Gobbling Up Bulls and Bears

Post on: 3 Июль, 2015 No Comment

Alan Brugler is the President of Brugler Marketing & Management, and the primary analyst and advisor.

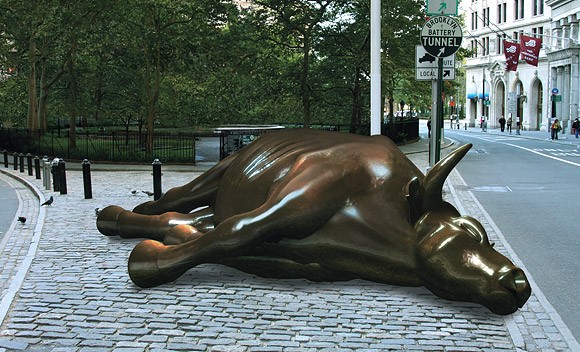

Gobbling Up Bulls and Bears

Nov 28, 2014

Market Watch with Alan Brugler

November 28, 2014

Gobbling Up The Bulls and Bears

Holiday markets are notoriously difficult to trade, whether you are a hedger or a speculator. Traders are gone, liquidity is lacking. As in football, getting past containment can result in a big move. Friday was such a day in a number of markets. Crude oil futures dropped 9% on an OPEC decision to maintain production levels, which had been well advertised ahead of time. Gold sank $31 per ounce on a strong dollar and apparent month end profit taking. Soybeans lost 31 cents in the nearby January contract despite a strong historical tendency for gains on the day after Thanksgiving. You get the picture. Limited liquidity and big moves. It wasnt all bearish, as the wheat bulls feasted on 5-6% gains for the week and double digit advances on Friday.

Corn ended the week 0.8% higher, a three cent per bushel gain. Net weekly export sales were improved for a third week in a row, to 944,900 MT. The biggest buyer was unknown destinations at 243,200 MT. The cumulative commitments are 49% of the full year USDA forecast. They would typically be 51% by now.It is worth noting that grain sorghum export sales are huge. The net sales were the largest of the marketing year at 461,700 MT this past week. China continues to allow sorghum in as a non-GMO feed alternative, with China buying another 177,500 MT. This is kind of sneaky feed grain demand but means corn will be fed somewhere else instead of sorghum. Corn consumption for ethanol use also hit the highest level of the year this week.

Soybean futures were down 2.2% for the week, due entirely to a meltdown on thin volume on Friday. Weekly soybean export sales were much larger than expected at 1.485 MMT (54.56 million bushels). Cumulative export commitments have already reached 83% of the current USDA forecast for the full year. They would typically be 73%, strongly suggesting an upward revision in the export number for the December WASDE report. Fundamentally speaking, the sell off on Friday was due to net negative weekly export sales in soybean meal, with cancellations of 22,300 MT. That said, meal export shipments this past week of 417,301 MT were the largest weekly total since April 1998 (excluding the multi-week lump from the government shutdown). Meal export commitments are 56% of the full year forecast, ahead of the 49% average for this date.

Wheat futures were sharply higher on all three markets, with Minneapolis the strongest with a 6.6% weekly gain. US weekly export sales were an improved 496,500 MT. Total commitments (shipped plus outstanding sales) are 66% of the USDA forecast for the year. The five year average for this date is 67%, so essentially we are on pace for the drop expected by the World Outlook Board in the monthly WASDE report. The EU continues to aggressively export wheat, with export licenses appoved for the year to date at 12 MMT vs. 11.2 MMT a year ago at this time. The bull story comes mostly from projections that 2015/16 world wheat production could be 20-25 MMT smaller than this year. The IGC did cut world 2014/15 production by 1 MMT in their latest update.

Dec Cotton futures were up 2% for the week after plunging to multi-year lows the preceding week. The weekly AWP is 46.09, resulting in a rise in LDP/MLG payments to 5.91cents per pound for any cash cotton sold by Thursday.The US dollar was sharply higher on Friday. The lower cash cotton prices facilitated by the LDP are boosting cotton exports, with commitments already at 71% of the forecast for the year. They would typically be 69%.