Good and Bad Uses of Leverage

Post on: 23 Июнь, 2015 No Comment

Earlier this year, I suggested starting the decade off right by paying off debt. In general, debt is something that should be eliminated. Credit card debt is expensive and often unnecessary, personal loans generally carry a cost to personal relationships as well as interest, and mortgages hang around forever and make you a renter who still must pay for maintenance rather than a true owner.

On the other hand, businesses use debt strategically even when they have cash available, so why cant people? Well, businesses, if operated well, often have teams of well-paid financial analysts who know how to determine whether assuming debt will likely be a profitable solution. You and I have just you and me.

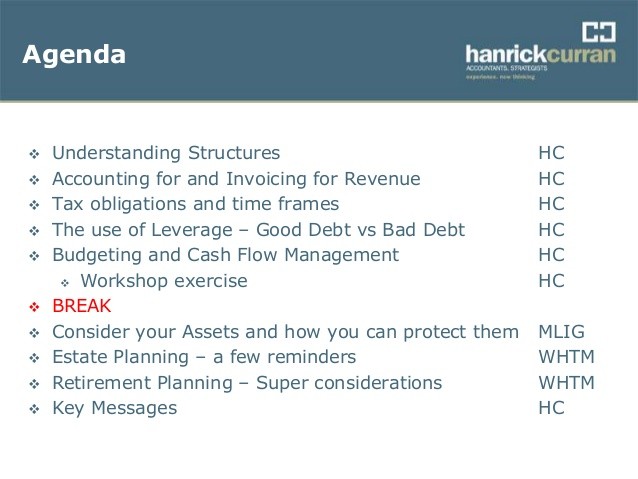

Although I dislike rules of thumb, one that may help in this decision states you should go into debt only to invest in appreciating assets or assets that provide a positive cash flow. This is the crux of the good debt vs. bad debt argument. How do the most typical uses of debt stand up to this rule of thumb?

A car fails the test. The value of a vehicle decreases over time and produces a negative cash flow. You have to pay expenses like maintenance and fuel to operate the vehicle properly. One should not go into debt to buy a car unless absolutely necessary because you will certainly spend more money with a car loan that you would otherwise. A car wont provide you with any income to cover your loan unless youre using your car in business.

A house, however, is a tougher decision. Over long periods of time, houses appreciate at a rate similar to inflation, but they produce negative cash flows (maintenance expenses) just like a car. But many people dont have hundreds of thousands of dollars available in cash when they buy a house, so they are willing to take on the risk of debt.

Student loans are interesting. What are you buying when you pay tuition? Certainly nothing you can photograph like you do when you document your household inventory. Education builds an income-generating asset: your mind and its ability to think and do. An education will help you increase your cash flow because youll be qualified for better jobs and youll likely earn more money. That qualifies as an appreciating asset, so under this rule of thumb, going into debt for an education could be worthwhile.

Buying a house and renting it out might be a good candidate for borrowing. By making some assumptions about how much you expect to earn from rent and how much you expect to pay for maintenance expenses, you can use the Net Present Value formula in Excel to determine whether you should proceed with the purchase and what kind of financing you should accept.

Savvy investors use leverage to increase their returns in the stock market. By using borrowed money to buy stocks, traders count on the stocks value increasing so they can pay back the lender with the proceeds and keep the rest. The problem with trading on margin like this is that if the value of the stock decreases, you will have to pay pack the loan with your own money.

In the best case scenario, leverage is used when the returns from the investment cover more than the cost of debt in the form of interest to be paid. This ensures youre making money on your investment above the ability to pay back the loan. Leverage gone wrong can destroy your finances, take down a business, or collapse an economy.

Lexically related: If you havent already, take a look at the television show Leverage on TNT. It has nothing to do with finance, but it is well-written.

Updated January 12, 2012 and originally published June 25, 2010. If you enjoyed this article, subscribe to the RSS feed or receive daily emails. Follow @ConsumerismComm on Twitter and visit our Facebook page for more updates.

3A%2F%2Fwww.consumerismcommentary.com%2Fimages%2Fgravatar.png&r=G /%