Global Bond Income Portfolio

Post on: 17 Апрель, 2015 No Comment

Global Bond Income Portfolio Providing Global High Institutional Yields for our Investors !

Durig Capital provides customized portfolios targeting:

Average maturity: under 3.5 years

Laddered maturities: 1-6 years

Minimum investment: $125,000

US Dollar based: 100 to 0% (Client’s discretion)

Custodian: TD Ameritrade Institutional

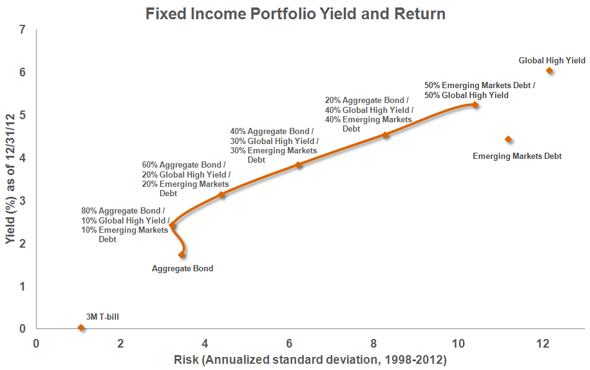

Our Global Bond Income Portfolio is designed to be a laddered portfolio for income investors wanting higher yields with short maturities, diversification away from the US and the dollar and a focus on maximizing cash flow. In light of the current global instability, the growing incubation of inflation, and the fact that shorter maturity bonds have less volatility, we have selected a model whereby ⅙ of the entire portfolio matures each year, enabling it to roll over or become available for other options.

You may have seen our website Bond-Yields.com. where we present our very strong and rewarding selection process. This process has worked very well for our clients, who know that we search the globe for bonds with the most important criteria being that we screen to help insure companies or countries we invest in will pay back their entire principle. With our exemplary record in default risk, clients can relax and enjoy higher yielding bonds with shorter maturities.

The US economy faces several major issues:

- The US Debt to GDP, is approaching Greeces Hellenic levels.

- The printing of United States dollars (at unprecedented rates) has resulted in significant dilution, and undermined the value of the US currency.

- The US trade deficit is so large that we often have trouble finding something to purchase that is made in the USA.

Any one of these three factors, growing unchecked, adds toxicity to the US Dollar. We believe that having all three growing at aggressive rates puts the US dollar in significant risk of losing value over time. Having the dominant/monopolistic reserve currency questioned or challenged by many foreign countries only increases this risk.

Here at Durig Capital, a high level of personal attention is given to individual client accounts. We offer open and honest appraisals, and give clients direct access to our money managers. Our many global resources and relationships allow us to find, research and select global bonds with institutional yields directly from many International trading firms, often at a far lower cost than the more restrictive (and less transparent) use of a proprietary in-house only trading desk. Our preferred custodian, TD Ameritrade, allows us to acquire any bond away from their in-house trading desk should the bonds be buyable at a lower price elsewhere.

Durig Capital believes that about 30-40% of your income should be protected from the risk of a dollar devaluation. To achieve this goal of protection against a dollar decline, while attaining much higher yields in a globally diversified, low cost, laddered portfolio, please contact us today.

At Durig Capital, we are “Always putting our client’s interest first!”