Global Money Market Rates

Post on: 21 Август, 2015 No Comment

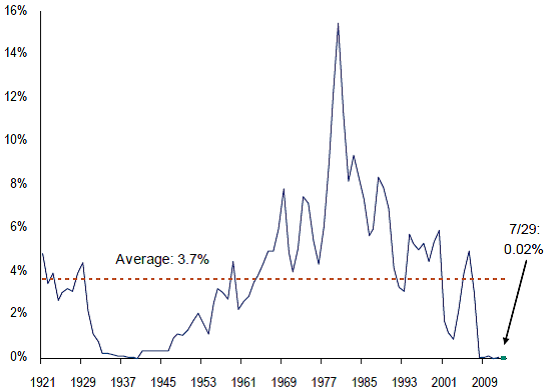

Global money market rates differ dramatically depending on various factors, including underlying economic fundamentals and confidence in monetary policy. Attractive real rates tend to be related with positive near-term currency strength and are often the result of economic growth and monetary stability. Investing in foreign money markets with high real yields can add yield enhancement in addition to diversification benefits. The chart below uses Global 1-Month Deposit Rates to present the range of yield opportunities available to Global Investment Managers.

Although WisdomTree Currency Funds invest in very short-term, investment grade instruments, the funds are not money market funds and it is not the objective of any of the funds to maintain a constant share price.

This data is updated every Monday, displaying data as of the previous Friday. Source: Bloomberg

Global 1-month Deposit Rates do not represent actual performance of any WisdomTree product or other security. This chart is provided to illustrate the differences in money market rates around the world.

Past performance is not indicative of future results.

Global 1-month Deposit Rates represent the annualized rate of interest offered by banks in exchange for 1-month deposits. U.S. U.K. Euro Area, Japan, and Switzerland deposit rates are represented by the London Interbank Bid Rate (LIBID) for one-month deposits. LIBID rates are the daily reference rate at which a consortium of British banks is prepared to borrow or accept deposits.

Bloomberg composite rates for 1-month deposits were used for Australia, Canada, Israel, Mexico, New Zealand, Poland and Sweden.

The Norway Interbank Deposit Rate and the Johannesburg Interbank Agreed Rate were used to proxy 1-month deposit rates for Norway and South Africa respectively. Each rate is an average of the rates indicated by local and international banks for 1-month deposits in the specified currency.

For Brazil, China, Chile, Colombia, India, Indonesia, Malaysia, Philippines, Russia, South Korea, Taiwan, and Thailand, the implied yields for one-month non-deliverable forward contracts were used to represent the rates and exposures available to Global Investment Managers.

A forward currency contract is an agreement by two parties to transact in currencies at a specific rate on a future date and then cash settle the agreement with a simple exchange of the market value difference between the current market rate and the initial agreed upon rate.

For Turkey, the implied yields for one-month deliverable forwards were used to represent available rates. Given restrictions on direct access to local short-term deposits, implied yields on currency forward contracts are often used to represent the short-term rates available to foreign investors in emerging market countries. Implied yields on forward currency contracts incorporate both the difference between the forward currency and spot currency rate as well as the potential interest earned from investment in the underlying cash collateral.

The yield on the Emerging Basket is simply an average of the yields on the 15 emerging currencies in the graph — Brazil, China, Chile, Colombia, India, Indonesia, Malaysia, Mexico, Philippines, Poland, Russia, South Africa, South Korea, Thailand, and Turkey. The yield on Commodity Basket is simply the average of the yields on the 8 commodity exporting countries — Australia, Brazil, Chile, Canada, New Zealand, Norway, Russia, and South Africa.

GO PAPERLESS

Contact your broker to sign up for eDelivery of WisdomTree Fund documents.

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As these Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded funds, there are no indexes that the Funds attempt to track or replicate. Thus, the ability of the Funds to achieve its objectives will depend on the effectiveness of the portfolio manager. Please read the Fund’s prospectuses for specific details regarding the Fund’s risk profiles.

WisdomTree Funds are distributed by Foreside Fund Services, LLC. Foreside Fund Services, LLC is not affiliated with The Dreyfus Corporation, sub-advisor for the Currency Funds.