Great Rotation Sector Rotation Ignore Catchphrases When Selecting Your ETFs

Post on: 8 Май, 2015 No Comment

Great Rotation? Sector Rotation? Ignore Catchphrases When Selecting Your ETFs

There are moments when the media will grab hold of a terrific sound byte and refuse to let go. For example, some blame the recent weakness on yield-oriented assets investment grade bonds, high yield bonds, convertibles, preferreds, REITs, defensive dividend stocks on a mythical Great Rotation. The popular catchphrase describes a circumstance whereby investors exit bonds for the sunnier shores of high-powered equities.

With the stock markets recent surge to all-time highs, doesnt the Great Rotation have to be real? Hardly. Bill Gross of PIMCO fame recently stated that stocks and bonds have become highly correlated such that both asset classes gain in price or both lose in price. And then theres the data itself. During the first quarter of 2013, $69 billion poured into bond funds. Stock funds? Only $19 billion.

In truth, stocks surpassed even the most bullish expectations in the first 5 months of 2013 because institutional money pensions, registered investment advisers, hedge funds needed alternatives to lower-yielding treasuries. Retail investors have sat on cash rather than dive headlong into stocks; the asset allocation to equities remains historically low.

Bullish prognosticators remain convinced that the sidelined money will eventually enter the marketplace, pushing stock indexes to extraordinary heights. They are citing the University of Michigans consumer sentiment reading as well as the Conference Boards Consumer Confidence Index as evidence that the economy is strengthening; both gauges hit levels not seen in 5+ years.

Unfortunately, these measures tend to be highest at stock market tops and lowest at stock market bottoms. Indeed, these indicators might even be less beneficial than looking in the rear view mirror. At least when one looks in the rear-view, one has an opportunity to avoid smashing into another vehicle.

No, I am not predicting catastrophe. What I am doing, however, is explaining that the U.S. markets current direction has little to do with a Great Rotation or a strong domestic economy. A portfolio that is heavy on stocks will continue smelling like roses or start to smell like dog waste, depending on what the U.S. Federal Reserve is able to do in its containment of interest rates.

Simply put, the last few weeks of market volatility have been driven by a singular concern; that is, will the Fed slowly begin tapering its bond purchases? The mere suggestion by Fed officials that they may begin the process of winding up the program has led to a rapid run-up in the 10-year to 2.15%.

In turn, every yield-sensitive ETF asset in the 10-years wake has experienced greater pain than non-income producers:

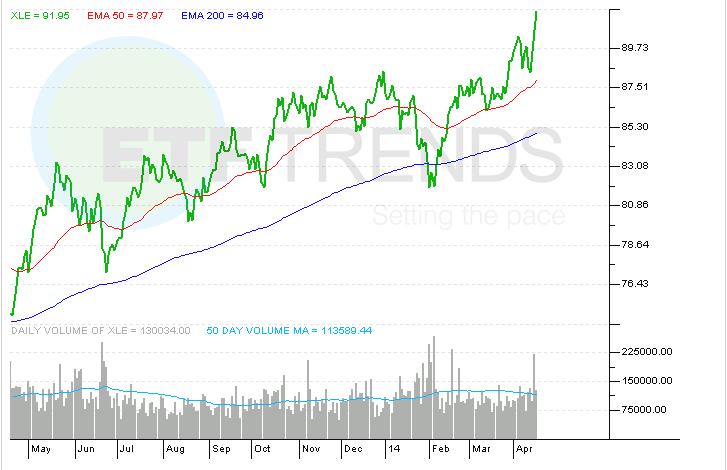

Higher-Yielding ETFs Feel The 10-Years Sting