Give your portfolio a checkup Fidelity Investments

Post on: 24 Июль, 2015 No Comment

Your e-mail has been sent.

In investing, as in life, you can count on one constant: Things change. Markets shift, fund managers develop new strategies, companies transform themselves, and your life evolves. These forces can change your portfolio, as well as your goals for it. So it’s critical to perform regular checkups to assess your strategy, asset allocation, and individual holdings in light of your plans for the future.

Here are four steps you can take to stay on top of your investments today and help you meet your goals tomorrow.

Step 1: Assess overall performance

Your checkup should begin with an assessment of your portfolio’s returns. You should check in at least annually, if not more frequently. When evaluating performance, context is key. You need to know two things: whether your portfolio is on pace to meet your goals, and whether it has performed as well as comparable investments over a reasonable period of time.

First, check your assumptions about the returns you would need to generate to reach your goals. If your portfolio’s performance has fallen short of your assumptions over a long time period or if you find you cannot stomach the volatility of your investment mix, you may need to revise your strategy, perhaps by saving more or revisiting your investment allocation.

You also want to see whether your investments have performed as well as they should have. Your first instinct may be to look at the bottom line—we all want to see the value of our investments rise. But what may be more important is that your investments perform in line with your strategy. For instance, an aggressive investor looking for growth should expect to see periods of large gains and losses aligned with the performance of the stock markets, while a more conservative investor would want to see less volatility. To make a meaningful comparison, check the returns of your stock, bond, and cash holdings against benchmark indexes that are appropriate for each. The exact benchmarks to use will vary based on your particular strategy, but here are a few examples:

- U.S. stocks: The Dow Jones U.S. Total Stock Market Index SM measures the performance of a broad range of equities.

- International stocks: The MSCI All Country World Index (excluding U.S.) measures the performance of stocks in emerging and developed markets outside the U.S.

- Bonds: The Barclays Capital U.S. Aggregate Bond Index measures the performance of investment-grade bonds traded in the United States.

- Short Term: The Barclays Capital U.S. 3-Month Treasury Bellwether Index captures the return of Treasury bills with maturities of less than three months, a useful proxy for cash accounts.

Using benchmarks will give you a snapshot of your portfolio’s performance relative to the market. Ideally, you want your returns to be close to, but (hopefully) exceeding, the relative benchmarks. Returns that differ dramatically from the benchmarks—on either the high or low side—may indicate that your investment portfolio may need a review to understand what is causing the difference. And it is important to note that most investors are in it for the long haul, so don’t let short-term performance weigh too heavily in your decision making.

Actions:

- Stay on plan. Successful investing can start with laying out clear goals and, over time, making sure your performance is on track to meet those goals.

- Look for red flags. Keep an eye on holdings that are significantly under- or overperforming their asset class benchmarks.

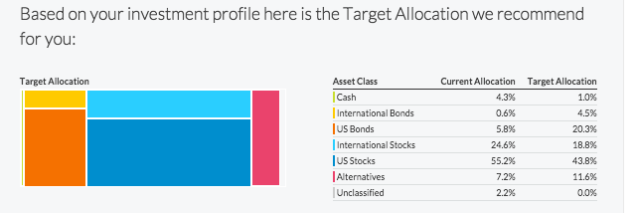

Step 2: Evaluate your asset allocation

Once you have a handle on your portfolio’s overall performance, you can assess your asset allocation. As a starting point, check to make sure that the target you have set for your balance of stocks and bonds matches your goals, risk tolerance, and time horizon.

As your life changes, you may want to adjust your strategy and target asset mix. For instance, a young person investing for retirement may be willing to take on more risk in his or her portfolio, and as a result could aim to hold a greater proportion in stocks than bonds. On the other hand, an investor nearing retirement may want to protect against near-term volatility by constructing a more balanced portfolio. Similarly, a shift in income due to a job change, a new family situation such as a marriage or divorce, or some other life event could require you to revisit your strategy.

Next, ensure that you are diversified within each asset class. Among individual stocks and stock funds, for example, your holdings could include a mix of investments in each of the following categories:

- Size: Choose companies with small, medium, and large market capitalizations, because different-sized companies tend to lead the market at different times.

