High Yield Stocks Too Risky Independent Financial Advice

Post on: 13 Апрель, 2015 No Comment

High Yield Stocks Too Risky: Independent Financial Advice

The dangers of chasing after high yielding stocks

An example of a high yield stock is Linn Energy which yields 7.5%. Andrew Bary in Barrons wrote an article where it was stated that in the first quarter the firm didn’t produce enough cash to meet its distribution. (The firm is a Master Limited Partnership, so it has distributions instead of dividends). The article questioned the sustainability of the distributions.

Some other risks to high dividend paying companies are in the telecom industry. For example, if the duopoly of ATT and Verizon was hurt by some new entrant to the market like Google offering wifi or cable then consumers could use wifi from a new provider instead of the incumbent providers.

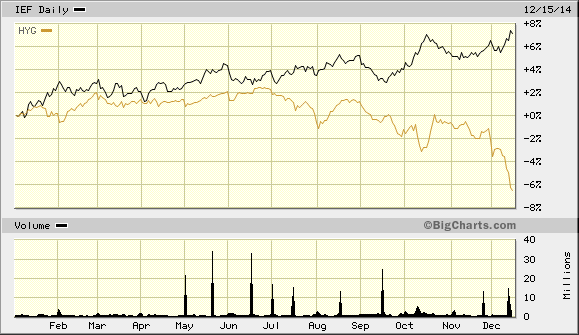

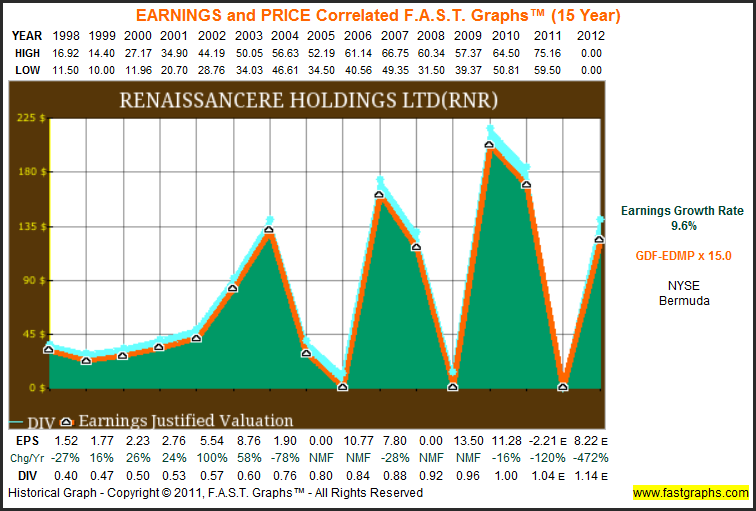

If a typical company stock trades for 1.5 times it sales and its sales have a 9% profit then the company’s “earnings yield” (a hypothetical amount that could be paid out in dividends if no funds were used for retained earnings) is about 6%. Since the prudent thing would be for the company to keep some money for emergencies then perhaps half of the 6% earnings yield could be paid out as dividend, which is 3%. So when a company offers a dividend a lot higher than 3% that should be seen as a risky investment. A high dividend yield maybe because the stock price is too low due to some unjustified panic, except that in today’s bull market there is no bearish panic, so that is not the explanation for high yields. So then a yield may be high because the invisible hand of the marketplace anticipates the company will fail, making the stock price go down. This is called the “Value trap”. Another way that a high yielding company can temporarily have an unsustainably high dividend (or distribution, if an MLP) is if they are engaged in a risky business that is fundamentally unsustainable. For example, there is an industry called Business Development Companies (BDC) that loan money to struggling small businesses. These BDC’s yield about 9%. To get that income they need to loan money to businesses that need to borrow at the credit card rate of interest because no one else will lend them money. But that is a high risk, since 80% or more of small businesses fail in their first five years. So the 9% yield from a BDC could easily turn out to be another Lehman-like failure if the businesses that borrowed were unable to pay back the loans.

Investors first priority is to avoid losing money which can easily happen if a company engages in high risk activity.

Investors should seek independent financial advice.