Greenspan Slept as OffBooks Debt Escaped Scrutiny (Update1)

Post on: 2 Июль, 2015 No Comment

Greenspan speaks during a television interview

Oct. 30 (Bloomberg) — As George Miller welcomed 60 bankers to the chandeliered Charlotte City Club one evening in September, the focus was on more than the recent bankruptcy of Lehman Brothers Holdings Inc. From their 31st-floor perch, members of the American Securitization Forum. which Miller leads, fretted about the future of their $10.7 trillion industry.

The bankers were warned that a Financial Accounting Standards Board plan would force trillions of dollars back onto balance sheets, requiring cash reserves to soar. Their business of pooling and reselling assets had dropped 47 percent in the first six months of the year, and the industry couldnt afford another setback.

The next day, Miller, 39, the forums executive director, took that message from North Carolina to a Senate hearing in Washington examining the buildup of off-balance-sheet assets. «There are great risks to the financial markets and to the economy of moving forward quickly with bad rules, he said of FASBs proposal.

Miller was trying to preserve an accounting rule for off-the-books assets that helped U.S. banks export toxic debt around the world. It is a loophole that Jack Reed. the Rhode Island Democrat who chairs the Senate securities subcommittee, said had contributed «to the severity of the current crisis.

The damage to date: more than $680 billion dollars in losses and writedowns, about one-third of that by European banks.

Unregulated Derivatives

Efforts by lobbyists have delayed FASB decisions and kept key parts of the American financial system beyond the reach of regulators. Their victories included ensuring that over-the-counter derivatives stayed unregulated and persuading the Securities and Exchange Commission to let investment banks broker-dealer units reduce capital requirements. That allowed them to increase borrowing and magnify profits. Bank watchdogs also didnt move to tighten mortgage-industry standards until after the collapse of the subprime market.

Today, a road snakes from the foreclosed homes of California and Ohio to the capital cities of Europe, where politicians and bankers have struggled to contain a widening credit crisis by pumping hundreds of billions of euros into the financial system. The road was paved with decisions like ones by FASB that allowed banks to keep shifting assets into blind spots outside the view of shareholders and industry overseers.

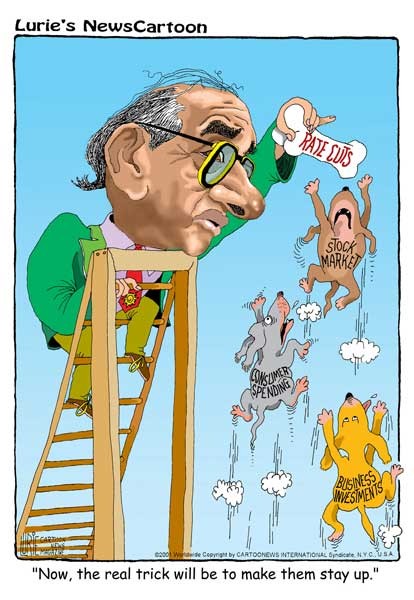

`Magic Trick

«Ive always regarded it as a bit of a magic trick, Pauline Wallace, a partner at PriceWaterhouseCoopers LLP and team leader in London for financial instruments, said of off-balance-sheet accounting. «Magicians come to parties, and they make things seem to disappear. The risk is somewhere, but you never knew where.

Pushed by taxpayers angry about financing a bailout of Wall Street while their retirement accounts wither, Congress is likely to shake up bank and securities regulation, giving the Federal Reserve more power.

«I wouldnt be surprised if the Fed ends up officially becoming our systemic-risk regulator, said Robert Litan. an economist at the Brookings Institution in Washington.

Thats ironic to Donald Young, an investor advocate and FASB board member from 2005 until June 30. He testified at the same Senate hearing on Sept. 18 that both the Fed and the SEC joined the banks they oversaw in resisting proposals for more disclosure of off-the-books assets.

«There was an unending lobbying of FASB by companies and regulators, Young told the committee.

`Lack of Transparency

The former FASB board member made a similar point in a June 26 letter to Senator Reed. «We lacked the ability to overcome the lobbying efforts that effectively argued that if we made substantive changes we would hamper the credit markets and hurt business, Young wrote. «Our inaction did not hamper credit markets — it helped to destroy them.

The issue, Young said in an interview, was the «lack of transparency that comes with off-the-books accounting.

«There is a perceived free lunch that they can take on risk and not reflect it, and make things look better than they are, he said. «That encourages them to do it more and more.

A spokesman for FASB, Neal McGarity. said in an e-mail that Young voted with the majority of the board in a January 2005 decision to expand the use of an off-balance-sheet vehicle.

