Global Demographics Trends and Their Investment Implications

Post on: 16 Март, 2015 No Comment

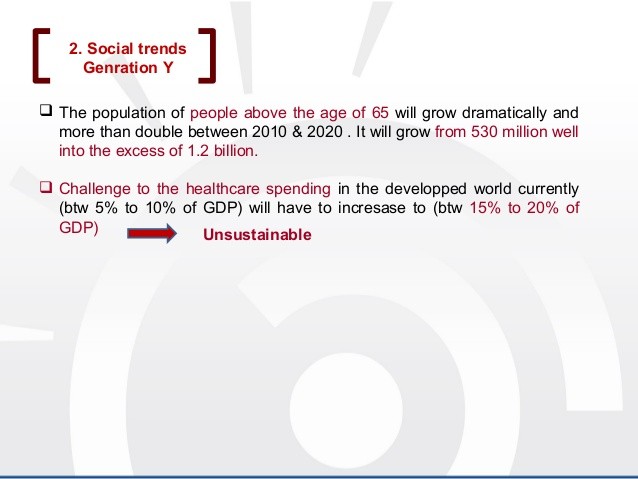

As Professor David K. Foot, demographic expert and author of Boom, Bust and Echo observed, the study of demographics is predicated on a simple premise each year every person in the population grows exactly one year older. In ten years, each will be ten years older. Today, the earths population is nearly seven billion people, growing at more than 1% annually. (Source: World Bank. See graph here .)

A review of the underlying trends is useful as it reveals a significant divide, split neatly along prosperity. Richer, developed markets are aging rapidly in stark contrast to developing markets. China is one exception to this observation.

It is well known that Japan is at the forefront of the aging demographic curve. The overall picture is top heavy. Also notable is the continuing trend of an increasingly female dominated older population. Of the countrys 126.8 million people, 30% are at retirement age. In the next two decades, more than half (56%) of the existing population will be in retirement. This makes Japan important to understanding behavior and demand trends for financial, healthcare consumer services.

click to enlarge images

The United States, with a population of 310 million also reveals concerns, though less pressing than Japan. Currently, 21% of the population is at retirement age and 41% is under 30. However, the retired segment will increase to 48% over the next 2 decades, fuelling concerns on the size of Social Security and Medicare related payments. The impact of the recent global financial crisis, simultaneously affecting the value of residential property and financial assets, exacerbates concerns of outliving ones assets and quality of retired life. Furthermore, a continued low interest rate environment offers limited opportunity for recouping losses through longer term fixed income investments.

Of the remaining countries, Italy shows trends similar to Japan, with 30% of the population at retirement age. In two decades, 60% of the current population will be in retirement. Like many of its EU peers, the Italian state is the main source of retirement income. These trends highlight the importance of continued pension reform and the introduction of other retirement / tax-advantaged savings schemes to reduce an otherwise mounting fiscal strain.

With small variations, Germany, France and Spain each reveal a similar, but slower aging pattern, with one quarter of the current population in retirement and 30% of the population below the age of 30.

Amongst developing countries, Chinas demographic trends are closer to its developed nation counterparts. Of its 1.33 billion citizens, 14% are in retirement. However, over the next two decades the retired segment will grow rapidly, accounting for 42% of the current population. With limited social services infrastructure in place and low penetration of consumer financial services, the governments priority in developing its banking, insurance and pension segments is understandably urgent. Viewed in this light, the current high savings rate is entirely rational. The past single child policy, which means that a married couple will likely be supporting four parents in addition to their own children, is an added complication. And, as the populations economic position improves and healthcare services expand, longevity of the retired will increase commensurately, lengthening the support burden. The Chinese may be the highest at-risk to out live their assets.

Underlying the developing market decoupling thesis are the demographic trends for some of the largest countries in this category. While India, Indonesia, Brazil and Mexico are the most interesting in this group, similar trends are found for Malaysia and Vietnam.

Of Indias 1.17 billion people, a mere 8% of the current population is above 60 years, while 57% are below the age of 30. Though with much smaller populations, the percentages for Indonesia, Brazil, Mexico, Malaysia and Vietnam are nearly identical. This means that the working age population will continue to grow for more than four decades, driving growth and consumption. In each of these countries, consumer financial services penetration is low and savings rates are high (vs developed markets). Sustainable GDP growth driven through comparative advantage (labor, commodities and/or manufacturing), exports and domestic consumption forms a solid foundation for continued growth and demand for banking, insurance and investment services.

Consequently, there are numerous investment implications of these demographic trends, particularly in the financial sector linked to a medium-term investment horizon. This is against a backdrop of the recent financial crisis during which many developed market individuals at or nearing retirement have seen substantial declines in the value of their financial assets, including their homes. For this rapidly aging demographic, protecting assets and managing the risk of not outliving them becomes a top concern. The insurance sector is better positioned to help manage this risk.

First, developing markets offer the greatest opportunity for banking and insurance growth, underlying continued developed market bank and insurer interest in these countries. Low retail penetration, attractive lending margins, sensible lending practices and, importantly, sound regulatory oversight combine to yield profitable growth. While many of these markets, run cost efficient operations benefiting from state-of-the-art technology, the retail customers shift towards more sophisticated products and other fee income generating services are still in their infancy. To date, disintermediation of the banking sector remains limited. The concurrent development of insurance services supported through government initiatives reveals opportune investments, particularly in the life sector. Understanding a countrys regulatory environment is key to successful stock selection.

While the growth profile of developed markets is very different, the recent financial crisis underlies bank stock selection. Banks with significant EU exposure, particularly sovereign debt, are likely to remain constrained and offer limited investment potential until meaningful resolution is achieved. Instead, growth in the EU insurance sector continues to be buoyant, supported by consumer distaste for their banks and underlying need for pension reform. In most European countries, insurers are the beneficiaries of the shift towards long-term savings products. While pension reform is urgent, political inertia has meant a slow pace. Unlike many instances in the past, the insurance sector has also distinguished itself in this recent crisis measured by the limited impact on most balance sheets.

With minimal exposure to EU sovereign debt and US regulatory reform nearly complete, large cap US banks offer strong investment opportunity (see discussion here ). Growth is driven less by demographics, than by expanding lending margins and improving credit provisions. Opportunities in the US insurance sector linked to the retirement and annuity segment will see sustained growth as the first of the baby boomers retire in 2011.

Driven by its demographics, Japanese retirees have entered the annuitisation phase, withdrawing savings to cover retirement and other costs. Other structural issues facing both the banking and insurance sector constrain the investment opportunity.

Favorable demographic trends are a key underlying support for growth in financial services. Stock selection incorporating these trends, combined with a strong business franchise and balance sheet forms a solid basis for out-performance.

Disclosure: No positions