HighYield Munis Rewards and Risks

Post on: 25 Апрель, 2015 No Comment

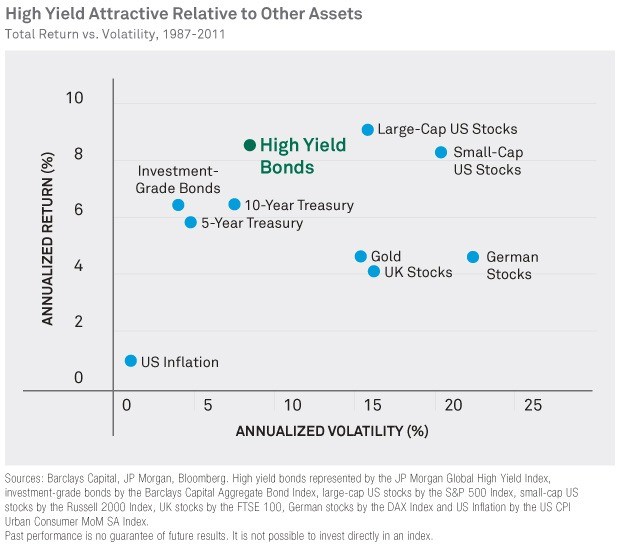

High-yield debt has paid off over time, but it comes with added risks

Fixed-income investors, hungry for yield in a low-interest-rate environment, have been pouring money into high-yield municipal debt, a small but highly lucrative niche of the muni market. For the three years ended Oct. 31, funds in the sector returned an average of 9.1% a year, according to Morningstar Inc. And over the near term, the funds have done even better—gaining 12.8% for the year to date.

More in Investing in Funds

In the first nine months of this year, the funds attracted $10 billion in net new cash from investors, a significant portion of the total $43 billion that went into muni funds, according to Morningstar.

However, this isn’t a market for the faint of heart or the uninformed. High-yield municipal debt has inherent risks and anomalies, and it is critical that investors approach the market with care.

We think high-yield municipal debt is compelling and will remain so for some time, but certainly, there are risks, says Gary M. Fuqua, managing director and head of high-yield and distressed municipal strategies at asset manager Spring Mountain Capital LP, in New York.

Those risks include:

EVENT RISK. The high-yield muni market includes such high-risk issues as debt from municipal entities that own airport terminals and rely on fees from airlines for repayment. According to Morningstar, Goldman Sachs High Yield Municipal took a hit in late 2011 because at the time it had 4% of its assets in special revenue bonds backed by AMR Corp. the parent of American Airlines, which filed for bankruptcy protection last November. The fund has since recovered and ranks in the top half of the category for the past 12 months. Goldman Sachs Group declined to comment.

ENLARGE

Christophe Vorlet

LIQUIDITY. The size of the market is only $65 billion, a tiny slice of the total municipal market. And many individual issues are small. It can be difficult to buy in or sell out, says James Colby, senior municipal strategist at Van Eck Global.

DEFAULT RATES. According to Moody’s. the cumulative default rate for high-yield muni debt since 1970 is 7.94%. By comparison, Moody’s says the cumulative default rate for investment-grade muni debt—issues with credit ratings from triple-A to triple-B—is 0.08%.

Investors are compensated for that risk with higher yields. The Barclays Municipal Bond High Yield Index yielded 5.73% as of Oct. 31, well above the 2.16% yield of the Barclays Municipal Bond Index.

For investors interested in high-yield munis, the diversification of a mutual fund or exchange-traded fund is one way to manage the risks. Here are a few funds that are worth considering:

ENLARGE

Van Eck’s Market Vectors High Yield Municipal Index ETF, managed by Mr. Colby, is a good choice for investors who want the benefits of ETF exposure—such as relatively low cost—but also wish to avoid some of the most volatile issuers in the market. The fund buys a selection of issues in an attempt to match the performance of a Barclays index that is a mix of 75% below-investment-grade debt and 25% low-investment-grade issues. Additionally, the index limits exposure to very small debt issues: 75% of the Barclays Municipal Custom High Yield Composite Index is in bonds issued as part of transactions of at least $100 million in size. The ETF has $820 million in assets and an expense ratio of 0.35%.

Over the three years through October, the ETF returned an average of 8.8% a year, according to Morningstar.

Among actively managed mutual funds, Morningstar analysts favor two funds. T. Rowe Price Tax-Free High Yield. with $2.4 billion in assets, ranks in the top third of its category for the past three years, with an average return of 9.6% a year, according to Morningstar. The fund’s recent 9.8% housing-related exposure favors larger issuers such as the massive Hudson Yards development on the West Side of Manhattan. Its largest exposure is in health care—24.7%.

The T. Rowe Price fund minimizes exposure to riskier sectors, such as tobacco, which represented about 2.5% of assets recently, and airline bonds. Fund manager Jim Murphy says the fund’s recent 1.8% exposure to airline-backed bonds favors carriers such as Southwest Airlines Co. which he says aren’t saddled with the pension obligations of more established carriers.

The other fund Morningstar likes is Franklin High Yield Tax-Free Income. Over the three years through October, it returned an average of 8.8% a year, trailing the category average by 0.28 percentage points. It favors steady holdings such as Texas toll roads. Even though the fund trails the average slightly, Morningstar says high-yield muni funds don’t come much sturdier, thanks to careful selection of sectors and a focus on income over total return.

Mr. Rosenbush is deputy editor of CIO Journal, at WSJ.com. Email him at steven.rosenbush@wsj.com .