UBS Writedowns

Regulators outside the U.S. didnt do a good job policing investments in subprime-mortgage assets either. Zurich-based UBS AG, hurt the most in Europe with writedowns and losses totaling $44 billion, told the Swiss Federal Banking Commission early last year that it was «fully hedged, yes, even overhedged, director Daniel Zuberbuehler said at a press conference in April.

«This answer subsequently proved to be wrong, because UBS did not correctly capture its actual risk exposure and seriously overestimated its hedges, Zuberbuehler said. The Swiss commission now says it will force the bank to hold more capital in reserve and is negotiating with UBS over new capital requirements.

An International Monetary Fund report in April described how the housing turmoil in the U.S. «spread quickly to Europe, prompting bank rescues and capital injections. It said that as of March, European banks still had $173 billion in subprime mortgage-backed securities and collateralized debt obligations, about the same amount as U.S. banks.

The accounting standards board, housed in a corporate office park in Norwalk, Connecticut, an hour northeast of New York City, operates in an unusual position between the public and private sectors. It was set up in 1973 as an independent rulemaking group, though the SEC gets a say in who is named to the board and can override its rules.

FASB Rules

For the past decade, FASB has been wrestling with how to account for off-balance-sheet assets, which include the majority of securitized financial products. In a securitization, a company pools loans such as mortgages and credit card receivables, slices them into securities and sells them to investors, usually through a separate trust.

The process allows the originating company or bank to get cash up front, while investors are paid off with the consumers monthly payments. The issuer can also record profit from the sale to the trust and take the loans off its balance sheet. That reduces the amount of capital required as a buffer against losses, letting the company increase lending and boost earnings.

Citigroup Inc. reported that it had $1.18 trillion in off-balance-sheet holdings as of June 30, including $828.3 billion in qualified special purpose entities, or QSPEs, a type of trust that is supposed to be beyond a lenders control.

SIVs, QSPEs

Banks also created off-balance-sheet entities known as structured investment vehicles, or SIVs, that were marketed to outside investors. SIVs purchased many of the mortgage-backed notes issued by QSPEs, either directly or through other structures called collateralized debt obligations.

Securitization accelerated in the mid-1990s. The total amount of mortgage-backed securities issued almost tripled between 1996 and 2007, to $7.27 trillion, according to the Securities Industry and Financial Markets Association, or SIFMA.

Ten years ago, Wall Street was enjoying a bull market fed by a booming dot-com industry, a Fed chairman, Alan Greenspan. who trusted the market to correct its own ills, and a Congress amenable to lightening the touch of regulators.

In 1998, the imminent collapse of hedge fund Long-Term Capital Management forced the Fed to organize a bailout by Wall Street. Investment banks had loaned the fund billions and were among counterparties in more than $1 trillion in derivative contracts used to hedge investment risks.

Greenspan, Rubin

That same year Greenspan, Treasury Secretary Robert Rubin and SEC Chairman Arthur Levitt opposed an attempt by Brooksley Born. head of the Commodity Futures Trading Commission, to study regulating over-the-counter derivatives. In 2000, Congress passed a law keeping them unregulated.

Levitt said he went along with concerns by Greenspan and Rubin that Borns action might throw derivatives contracts into «legal uncertainty. He said he now regrets that he didnt press a presidential advisory group «to take a closer look at the issue. Rubin said in an interview that «you could have had chaos if Borns plan found existing derivatives contracts invalid because they werent traded on an exchange. Both Born and Greenspan declined to comment.

Outstanding credit-default swaps, derivative contracts used to hedge or speculate on a companys debt, would grow to $62 trillion from $631 billion in 2001. While the swaps spread risk, as intended, they also helped spread fear. Ninety percent of the trades were concentrated in the hands of 17 banks, according to the Federal Reserve Bank of New York. That left them exposed to losses if one failed, as Lehman Brothers did in September, and contributed to the unwillingness to lend to each other thats at the center of the recent credit squeeze.

3 Percent Rule

FASB had issued off-balance-sheet accounting standards in June 1996 to deal with the growth in securitizations. They were replaced in 2000 by FAS 140, which required more disclosures and rules for dealing with collateral.

Companies were allowed to push an entity off their books if an outside party put up as little as 3 percent of the capital. Houston-based Enron Corp. declared bankruptcy in late 2001 when it was forced to put trusts back on its balance sheet because it hadnt met the 3 percent rule.

The Enron scandal put pressure on FASB to make it harder for companies to keep assets hidden. In January 2003, it proposed a new rule, known as FIN 46, which increased the outside-party requirement to 10 percent.

