How Bear Markets Start

Post on: 11 Август, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

During the March-April market plunge, many of the formerly best performing stocks declined a big 20%-60%. Investors who were lulled into complacency by Wall Street bullishness were shocked. That’s why it’s important to listen to impartial analysts who don’t have a conflict of interest. A money manager can never tell you to go to cash.

Early this year, my column on Forbes.com was headed: The Most Reliable Indicator Of An Approaching Market Top. Now you can see that the ETF (iShares Russell 2000, IWM) for the Russell 2000 index (small cap stocks) and the Nasdaq composite are well below their January levels and their highs for this year. They have big, bearish “head & shoulder (H&S)” tops. The IWM has broken its 200 day MA, which is considered the dividing line between a bull and bear market if the trend persist.

Over the past two months, the Nasdaq lost 10.7% (top to bottom) while the other major indices declined less than half that much. The DJI is now back at its all-time high. But are these 30 stocks, subject to easy manipulation, really a true measure of the stock market?

In March I got warning signals from all my technical indicators that meaningful declines in the favorite high-flyers were ahead. I cautioned investors (see CNBC, CNBC Asia, YouTube, etc.) to ignore the DJI and S&P 500 and focus on the small-cap stocks and the Nasdaq to get a true reading of the markets. When Wall Street is looking at the DJI and the S&P 500, it’s more important to look at the Nasdaq and the small cap indices to tell you about the only thing that can change the price of a stock or an index: a change in money flow.

The popular stocks got slammed. Look at this list and their losses since late March when I got my “sell” signal. These are losses for just two months, which many traders following the traditional advice incurred. As you can see, the action of the DJI was irrelevant.

That first decline was in all the sectors that had performed very well. The big cap stocks declined only around 5%, while the high performers declined from 20%-68%. Here you can see that when analysts in the media tell you “a market correction may only be 10%-20%,” this could mean a disaster for your own portfolio unless you hold only an S&P 500 fund.

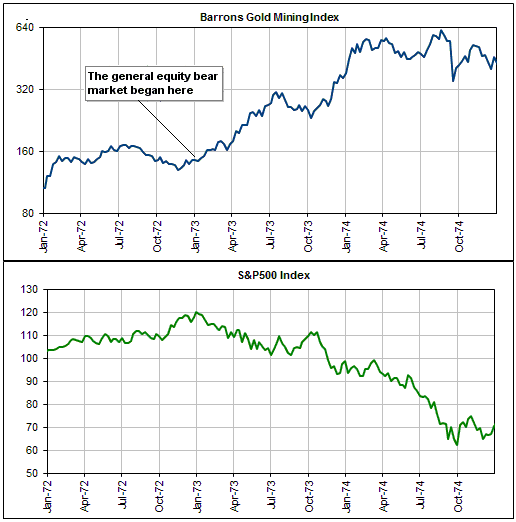

The severity of the declines in the most sensitive stocks is typical of what you see at an important market top. First the speculative stocks are dumped, but the money stays in the big caps and conservative areas such as utilities. Later, these are no longer a safe haven either.

The March-April market correction ended temporarily on April 15. Then came the typical seasonal post-tax rally. These rallies are usually short term.

Has anyone noticed the rapid and significant downward revisions in earnings projections on the S&P or even the downward revisions to economic growth? At the beginning of the year, Standard and Poor’s forecasted a 19% increase in “as reported EPS” (earnings per share) for 2014. For 2015, S&P initially forecasted an EPS increase of 24% over 2014. Imagine, that would be a cumulative increase for the two years from 2013 to 2015 of almost 50%! Apparently, the firm believes in economic miracles.

By mid-April, forecasts had diminished substantially. One firm is now forecasting earnings growth for this year of a meager 1.2%. Some analysts even say that the profit in the S&P 500 probably fell 0.9% in the first quarter. Just a few months ago, the consensus was for a 6.6% rise, down from a 19% rise. The bulls say that this was weather related.

Remember, this is EPS growth, not growth of total company earnings. If it weren’t for the huge corporate stock buybacks, which reduce the number of shares and thus increase the “per share” profits, the picture would be more dismal. You always have to look beneath the surface to find the truth.

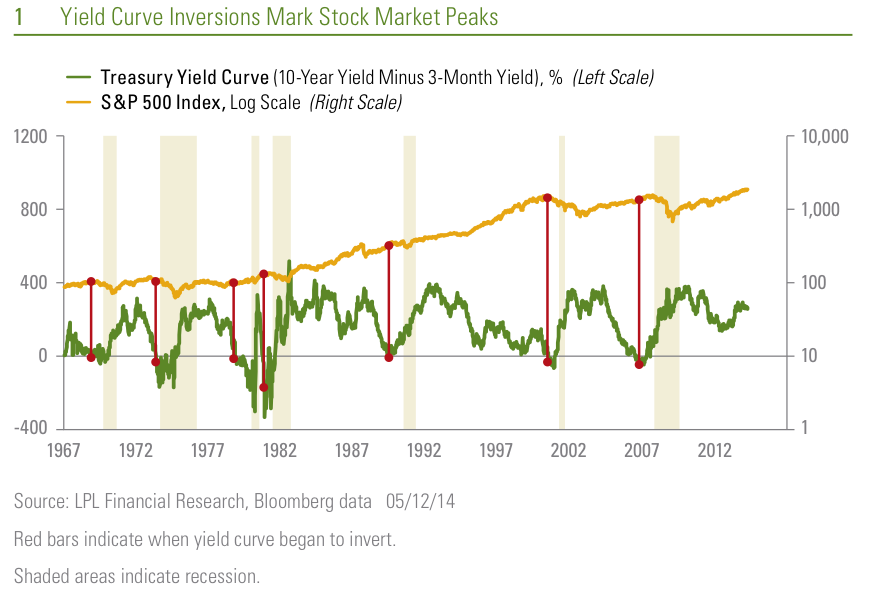

The fact that T-bond yields continue to decline (rising bond prices) is a very important signal for investors. “Deflation” is the big fear of the informed money. That means recessionary forces are growing even while Wall Street’s analysts are sent into the media to distribute their bullish views on the economy. Always ask, is the advice tainted?

I am forecasting a decline in corporate earnings this year. In fact, all the surprises will unfortunately be to the negative side.

Conclusion: The markets are on thin ice. The major central banks are trying hard to fight the deflationary forces in the credit system. Every time the markets approach critical downside level, central bank action will try to support. Their actions will temporarily boost the markets until it no longer works.