HighYield Bonds EquityLike Returns with Lower Risk

Post on: 17 Апрель, 2015 No Comment

On the surface, high-yield bonds look a lot like their relatives in the fixed income world. But in some key respects, high-yield debt acts a lot more like equities than like other bonds. This has some often unappreciated implications for portfolio construction.

Instead of thinking about how much of their bond exposure they should allocate to high yield, we think investors should ask how much equity exposure they should allocate to high yield. Recent research by my colleagues Gershon Distenfeld, Ashish Shah and Jonathan Nye provides a number of reasons.

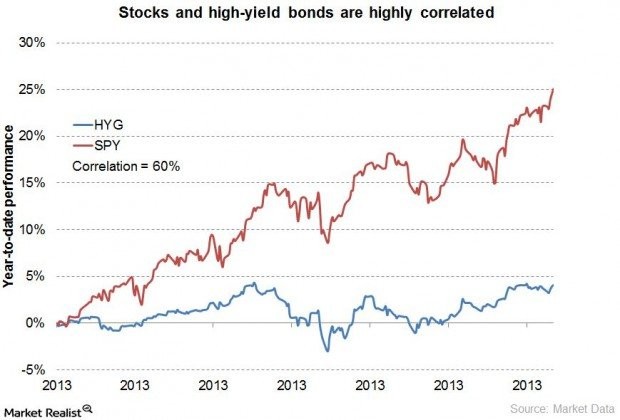

First, the performance of high-yield bonds traditionally has not followed other fixed-income sectors very closely. Looking back over three decades, the correlation of high-yield bonds with investment-grade bonds has been just 0.30. With US stocks, the correlation has been 0.56. Clearly, high-yield bonds (as represented by the Barclays Capital US Corporate High-Yield 2% Issuer Capped Bond Index) have historically tracked stocks much more closely than they’ve tracked investment-grade bonds (represented by the Barclays Capital US Aggregate Index).

Why is this? Well, the returns of high-yield corporate bonds, like equities, are strongly linked to the business results and fundamentals of the companies they represent. While this is also true for investment-grade corporate bonds to a limited extent, high-yield bonds offer a greater incremental yield over government debt than investment-grade corporates because they typically are more leveraged or have less-certain cash flows, which makes them more vulnerable to weakening business conditions or, say, a new competitive threat.

On the other hand, rising interest rates are a less significant problem for high-yield bonds than for investment-grade corporates. In fact, high-yield bonds tend to outperform investment-grade bonds when interest rates rise, because interest rates usually rise when business conditions are strong.

For these reasons, high yield, unlike other fixed income sectors, is typically insensitive to movements in interest rates. In fact, US high-yield bonds have a correlation of just 0.04 with 5-year US Treasuries over the long term.

Second, high-yield assets have delivered annualized returns only marginally below those of equities, with almost half as much volatility, over the past three decades. Yet high-yield bonds are less risky than equities, in that bondholders get paid before shareholders in bankruptcies.

Since high-yield’s correlation to equities is low, an allocation to high-yield bonds can significantly improve the risk and return characteristics of an equity portfolio (Display ). Their low correlation to other types of bonds means that an allocation to high yield can significantly improve the efficiency of a diversified stock/bond portfolio, as well.

All of this raises the question: why do investors continue to think of high yield as a (higher risk) part of their bond allocations? Instead of pigeonholing high-yield bonds because they “look like bonds,” our research suggests that investors should consider high-yield bonds as a worthy replacement for part of a portfolio’s equity exposure—or even as a standalone allocation distinct from both stocks and bonds.

Of course, there are caveats. Transaction costs can be significantly higher for high yield than for equities, because of high yield’s lower liquidity. Interest rates at historic lows also make bonds of all kinds less attractive than usual. Indeed, the extraordinarily low interest-rate environment that we’re in today is virtually uncharted territory. It’s possible that a rapid increase in rates, perhaps due to renewed inflation fears, could make high-yield debt more sensitive to rising interest rates than it has been in the past.

Nonetheless, we think that high yield can provide valuable diversification to equity exposure, while helping to dampen portfolio volatility. It’s also worth remembering that high-yield bonds are less risky than equities, since bondholders get paid before shareholders in the case of liquidation or bankruptcy. In an age when many equity investors are seeking ways to reduce the risk in their portfolios, we think high yield is an alternative worth considering.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Douglas J. Peebles in Chief Investment Officer and Head of Fixed Income, Gershon Distenfeld is Director of High Yield, Ashish Shah is Head of Global Credit and Jonathan Nye is Director of Insurance Portfolio Solutions, all at AllianceBernstein .