High dividend yield a popular investment strategy

Post on: 16 Март, 2015 No Comment

High dividend yield, a popular investment strategy

Posted by kcchongnz at Jun 7, 2013 07:05 PM | Report Abuse

High dividend yield, a popular investment strategy

One can see that dividend payment of a company is an important consideration for people in i3investors here for investing in a stock. Isn’t it logical that one should invest in stock if that stock provides a dividend yield higher than the interest earned from fixed deposit in bank? However, dividend forms just part of the return for investing in a company. The other part is the capital gain on the stock which comprises of earnings growth and expansion of the price-earnings ratio when it is sold later. Together they form the total return of a stock.

Total return = Dividend + Capital gain (Earnings growth + PE change)

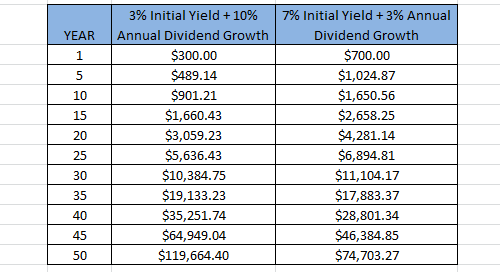

The US equity market provided a compounded annual total return of 10.4% from 1900 to 2000 which was made up of 5% in dividend yield, 4.8% from earnings growth and just 0.6% due to change in the PE ratio (John Bogle of Vanguard). One can see that dividend yield made up the highest portion in the total return. The important question is, “Is a company which pays high dividend a more attractive investment ?”

Let’s look at a high dividend stock in Bursa and its total return over the last 5 years, my favorite, Pintaras Jaya, a specialist foundation construction company as shown in Table 1 below.

Table 1: Return of share price from 2008 to 2013

Period 1 year 2-year 3 year 4 year 5 year

Dividend, sen 19 15 10 12 10

Adj. Price, RM 2.80 2.35 1.60 1.20 1.40

Total return 72.1% 105.1% 201.3% 301.7% 244.3%

CAR 72.1% 43.2% 44.4% 41.6% 28.1%

Dividend yield 6.8% 6.4% 6.3% 10.0% 7.1%

Capital gain 65.4% 36.8% 38.2% 31.6% 20.9%

Share price of Pintaras Jaya at the close on 7/6/2013 is RM4.82

CAR is compounded annual rate of return

Pintaras has been paying dividend which has been growing from 10 sen in 2008 to 19 sen in 2012. The average dividend yield through the years is about 7.3%, which is one of the highest dividend yield companies in Bursa. It has been providing a total return of 244% since 5 years ago which works out to be a CAGR of 28%, about 3 times the annual return of KLCI. The CAGR of its return are even more impressive in the order of more than 40% for the last 2-4 years, and 72% for the past one year. So does it prove that a high dividend stock would provide a higher total return? Not necessary.

Let us look at some other high dividend companies from Bursa as shown in Table 2 below.

Table 2: Some high dividend yield stocks

Price 1 year Dividend Price now DY Cap gain Total gain

HB Global 0.550 0.038 0.155 6.9% -71.8% -64.9%

JCY 1.500 0.09 0.59 6.0% -60.7% -54.7%

MEGB 1.08 0.0558 0.545 5.2% -49.5% -44.4%

If you have bought some of the stocks above a year ago because they give high dividend yield, you would have lost quite a lot of money of up to 50% or more if you were to sell them now.

Of course we can’t just pick a few stocks and prove that a high dividend yield stock will provide investors with higher or lower return like that. Research studies in the US market concluded that while raw returns from buying the top dividend paying stocks is higher than the index, adjusting for risk and taxes eliminates all the excess return. (McQueen, Shields and Thorley, 1997, Does the Dow-10 Investment Strategy beat the Dow statistically and economically?; Hirschey 2000, The “Dogs of the Dow” Myth).

High dividend payment may not be good for the company if there is inadequate normalized earnings and free cash flows. It is especially so if there is none excess cash in its balance sheet. This dividend payment is hence unsustainable as the company has to borrow or issues new shares in order to pay dividend. Paying too much dividend also negatively affect growth as less money is spent on capital expenses for the growth of the business in the future.

However investing in high dividend stocks is still a viable strategy with the following checks:

1. Dividend yields exceed the bank fixed interest rate, currently about 3.5%.

2. Dividend payout ratio should be less than a cut-off, say 65-80% to have growth

3. Reasonable growth rate in earnings at least matches the overall economy, say >4%.

Do you have such a company in mind for this high dividend yield strategy? Please share.