`Bill of Goods

Banks went on the offensive. The rule «was developed in a rush, the American Bankers Association wrote in a letter to FASB that July. That same month Robert Traficanti. deputy controller of Citigroup, wrote that the proposed change would have a «significant impact, forcing the lender to move the entities to the balance sheet and raise more capital.

In December 2003, FASB published FIN 46R, a revision that gave the banks more flexibility to keep off the books investment vehicles they managed for a fee.

Banks have lobbied on the issue since at least the early 1980s, said Timothy Lucas. who was at the FASB for more than two decades starting in 1979.

«I think we were sold a bill of goods by banks on some off-the-books structures, Lucas said.

In 2004, the SEC allowed the biggest securities firms — Goldman Sachs Group Inc. Morgan Stanley, Merrill Lynch & Co. Lehman and Bear Stearns Cos. — to set up a system giving the commission oversight of the investment banks holding companies, rather than just their brokerage units, as had been the case.

Increased Leverage

With the change, approved in April that year, the Wall Street firms avoided having their operations in Europe regulated by the European Union. They were also able to reduce the amount of cash their broker-dealer units had to set aside as a cushion against unexpected losses by as much as 30 percent, Annette Nazareth. then head of the SECs market-regulation staff, said in an interview. Nazareth, who later became an SEC commissioner, is now a partner at New York law firm Davis Polk & Wardwell.

That allowed the banks to increase their leverage, the ratio of borrowed funds to each dollar of equity capital held, and to invest even more heavily in subprime-related securities. Bear Stearns increased its leverage to 33.5-to-1 after the rule change from 26.4-to-1.

The continued delays and revisions of FASBs off-balance-sheet rules let financial institutions keep the scope of their assets from public view.

In May 2007, after the subprime mortgage crisis began to unfold, the accounting board proposed abolishing QSPEs altogether. It approved the move this April.

`Time Bombs

Under FAS 140, entities are allowed to be kept off the books only if their activities are beyond the control of the sponsor. The problem, FASB Chairman Robert Herz said in a Sept. 18 speech in New York, was that the QSPE concept was «stretched by the addition of subprime loans, which require «active management and large-scale restructuring by the lender.

«We now know with hindsight that some of these entities, treated as Qs for accounting purposes, were effectively ticking time bombs, Herz said, referring to rising subprime defaults. «And the bombs started to explode.

Switching metaphors, he added: «Unfortunately, it seems that some folks used Qs like a punch bowl to get off-balance-sheet treatment while spiking the punch. That has led us to conclude that now its time to take away the punch bowl.

In July, FASB decided to keep the bowl on the table a little longer, postponing by a year the effective date of the changes, to Nov. 15, 2009. The decision came after major banks, a member of Congress, Millers securities association and other trade groups complained that the board was moving too fast and that the results would be confusing for investors.

`Intense Pressure

FASB was «under intense pressure from industry, Alan Blinder. a former Federal Reserve Board vice chairman and now a Princeton University professor, said in an interview.

«Its fair to say that the industry and the regulatory community alike failed to look through the off-balance-sheet entities with a skeptical eye and see the extent of what they might be on the hook for in a bad-case scenario, Blinder said.

That view is shared by Susan Bies. a Federal Reserve Board governor from 2001 to 2007.

«The No. 1 reason were in this crisis is the deterioration of underwriting of mortgage loans, Bies said. «What has made it worse is the lack of transparency in disclosures of the exact nature of assets both on and off the books. We need a clearer description of what potential exposures are out there.

Miller said in an interview that the securitization industry got a bad rap from the Enron bankruptcy and that equating off-the-books entities with «fraud or abuse is «clearly an over-generalization.

Greenspan Blasted

At hearings in Congress last week, financial experts and industry groups urged House and Senate committees to consider changes, including a regulator with overall authority to protect the system from risk. T. Timothy Ryan. SIFMA president, and Steve Bartlett. president of the Financial Services Roundtable, both supported the idea of a clearinghouse for credit-default swaps at an Oct. 21 House hearing. The clearinghouse would help ensure payment if counterparties failed to manage risk.

Two days later, Greenspan was blasted at another House hearing for failing to curb the growth of subprime-mortgage loans. He came out in favor of new rules requiring issuers of securitized assets to «retain a meaningful part of the securities they issue.

Barney Frank. chairman of the House Financial Services Committee, said in a speech in Boston on Oct. 27 that he is also in favor of rules «to contain the excesses of this great innovation of securitization.

Others took a more global view.

«We exported our toxic mortgages abroad, Joseph Stiglitz. a professor of economics at Columbia University and a Nobel Prize winner, said at the Oct. 21 House hearing. «Had we not, the problems here at home would have been even worse.

(Wall Streets Toxic Exports: Part 4 of 4.)