Great BigCap Stocks Retail Boosts IBD Big Cap 20

Post on: 17 Июль, 2015 No Comment

R etail and consumer stocks, IBD research has found, have contributed mightily to the pantheon of great stock market leaders.

Home Depot (NYSE:HD ) was a shooting star soon after it went public on Sept. 29, 1981. In March 1982, the stock broke out of a seven-week flat base and cruised 951% in only 15 months.

Before Home Depot came fast-growing companies such as Levitz Furniture in 1970, Wal-Mart (NYSE:WMT ) and Walt Disney (NYSE:DIS ). Despite growing into the billions of dollars in market cap, a big retail chain or goods maker can still post strong growth and solid price runs.

Keep these historical examples in mind as you scour the Big Cap 20 list, both today and in recent weeks.

A stock on the weekly Big Cap 20 might not have the same level of exciting triple-digit EPS and sales growth that may show up in stocks that top the IBD 50 or Friday’s Your Weekly Review. Yet, if you buy a large-cap stock correctly and the stock not only rises decently but also furnishes new follow-on entry points, you get the golden opportunity to add to your winning position and experience the power of compounding gains.

The point: When you are right, be right in a big way.

You’re not going to make a very satisfying gain if you own just 50 or 100 shares in a stock that rises 50% or more.

In a solid market uptrend, even among those stocks that carry at least $15 billion in terms of market valuation, consult a weekly and daily chart frequently to find moments in which you may be able to pyramid your position.

Chipotle Mexican Grill (NYSE:CMG ), which ranked No. 4 in the Jan. 27 list, meets the ‘N’ in CAN SLIM by truly redefining what it means to be successful in the fast-food space.

Sure, the burrito and taco chain would likely prefer to be called a fast casual eatery. But in reality, Chipotle has captured consumers’ desire for higher-quality ingredients that are more responsibly sourced. The cost of dinner or lunch is comparable with its rivals, including McDonald’s (NYSE:MCD ) or Taco Bell, yet Chipotle has proved able to grow its profits at a higher rate.

After-tax margin at Chipotle has risen from 9.2% to 10.5% to 12.1% in the first three quarters of 2014. McDonald’s, ironically has a higher net margin (18.0%, 19.3%, 15.3% and 16.7% in the four quarters of 2014), but these numbers are down from recent years.

Chipotle also sports an A for SMR Rating. reflecting excellent return on equity and sales growth. It reports Q4 results Tuesday. McDonald’s scores a B.

Monster Beverage (NASDAQ:MNST ) ranked No. 13 in the Jan. 13 edition and No. 18 last week. The energy drink, soda and juice giant has been getting big cash infusions from Coca-Cola (NYSE:KO ) to help grow the business. In August, Coke said it would take a 16.7% stake in the company.

R etail and consumer stocks, IBD research has found, have contributed mightily to the pantheon of great stock market leaders.

Home Depot (NYSE:HD ) was a shooting star soon after it went public on Sept. 29, 1981. In March 1982, the stock broke out of a seven-week flat base and cruised 951% in only 15 months.

Before Home Depot came fast-growing companies such as Levitz Furniture in 1970, Wal-Mart (NYSE:WMT ) and Walt Disney (NYSE:DIS ). Despite growing into the billions of dollars in market cap, a big retail chain or goods maker can still post strong growth and solid price runs.

Keep these historical examples in mind as you scour the Big Cap 20 list, both today and in recent weeks.

A stock on the weekly Big Cap 20 might not have the same level of exciting triple-digit EPS and sales growth that may show up in stocks that top the IBD 50 or Friday’s Your Weekly Review. Yet, if you buy a large-cap stock correctly and the stock not only rises decently but also furnishes new follow-on entry points, you get the golden opportunity to add to your winning position and experience the power of compounding gains.

The point: When you are right, be right in a big way.

You’re not going to make a very satisfying gain if you own just 50 or 100 shares in a stock that rises 50% or more.

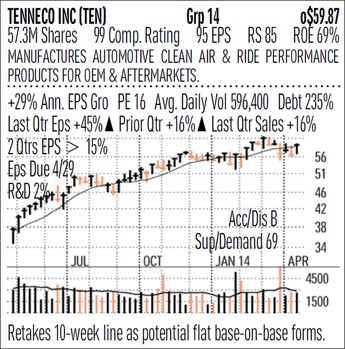

In a solid market uptrend, even among those stocks that carry at least $15 billion in terms of market valuation, consult a weekly and daily chart frequently to find moments in which you may be able to pyramid your position.

Chipotle Mexican Grill (NYSE:CMG ), which ranked No. 4 in the Jan. 27 list, meets the ‘N’ in CAN SLIM by truly redefining what it means to be successful in the fast-food space.

Sure, the burrito and taco chain would likely prefer to be called a fast casual eatery. But in reality, Chipotle has captured consumers’ desire for higher-quality ingredients that are more responsibly sourced. The cost of dinner or lunch is comparable with its rivals, including McDonald’s (NYSE:MCD ) or Taco Bell, yet Chipotle has proved able to grow its profits at a higher rate.

After-tax margin at Chipotle has risen from 9.2% to 10.5% to 12.1% in the first three quarters of 2014. McDonald’s, ironically has a higher net margin (18.0%, 19.3%, 15.3% and 16.7% in the four quarters of 2014), but these numbers are down from recent years.

Chipotle also sports an A for SMR Rating. reflecting excellent return on equity and sales growth. It reports Q4 results Tuesday. McDonald’s scores a B.

Monster Beverage (NASDAQ:MNST ) ranked No. 13 in the Jan. 13 edition and No. 18 last week. The energy drink, soda and juice giant has been getting big cash infusions from Coca-Cola (NYSE:KO ) to help grow the business. In August, Coke said it would take a 16.7% stake in the company.