Hedge Funds The Long And Short Of It Business Barbados

Post on: 24 Июнь, 2015 No Comment

10 November 2007

The global hedge fund industry has experienced tremendous growth in recent years. Hedge Fund Research Inc. estimated that there were over US$1.4 trillion in assets under management and 9,462 active hedge funds as of December 2006.

In recent years, investors have been seeking an alternative to traditional fixed income and equity investments. Traditional fixed income and equity investments usually rise and fall with the market. If the market falls precipitously, then it is difficult for portfolio managers to add enough value with their stock selection skill to overcome the negative impact of the market. Traditional investments have a high “beta†or correlation to the markets. Investors are now seeking returns in excess of the market. The return in excess of the market is known as “alpha†or investment skill.

When compared with a portfolio of long-only equities and bonds, the power of hedge funds lies in their potential to increase returns while reducing risk. This is possible because hedge fund strategies can give an investor exposure to a broader set of return drivers than those of traditional asset classes. Exposure to hedge fund strategies can result in portfolios that have the potential to generate strong returns but that do not have a high correlation or beta to equity and bond markets.

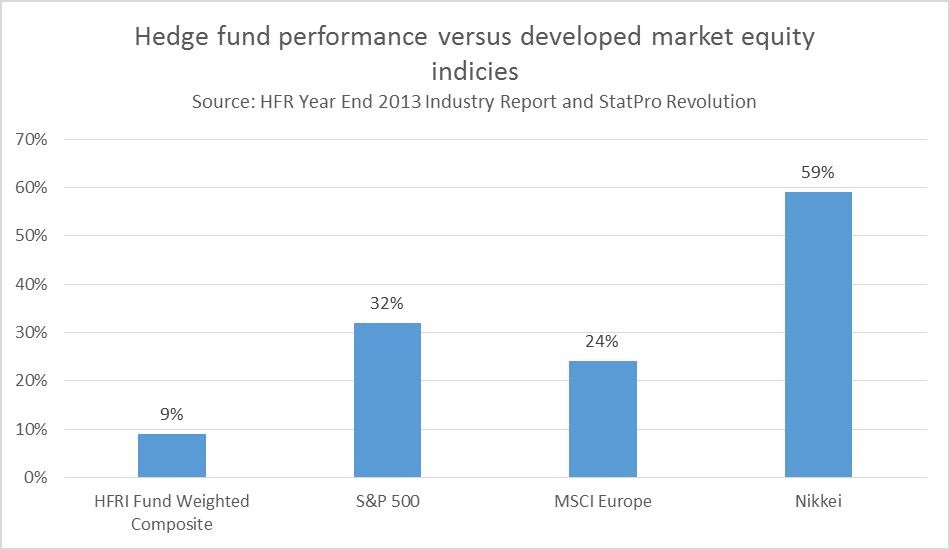

The key to hedge fund investing is to diversify the sources of active risk taken while ensuring consistently high quality managers. Hedge fund of funds are an efficient way for an investor to achieve this degree of diversification and gain access to top managers. This allows for consistent returns and capital preservation. Evidence of this success in hedge funds strategies can be seen through various hedge fund industry indices. The CSFB/Tremont Hedge Fund Index gained an annualized return of 10.33% for the 10-year period June 1, 1998 through May 31, 2007. By comparison, the S&P 500 had an annualized return of 7.78% and the MSCI World 8.10%. This clearly demonstrates that hedge funds can produce returns in line with equity markets over the long term. Over the period September 1, 2000 through September 30, 2002, the S&P 500 experienced a peak-to-trough drawdown of 44.73%. By comparison the CSFB/Tremont Hedge Fund Index gained a total return of 5.31% over the same period. Thus, hedge funds have shown the ability to preserve capital during a bear market.

A common misconception about hedge funds is that they are risky investment vehicles. While there can be risk involved in any investment, hedge fund strategies range from conservative market neutral strategies to more opportunistic strategies. Market neutral or relative value strategies typically have low market exposure thereby reducing the impact of sharp market moves. Market neutral strategies include equity market neutral, convertible arbitrage, fixed income arbitrage and Mortgage Backed Securities (MBS) arbitrage. Event driven strategies typically involve a corporate event and therefore profits are not driven by the market. Event driven strategies involve merger arbitrage, special situations and distressed securities investing. Directional or opportunistic strategies can have high market exposure as directional positions involving various asset classes may be taken. Directional strategies include macro, managed futures, fundamental long/short, short selling and emerging markets.

