Housing Wealth Declines Stabilize for Now US News

Post on: 21 Апрель, 2015 No Comment

New data show that the housing market won’t lose nearly as much value in 2009 as it did last year.

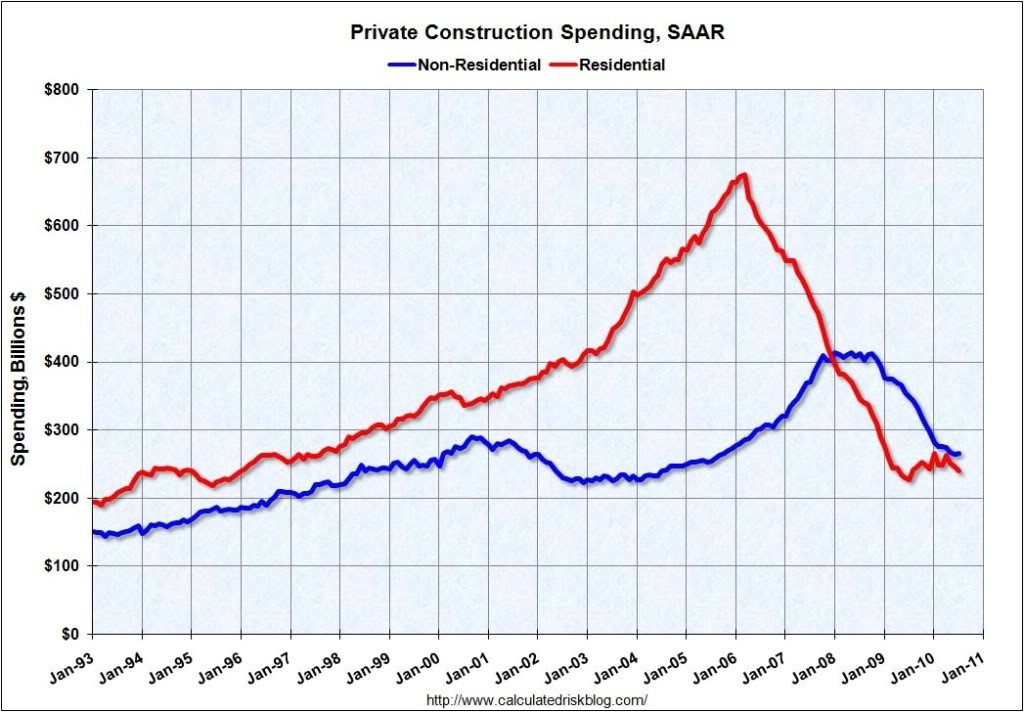

The real estate slump sucked nearly $500 billion in value from American homes through the first 11 months of the year—a notable improvement from the $3.6 trillion of housing wealth that evaporated in 2008, according to new data from real estate firm Zillow. The figures, which come on top of firming home sales and dwindling inventories, represent further encouragement for a housing market that’s been in retreat since its 2006 peak. Home values stabilized significantly during the second half of 2009, with the total dollar value of U.S. homes increasing since June, Zillow Chief Economist Stan Humphries said in a statement. But that doesn’t mean the housing market has hit bottom quite yet, Humphries cautioned, as several potential head winds appear poised to send home prices tumbling again in the coming months. Here are four things you need to know:

1. Market improvement : The smaller loss of housing wealth is linked to recent improvements in the real estate market. Amid better sales and tighter inventories, home prices at the national level logged an 8.9 percent decline in the third quarter from the same period of 2008. That’s a significant improvement from the 14.7 percent annual decline in the second quarter and the 19 percent slide in the first quarter, according to the most recent Case Shiller home price report. But in an interview, Humphries said it’s still too soon to call the bottom. We are encouraged by some of the stabilization we have seen thus far, but we are concerned that a lot of the stabilization is built on relatively short-term factors, he said.

2. ‘Short term’ factors : The steep decline in home prices—which have returned to 2003 levels—has juiced sales by making properties more affordable to a larger number of buyers. But the federal government’s sweeping intervention into the market has helped significantly as well. By launching a program to buy up debt and mortgage-backed securities from Fannie Mae and Freddie Mac, the Fed has pushed mortgage rates down to nearly record lows. Average 30-year fixed mortgage rates fell to 4.71 percent in the week ending December 3, according to Freddie Mac. A tax credit of up to $8,000 for qualified first-time buyers that was enacted in February—and expanded in November—is helping to push buyers off the sidelines. As banks jack up their lending standards, consumers can still get mortgages backed by the Federal Housing Administration by putting just 3.5 percent down. Finally, foreclosure sales have slowed as the federal government ramps up its housing rescue efforts.

3. Headaches : A number of factors, however, could work to undo the housing market’s recent momentum, Humphries said. For one, the Fed’s asset-purchase program that has been so instrumental in driving down mortgage rates is scheduled to expire at the end of the first quarter of 2010. If the private market isn’t ready to step in, Humphries believes mortgage rates could increase by as much as a full percentage point as a result. The home-buyer tax credit, meanwhile, is slated to expire at the end of June. Government efforts to modify troubled mortgages have produced lackluster results so far, and some experts believe the initiative is simply delaying an inevitable surge in foreclosures. Finally, as higher delinquencies drag the FHA’s capital ratio below its congressionally mandated level, the agency is under pressure to boost lending standards. Earlier this month, the FHA said it would raise minimum credit scores, increase upfront cash requirements, and possibly impose higher insurance premiums on borrowers. These and other potential new lending requirements could reduce the number of borrowers who can get a home loan backed by the agency. As defaults rise in that portfolio, there will be calls for either higher lending standards or just dialing back mortgage underwriting, Humphries said. [That could] take a key support in the market out. The FHA currently backs nearly 3 of every 10 new home-purchase loans and almost half of all mortgages to first-time buyers.