How best to profit from inflation ArabianMoney

Post on: 5 Июнь, 2015 No Comment

Posted on 03 July 2011 with 2 comments from readers

The Bank of International Settlements has recently warned the central banks of the world that without interest rate hikes very soon inflation is really going to take off. Chinese food price increases of 11.7 per cent in the month of May should also be sounding alarm bells.

However, the recent downtrend in commodity prices is being treated as an indicator that the worst of the inflation scare is almost over. This is a complete nonsense, and central bankers know it. They need inflation as a policy response to high global debt levels.

Debt and inflation

Lest we forget our economics 101: debts remain constant in nominal terms while nominal income rises in a period of inflation. The downside is that you devalue your currency in the process as clearly more now buys less.

Creditors or savers are thereby robbed by inflation. The alternative route for central banks is indeed the higher interest rates recommended by the BIS combined with public spending cutbacks. But the risk of a deflationary downward spiral, with falling nominal asset values eventually bankrupting the banks, is thought just too great.

We have not really been in this position since the 1970s. Then as now financial markets blew up and there was too much debt in the system to tighten monetary policy aggressively. From 1973 to 1980 stagflation raged with high inflation rates and low economic growth. Only in 1980 did the US feel strong enough to squeeze inflation out of the system.

The parallel is not an exact one. Global financial markets were a smaller place in the 70s without Russia, China, Eastern Europe or India. The borrowing was on a lesser scale though the forecasts of the end of the dollar were just as vociferous.

However, the most reasonable supposition is that it will not be so much different this time. In the late 70s the US stock market performed badly and investment crowded into energy and precious metals and avoided financial stocks. Bonds were a disastrous investment once inflation really got going.

Cash, gold and silver

The best places to be in the late 70s were cash and precious metals. Cash because the interest rates paid on deposits did have to go up with inflation (unlike the fixed coupon on a bond), and gold and silver because they represented a currency with a fixed supply and no central bank.

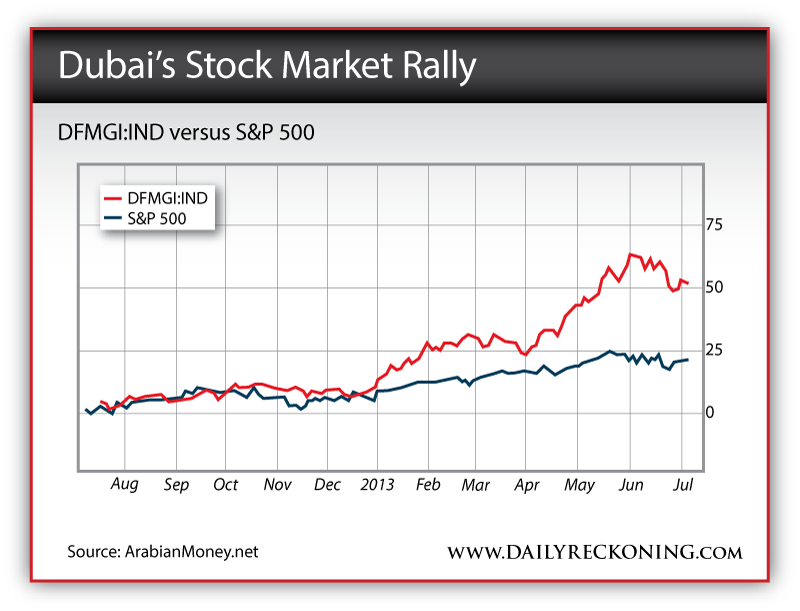

This is where the ArabianMoney investment newsletter kicks in with ideas for subscribers on how to profit from this scenario (subscribe here ). We see direct investment in the bombed-out equities of the Gulf States as an excellent leveraged play on a continuation of relatively high oil prices, for example, and month-after-month present actual alternative investment options that will never appear on this free website.

It is important for readers to realize that conventional financial advisers and most banks will not be giving this sort of advice because it is not very profitable for them in terms of commissions and can be seen as encouraging clients to invest against their interest (that is to say the banks interest not the customers).

Unfortunately those who stuck with conventional wisdom in the late 70s lost their shirts to inflation. You need instead to study how best to profit from it.