- Style: Different investment strategies, such as growth and value, tend to trade market leadership. Holding both types means you can help minimize volatility in your portfolio, and potentially benefit in all types of environments.

- Geography: You may want your portfolio to include exposure to domestic and international stocks, including those from emerging markets. Financial markets around the world respond differently to regional and global events, and some economists think that the prospects for economic growth are brighter outside the United States.

Your bond and bond fund holdings can be diversified within the following categories:

- Sector: Consider investing in various types of government and corporate bonds, with different yields, maturities, and credit quality.

- Geography: Consider holding both domestic and foreign bonds, possibly including emerging markets debt, to gain exposure to the opportunities and spread out the risks offered by various regions.

Keep in mind the risks associated with the different types of holdings and remember that just creating a diverse mix isn’t enough. Part of your monitoring process needs to make sure that your investments stay on track. For instance, a long period of outperformance by bonds or a bear market in equities could leave you with less exposure to the stock market than you wanted. A small-cap portfolio can grow to become mid-cap, or an explosive period of returns in one region of the world can leave you over-exposed to the fortunes of that economy. That’s why it is important to keep careful tabs on how your mix changes over time.

When it comes to individual stocks and bonds, you may want to make sure you don’t have too many of your eggs in one basket. In general, Fidelity believes you should avoid having too much concentration in any one investment: You should consider reviewing any individual positions that exceed 5% of your overall portfolio. A notable exception—products that provide broad diversification, such as target-date funds or diversified mutual funds that hold many underlying investments.

Actions:

- Adjust your investment strategy. Revisit your overall investment mix in light of any changes in your situation and make adjustments if you think they are necessary.

- Target areas to rebalance. There are a number of ways to rebalance. If your allocation to any asset class has drifted more than 10% from your target, you may want to get it back into balance. If you make regular contributions to your portfolio, you may want to adjust future investments into the assets that represent less of your portfolio than you had planned. Or you may want to sell some of the investments that are in excess of your strategy, and use the proceeds to get back on track. Some investors choose to reallocate back to their target mix periodically, such as every three, six, or twelve months.

- Review your concentration. You may want to review your holdings if any individual stock or bond position exceeds 5% of your overall portfolio and you think those positions have become too large a part of your portfolio. Keep your overall asset allocation in mind when considering any changes.

Step 3: Review individual holdings

While keeping the overall diversification of your portfolio in mind, you can consider making adjustments to individual securities. The answer to the question of what to sell and where to reinvest will be different for each investor. That said, the following principles can help you determine where to make adjustments that fit your personal goals.

Start with any individual stocks you hold. Check whether the companies have performed up to your expectations, and consider whether your outlook for them remains positive. Also review the stock’s valuation, to make sure it is still reasonable. The following measures can help you decide whether a stock remains a good candidate for your portfolio:

- Fundamentals: Check essential business metrics such as earnings and sales numbers, as well as stock valuation measurements such as price-to-earnings and price-to-book ratios, and compare them with the company’s peers.

- Analyst opinions: Market analysts’ projections can help you evaluate the firms’ outlook.

If you have individual bonds in your portfolio, you should include a review of your holdings in your checkup. Be sure to review:

- Credit rating: Check to see if the ratings of your bonds have changed. If analysts have downgraded any of your holdings, it may mean your portfolio has taken on a higher level of risk.

- Duration: As your bond holdings approach maturity, the duration of your portfolio may change. You should review this in light of your changing investment goals and the interest rate environment, and take it into account if you are reinvesting in bonds.

Next, evaluate the performance of your mutual fund holdings relative to their peers. Consider the following:

- Benchmarks: Each mutual fund in your portfolio can be compared to a benchmark to determine whether its performance is in line with its stated strategy and goals. Each fund’s prospectus lists the index that the fund’s sponsor deems most appropriate to use as a benchmark. Use these benchmarks to identify and monitor laggards.

- Fund documents: Annual reports and other fund filings are filled with important information. Check whether the fund has brought on a new manager, changed its investment approach, adopted a new benchmark, increased fees, or made other significant changes.

Actions:

- Revisit your positions. Consider whether your stock and fund holdings still make sense for your investment strategy and meet your expectations, and consider recent analyst opinions and ratings. Look for holdings to replace, trim, or increase, keeping in mind the costs and potential tax implications of a change.