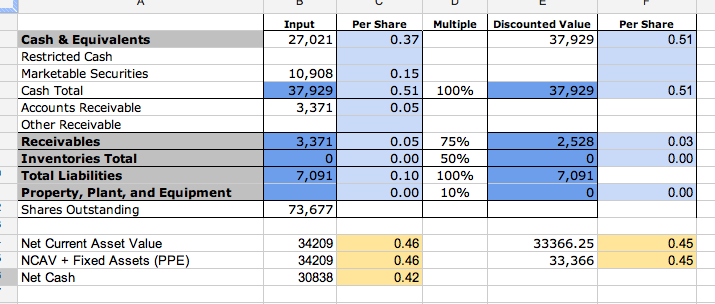

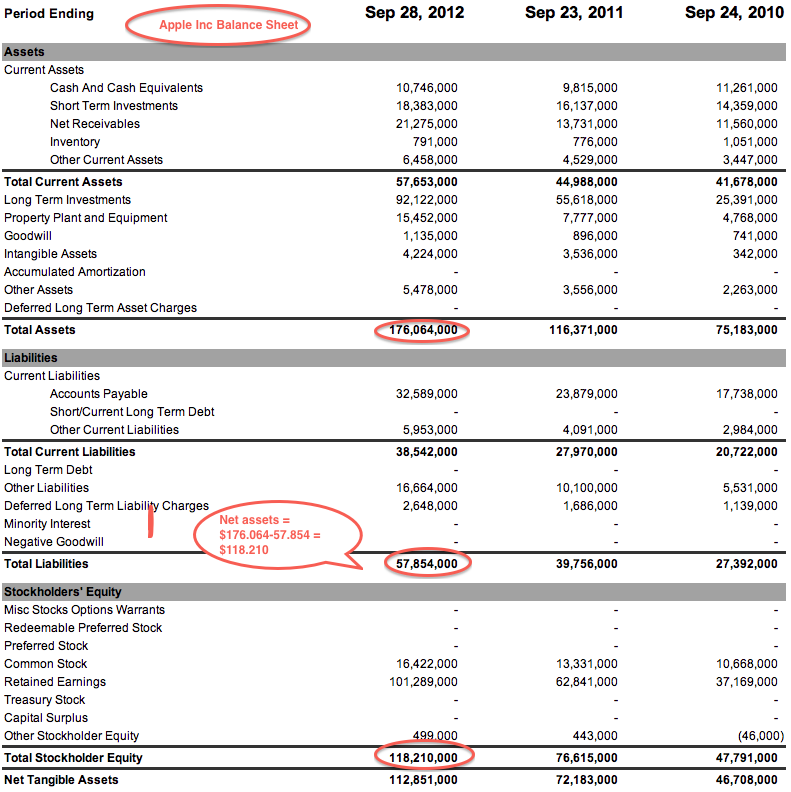

The valuation of a company is not based on the assets; as a rule of thumb assets are cents on the dollar in any M&A transaction. In other words, no one buys a company for its assets; they buy companies for the IP, the customer list, etc

There are many ways to calculate the value of a company. Unfortunately, the only truly valid method would involve an analysis of revenue traction over time and overall profitability of the business model.

In conventional formal valuation circumstances, the organization would retain someone to perform a 409(a) valuation model that private companies use to substantiate the valuation basis of the company. Most public accounting firms can provide this service, in the Bay Area Moss Adams is a good firm to utilize or Armanino and McKenna.

The 409(a) utilizes several data inputs, generally speaking the following would be considered:

1. A five year forecast indicating major assumptions applied to each element (i.e. revenue growth, headcount addition or RIF, etc).

2. Updated CAP table showing, Common Stock, Preferred, Convertibles, Warrants, etc.

3. A DCF model based on the Net Free Cash Flow Model

4. Black Scholes Value Model (for calculation of call value needed inputs are strike price, risk free rate, etc)

Once the inputs have been determined, the model will provide an estimate of the intrinsic value.

This model does not contemplate the tax implications of an equity instrument without a defined market value. The IRS has several rules, most common among which is the use of comparables to determine the FMV of the exchange.

Unfortunately you don't have time to go through and both learn and perform all that crap so your best bet is to go with #3. A DCF model based on the Net Free Cash Flow Model.

DCF models are relatively straightforward and can be accomplished by someone who has done the work in prior situations.

The most difficult aspect of this analysis is creating an objective model. There will be a big difference of opinion depending on which side of the table you sit. From the buyers side, you want the traditional 'buy for a little and sell for a lot'. From the sellers side there is too much ownership and separation anxiety from a company that is almost viewed as a child in that the seller raised it, nurtured and watched it grow from nothing to something.

The real tricky part of the strategy is, '. how to get a motivated buyer and an entrenched seller to compromise?'

The answer is to first define where the sticking point is, assuming talks can continue after the offer was made and rejected.

The second step is to create an understanding of the plan, if there really is such a thing, and how the seller was going to execute in that plan

The third step is to make an earn out offer. This involves offering a tiered incremental payout based on the seller remaining with the company and if they execute correctly the increased payouts take place. Otherwise the original offer stands.

This strategy has some beautiful implications: First is to have the owner remain and observe their operating style and business practices; learning priceless information like difficult customers and how to handle them to subtle rules of thumb such as who are the most critical customers or which vendors are the key vendors.

Secondly, the observation process will provide the best on the job training that would not normally be available in a post buy our situation.

Lastly, you get to see first hand exactly what type of leader the seller really is, which employees he goes to for fixing the worst in house situations.