Market neutral is an investment strategy that aims to produce positive returns regardless of market direction, often by taking a combination of long and short positions. Returns generated by a market neutral portfolio are typically uncorrelated to equity and bond markets.

Equity long/short strategies take (partially) offsetting long and short positions in the common stock of different issuers.

The objective is to be long the stock likely to outperform and short the stock likely to underperform while being largely protected against overall equity market movements.

Equity long/short strategies range from those that are purely market neutral, such as statistical arbitrage and quantitative equity long/short, to fundamental long/short which typically has net market exposure. In addition to being market neutral, these strategies will typically be country, sector and industry neutral so that they have minimal exposures to systematic market risk. As their name suggests, fundamental equity long/short strategies involve fundamental analysis of equities to build a portfolio of equities held both long and short. Fundamental long/short equity hedge funds typically have a net exposure to the market. They aim to capture a majority of the upside market movements and limit exposure to the downside.

Statistical arbitrage utilizes quantitative computer models to select stocks and measure market exposure to construct long/short equity portfolios. Equities are held both long and short in relative quantities designed to result in an aggregate portfolio that is neutral to broad equity market movements. Model input often includes fundamental balance sheet and income statement data such as: earnings yield, dividend yield, revisions in earnings forecasts, relationship between market capitalization, revenues and net asset values, earnings forecasts, and historical prices. The quantitative models monitor market exposure and manage risk across sectors, investment style and market capitalization.

This strategy primarily involves taking long positions in convertible bonds or warrants, hedged with a short position in the underlying stock. Many convertible arbitrageurs also hedge for credit, volatility and interest rate risk. In many cases, convertible bonds and warrants are not accurately priced due to illiquidity in the convertible debt and warrant markets as compared to the markets in the underlying common stocks, uncertainty concerning the call or redemption features of convertible securities and lesser market focus on these derivatives as opposed to the equities into which they are convertible or exercisable. These mispricings may give rise to significant profit opportunities.

Fixed income arbitrage attempts to capture mispricings, which develop between related classes of fixed-income securities. Relative value trades are structured among government bonds, corporate bonds, interest rate swaps and interest rate futures to name a few classes of securities. A high degree of leverage is often implemented in fixed income arbitrage.

The yield on mortgage backed securities (MBSs) is typically higher than that of comparable maturity U.S. Treasury notes or bonds, in large part as a result of the premium associated with the prepayment risk imbedded in mortgage securities. MBS arbitrageurs hold long and short MBSs while attempting to hedge interest rate, prepayment and other risks. Hedging strategies are based on modeling prepayment experience. Substantial profits may be realized if the hedge fund manager is able to purchase undervalued securities and hedge properly against interest rate, prepayment and other risks.

Event driven arbitrage is a broad category that includes merger arbitrage, special situations and distressed securities investing. Event driven strategies involve investments, long or short, in the securities of corporations undergoing major corporate restructurings (e.g. mergers, spin-offs, liquidations and bankruptcies). Profits can be generated when managers correctly analyze the impact of the anticipated corporate event, predict the course of restructuring and take positions accordingly.

Merger arbitrage seeks to profit by buying securities that are discounted from the value to be paid for them in a proposed merger or acquisition due to the uncertainty of transaction timing and completion. A typical merger arbitrage position involves purchasing of shares of the target and shorting shares of the acquirer in a ratio similar to the merger terms.

Distressed securities investing involves investments secured by identifiable collateral including cash, accounts receivable, inventory, fixed assets and real estate. Investment typically occurs in the most senior tranches of the capital structure of a corporation, i.e. those that will receive priority distributions in a restructuring. These tranches typically receive cash and/or new debt in a restructuring, thereby limiting stock market risk. In the case of liquidation, capital is protected by securing the debt with collateral, which is often a multiple of the value of the debt.

Multi strategy hedge funds have the flexibility to invest in a broad range of arbitrage strategies. Hedge fund managers opportunistically allocate capital across various strategies based on their assessment of the relative risk/reward opportunities.

In summary, hedge funds have become an important part of the investment industry. Forward thinking private banks are providing their clients with access to quality hedge fund products. Those prescient enough to offer hedge funds before 2001 were able to offer clients capital preservation during the bear market. One of the most compelling reasons to allocate to fund of funds is the ability of various strategies to perform better and earn absolute returns over the course of the business cycle. For example, merger arbitrage performs best during the boom stage of the economic cycle. Distressed securities provide good investment opportunities set during recessions. Hedge funds can provide absolute returns and capital preservation, increase portfolio diversification, and allow access to top financial talent.