HedgeChatter Can Social Media Analytics predict stock market price

Post on: 16 Март, 2015 No Comment

Previous post

Next post

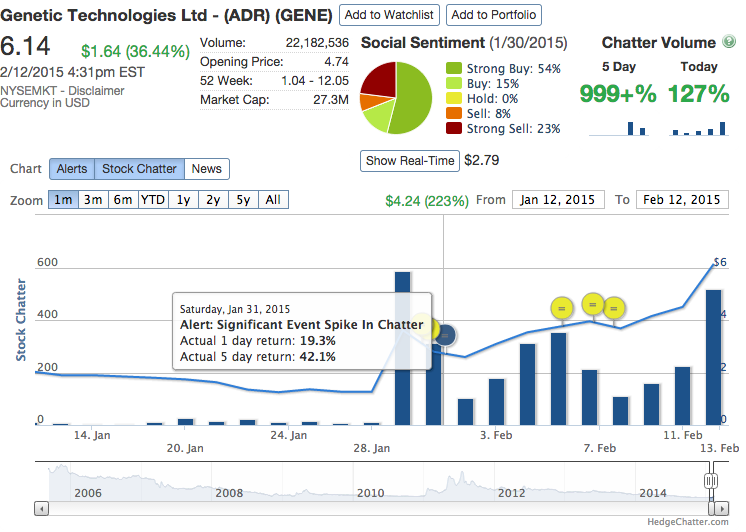

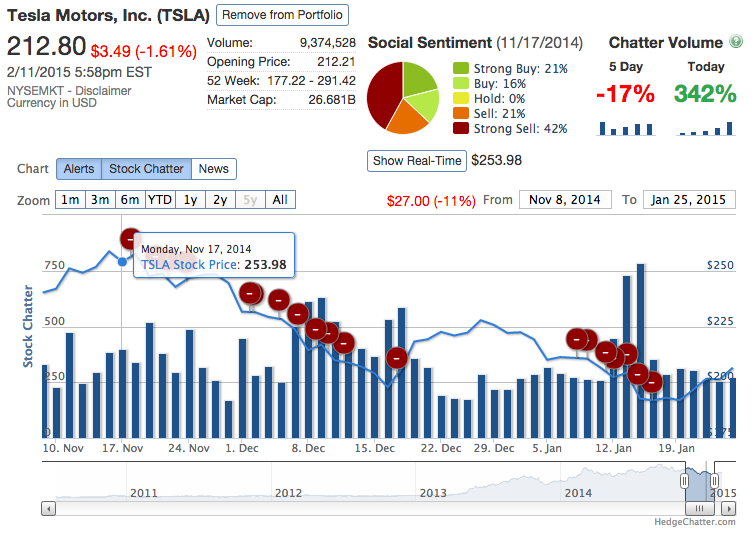

HedgeChatter has launched an online SaaS dashboard that allows investors, traders and hedge funds to see how key influencers on social media are affecting stock price and view price trends based on real-time social media data (chatter).

Guest post by Prasad Kothari, Oct 15, 2013.

Gregory Piatetsky, Editor: See also my interview on a similar topic with Social Market Analytics founder Joe Gits about using Twitter Sentiment for Investments. and their secret sauce which makes their platform effective, May 2013.

KDnuggets does not have financial interest in HedgeChatter or Social Market Analytics.

Knowing what information is important when making investment is imperative, but deciding what’s important is what separates successful investors from the average. Startup HedgeChatter is an online service that allows any investor real time analytics based on what’s being discussed on social media regarding investment.

There’s enough social media chatter discussing investment that can influence stock behavior including price and potential profit. Not only is this data clearly shown through HedgeChatter, but it also shows who those important people are.

HedgeChatter processes nearly 1.8 million financial chatter messages every day from Twitter and other leading social channels. These messages are filtered for noise reduction, manipulation detection and price-to-message correlation, resulting in predictive alerts for stock direction.

HedgeChatter is different from other social analytics firms by correlating multiple social media financial metrics and displaying the information visually. Many of the platform’s functionalities are available free to users at hedgefund.hedgechatter.com .

Hedge funds, wealth management firms and high-net-worth individuals have begun looking for ways to incorporate social media’s impact on stock price into their overall trading strategies. There is huge demand to capitalise on this lucrative insight. The current competition offers services to just see trends in the volume of social chatter, which is only where HedgeChatter begins, says HedgeChatter chief executive James Ross.

HedgeChatter Reputation Index Engine

HedgeChatter mines financial chatter from a multitude of sources across the web and continuously runs algorithms to determine who is predicting correctly, how often, who’s trying to manipulate, who’s being followed and by how many. These behavior elements are factored into the overall Reputation Index Engine and the Social Media Financial Buy Signals.

The company completed beta testing with multiple hedge funds and financial advisors with USD500m to USD2bn in assets under management.

Prasad Kothari is experienced analytics professional. He worked extensively with clients such as Merck, Sanofi Aventis, Freddie Mac, Fractal Analytics, US Government and NIH on various social media and analytics projects. He has also written books on social media analytics. You can contact him at prasadkothari74@gmail.com or +91-720-811-5292.